BP profits double on higher oil price

- Published

- comments

BP's annual profits more than doubled in 2017, largely thanks to the global increase in oil prices.

The oil giant made $6.2bn (£4.4bn), up from $2.6bn made during the previous 12 months.

Chief executive Bob Dudley hailed it "as one of the strongest years in BP's recent history".

BP opened seven new oil and gas fields during 2017 and its oil production rose 12% to 2.47 million barrels of oil per day.

Last week, BP announced that it hoped to double North Sea oil production to 200,000 barrels by 2020 through a variety of projects.

"We enter the second year of our five-year plan with real momentum," Mr Dudley said.

"We are increasingly confident that we can continue to deliver growth across our business, improving cash flows and returns for shareholders out to 2021 and beyond."

Its fourth quarter profits rose to $2.1bn, compared with $400m over the same three-month period in 2016.

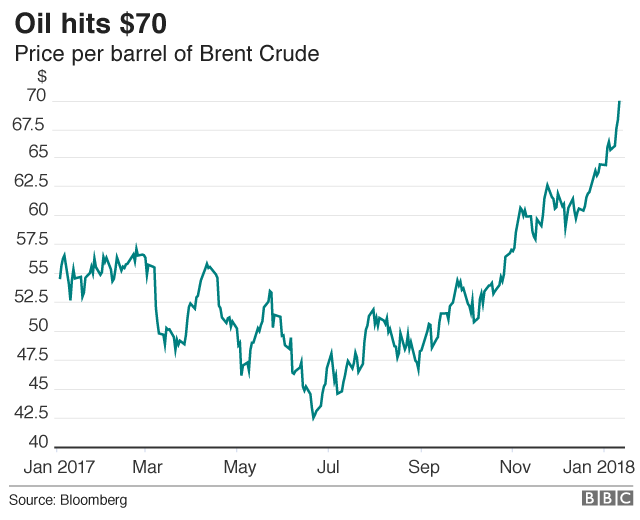

Oil companies have been boosted by the rising price of crude oil.

In early January, the price of oil hit $70 a barrel for the first time since December 2014.

Prices have been rising since late 2016 when members of the Opec oil cartel made a co-ordinated effort to curb their output.

BP spent years in recovery mode after the 2010 Deepwater Horizon oil spill in the Gulf of Mexico.

Eleven people were killed and 17 injured in an explosion with an estimated 4.9 million barrels of oil leaking into the Gulf as a result.

The total cost to the company came to more than $60bn and it had to sell off assets in order to pay the bill.

Richard Hunter, head of markets at interactive investor, said: "Wider market weakness has eclipsed the sturdy performance which BP has delivered.

"The company's ability to generate cash remains prodigious.

"BP is in fine shape, particularly considering the tribulations of recent times."

- Published31 January 2018

- Published21 November 2017

- Published2 May 2017

- Published7 February 2017