Japan's Nikkei index hits 26-year high

- Published

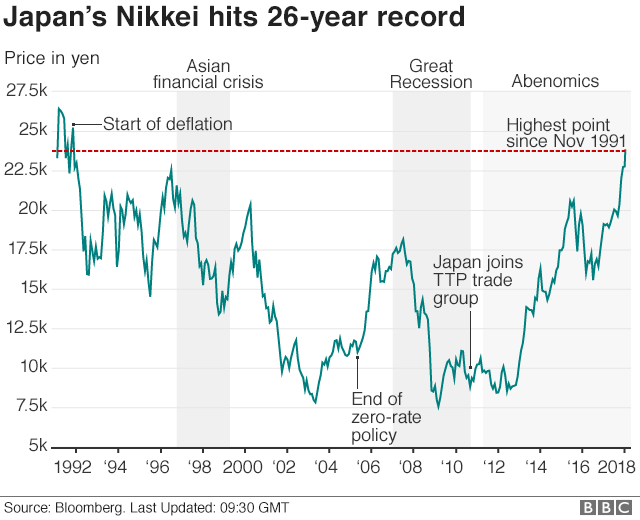

The Nikkei index of 225 leading Japanese shares reached its highest level for 26 years at the end of trading on Tuesday.

It added 0.6% to its value to end at 23,849.99 when the markets reopened following a public holiday on Monday - its highest level since November 1991.

The index was helped by gains on Wall Street during the holiday.

The Nikkei's rise follows Japan's longest period of economic growth in more than two decades.

Japan's economy has been boosted by Prime Minister Shinzo Abe's Abenomics reform package and a rise in business investment.

He introduced the reforms in December 2012 with a plan to take Japan's economy out of a long period of stagnant growth using the three "arrows" of Abenomics - monetary policy, fiscal stimulus and structural reforms.

In December, the world's third-largest economy showed its seventh straight quarter of growth.

This put the country in its longest stretch of uninterrupted growth since at least 1994, when comparable data was made available.

In an attempt to revive the economy in 2001, the country introduced a policy of zero interest rates to make it cheaper for consumers and companies to borrow money rather than save it.

However, the policy was scrapped in the summer of 2006.

- Published8 December 2017

- Published23 October 2017