Carillion collapse: UK puts up £100m to back Carillion contractor loans

- Published

Contractors affected by the collapse of outsourcing giant Carillion will be able to apply for government-backed loans from High Street lenders.

Thousands of Carillion suppliers were left unpaid after the construction giant collapsed in January.

Ministers say the state-owned British Business Bank will guarantee £100m of lending to those firms, which should make it easier for them to borrow.

This is in addition to funds created by Lloyds Banking Group, HSBC and RBS.

Business Secretary Greg Clark said he wanted small and medium-sized businesses who were owed money by Carillion to know "they will be supported to continue trading".

Liberal Democrat leader, Sir Vince Cable, urged companies to "take full advantage" the British Business Bank.

"There is a confidence issue... you've got a very complex supply chain, much of which depends on creditworthiness, and I can see their problem," he said.

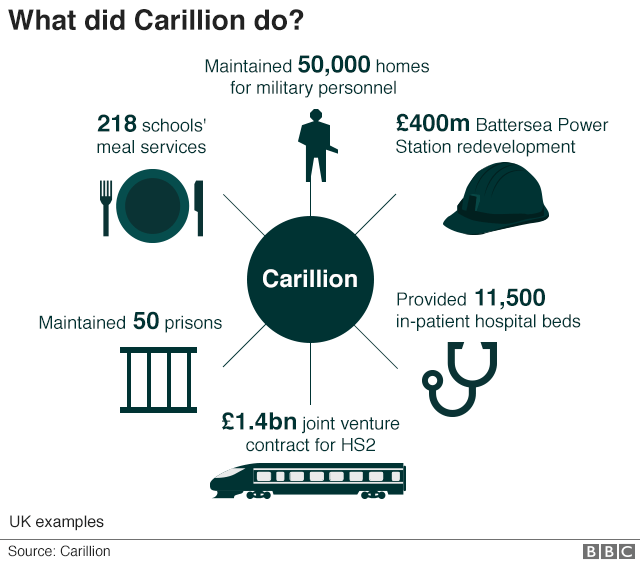

Carillion, the UK's second-largest construction company, manages a huge variety of public sector and private projects around the UK, from rebuilding Battersea Power Station to cleaning prisons.

It collapsed, under a debt pile of £1.5bn, on 15 January.

It had employed 43,000 people, including around 20,000 in the UK. Almost 380 workers at Carillion will be made redundant.

Carillion contractors who may not have the security otherwise needed for conventional bank lending can apply to lenders, external including Barclays, HSBC, Lloyds, NatWest, Santander, and TSB, for a so-called Enterprise Finance Guarantee (EFG) borrowing facility, external.

Banks are cushioned from businesses defaulting on the loans by taxpayer cash - 75% of any losses to the lender will be picked up by the British Business Bank if the loan cannot be paid back.

Additionally the UK banking sector has promised to take the circumstances surrounding Carillion into consideration if individuals face problems repaying loans, overdrafts or mortgages.

Analysis

By Joe Lynam, BBC business correspondent

The government is determined to show that it has a grip on the Carillion crisis. And it needs to.

At stake are not just the thousands of jobs directly employed but also the thousands of SMEs such as suppliers and contractors indirectly dependent on the former construction giant who will now not repay its debts.

On top of that there's the ideology behind the likes of Carillion and outsourcing in general.

Private finance initiatives and getting companies to do public sector work is an article of faith for the Conservative Party.

If thousands of small firms collapse in a domino fashion due to Carillion, then the PFI as a policy will come under intense scrutiny.

- Published2 February 2018

- Published30 January 2018

- Published29 January 2018

- Published18 January 2018

- Published15 January 2018

- Published15 January 2018