Stock markets: US shares steadier after wild swings

- Published

- comments

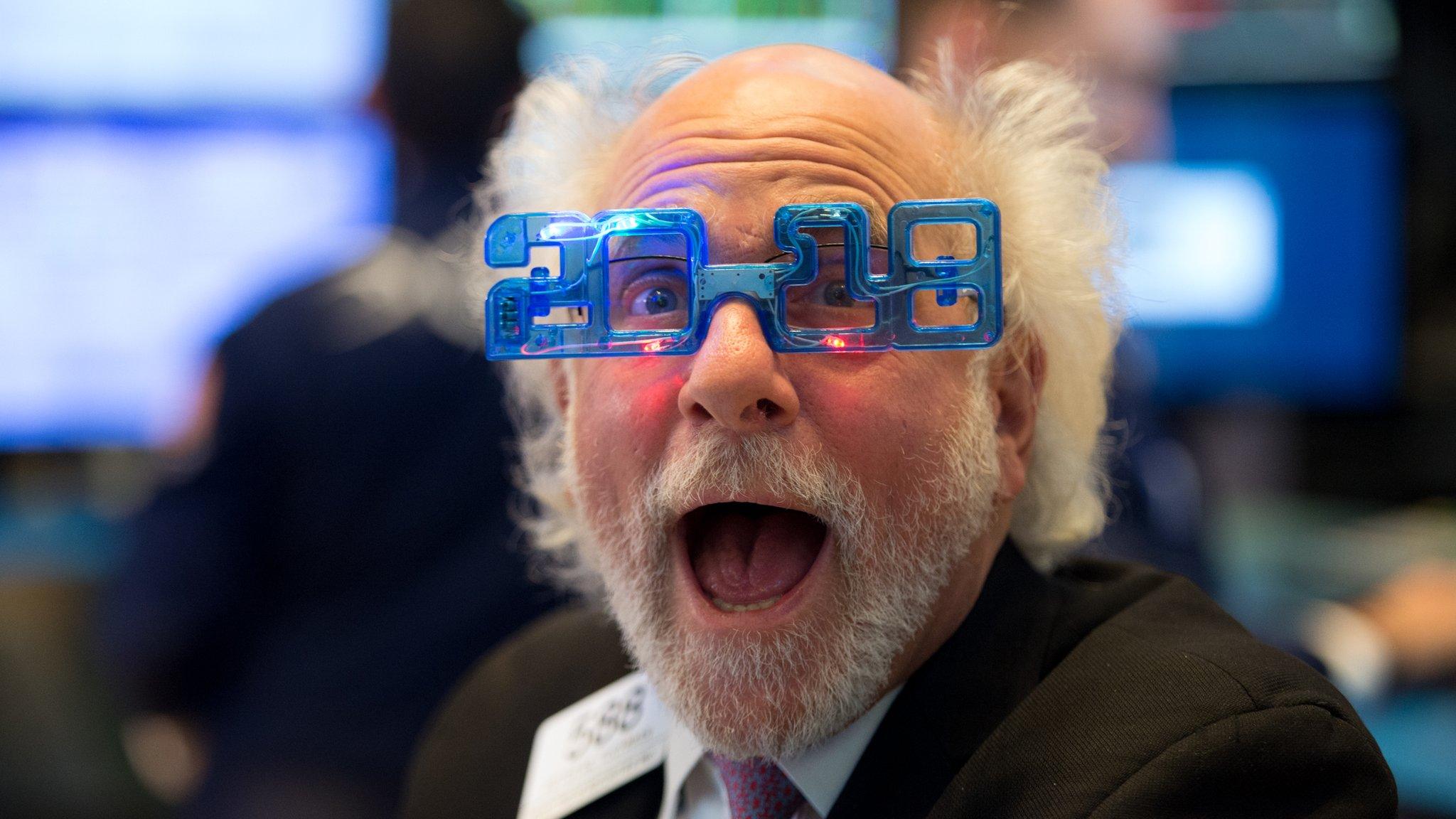

Wall Street shares slipped on Wednesday, but were somewhat steadier than in recent days, which saw sharp trading swings.

The Dow Jones dipped less than 0.1%, while the S&P 500 fell about 0.5% and the Nasdaq dropped 0.9%.

Declines in technology and energy shares weighed on the markets, which have seen a sudden increase in volatility.

Investors are worried by policy shifts, including higher interest rates.

European stock markets also recovered ground on Wednesday, but a rally in Asia faded.

The volatility marks a turn for the markets, which rose steadily for much of last year.

But analysts and economists, who for months have forecast that rapidly-rising markets were due a correction, said investors should get used to choppier markets.

"It's not like this is going to be one and done," said JJ Kinahan, chief market strategist for TD Ameritrade.

Signs of volatility have been rising in recent weeks, as investors digest the impact of new tax cuts and tighter central banking policies, among other shifts.

A US Labor Department report of strong wage growth in January triggered a market sell-off last week, as investors saw a sign that inflation could rise faster than expected and lead the Federal Reserve to raise interest rates more quickly.

The market plunge spread globally as investors rushed to redistribute assets in reaction to the shift.

Wednesday's declines came after US lawmakers announced a budget deal, which would lift spending caps and could add to the inflationary pressures.

Meanwhile, soft demand for US Treasuries at an auction on Wednesday sent yields higher - typically a signal of higher rates.

London's FTSE 100 closed 1.9% higher, in Paris the Cac-40 rose by 1.8% and Frankfurt's Dax was up by 1.6%.

In Asia, Japan's Nikkei 225 index pulled back from early highs to add 0.2%, while Hong Kong's Hang Seng lost 0.8%. Australia's S&P/ASX 200 ended up 0.8% while South Korea's Kospi index dropped 2.3%.

Analysis: By Kim Gittleson, business correspondent

During this week's market mayhem you probably heard a lot about volatility - and in particular, this thing called the Fear Index, or Vix.

But what is it?

Technically, the Vix is a measure of the expected amount of gyration in stock prices on the S&P 500 over the next month.

A low level indicates investors don't expect prices to fluctuate that much - a spike implies choppy waters ahead.

But it's only recently that investors could trade on - or against - fear. Well, fear of change, specifically.

The Vix, technically the Cboe Volatility Index, external, was first launched in 1993. But you could only bet on it - using options - in 2006.

A key thing about the Vix is that the volatility that the index predicts tends to be worse than actual volatility. In other words, we think the future will be worse than it is.

That pessimism is something a group of investors have exploited - they bet that the future would be calmer than the Vix model suggested. And over the years, that has made them a lot of money.

The only problem for them is when that calm evaporates, like now.

- Published7 February 2018

- Published6 February 2018

- Published6 February 2018

- Published6 February 2018

- Published2 February 2018

- Published11 October 2017

- Published30 December 2017