Number of middle-aged renters doubles in a decade

- Published

- comments

Paul McKay: 'It's just going to be renting until I die'

Forty-somethings are now almost twice as likely to be renting from a private landlord than they were 10 years ago.

Rising UK house prices have left many middle-age workers unable to afford a first home, or as "accidental renters" after a relationship break-up.

Analysts say a focus on young first-time buyers means older tenants, often with children, risk being ignored.

Concerns have been raised about the economic and social impact of these tenants in future years.

Future 'strain'

Data analysed for and by BBC News shows:

The proportion of 35 to 54-year-olds who live as private tenants has nearly doubled in 10 years since 2006-07, according to the Family Resources Survey, external by the Department for Work and Pensions

Renting among all age groups is now more likely to be from a private landlord than from a council or housing association

A particular rise in renting among 45 to 50-year-olds, sometimes as a result of death, debt or divorce, analysis for the BBC shows

Single parents with children who rent are a major concern among debt charities

"The danger of all this is the social inequality it will create between the haves - who are homeowners - and the have nots," said Paula Higgins, chief executive of the Homeowners' Alliance.

Richard Donnell, from property market analysts Hometrack, who studied the data for BBC News, pointed to the potential strain on the benefits system in 15 to 20 years' time when some of these tenants require financial assistance to pay the rent during retirement, external.

'Buying is off the radar'

Renting and house-sharing is a necessity for some - like Paul McKay, who has moved between a dozen rental properties in 20 years.

The 44-year-old retail worker, who lives in Kingston, Greater London, says that buying a home had previously felt out of reach, and now was completely off the radar.

"If I could go back in time, I would tell myself that the housing market might seem crazy now, but it is going to get crazier," he says.

Years ago, he decided that when prices breached £100,000 for a two-bedroom house, buying a property was too much of a risk.

"I know that now I'm ageing myself out of a mortgage, which is a slight concern. I don't feel I should be owed anything, but there is no support for my demographic, and there is still a stigma attached to renting in this country."

Lesley Steele says that renting has given her some freedom

However, renting in middle-age is a more attractive option for some people. Lesley Steele, 51, lives in a converted pub in Cumbria which she shares with a housemate of similar age.

"I've always done a lot of travelling and did not want to be tied down paying a mortgage," she says. She generally works on short contracts in the education sector, and moved to Cumbria for the lifestyle and surroundings.

"I've never wanted to settle down and have kids. It would be lovely to have a base, but I prefer my freedom. The idea of a mortgage is scary, even now."

She says she has savings so she will not face a financial "crisis" if she is left without a job, but has no long-term contingency plan.

'Accidental renters'

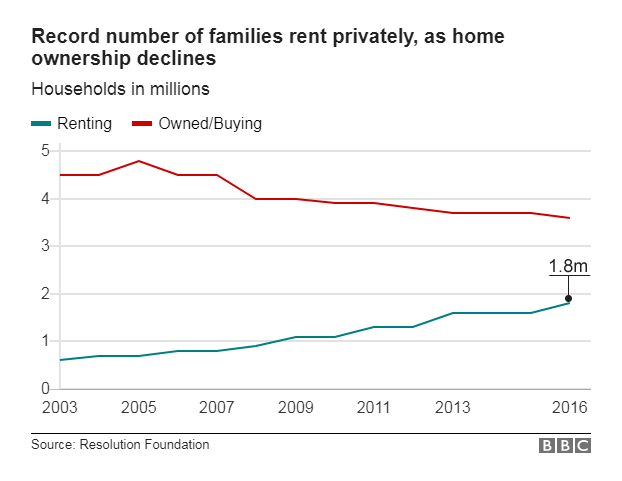

Record numbers of families are in rented accommodation and charities say there is a significant impact on the continuity of family and financial life.

Research by housing charity Shelter said two-thirds of private renters with families who it surveyed said they wished their children did not have to live in a privately rented home.

A fifth had moved from one rented home to another in the past five years, potentially affecting travel and schooling. One in six had been asked to move by the landlord.

Debt charity StepChange said that four in five of those seeking help for unmanageable debts were tenants. Many were single parents.

Most found themselves struggling with debts following a financial shock such as divorce or redundancy, rather than poor budgeting.

Mrs Higgins described many of those leaving long-term relationships as "accidental renters".

"People are stretched to the limit and have insecure wages. When they split up, a couple can't each buy a property in the same area that lets them share the children," she said.

Buying to renting

In the 10 years to April 2017, the proportion of people renting their home from a private landlord increased across all working age groups, the latest figures show. At the same time the proportion of homeowners with a mortgage fell among those of working age.

Overall, 20% of UK households were renting privately by 2017, compared to 28% who own with a mortgage, according to the Family Resources Survey, external by the Department for Work and Pensions (DWP). Of the rest, 34% own their home outright and 17% are in the social renting sector.

Since the start of the decade, there has been a greater proportion who pay rent to a private landlord than social housing tenants.

Nearly half of 25 to 34-year-olds rented their home privately by 2017, but the largest increase over the 10 years during and after the financial crisis were 35 to 44-year-olds. The proportion of private renters in this age group doubled from 13% to 26%.

The proportion of 45 to 54-year-olds renting from a private landlord rose from 8% to 14% over the same period.

BBC News has set up a new UK Facebook group all about affordable living. Join the Affordable Living group here, external.

A recent report by the Resolution Foundation suggested that up to a third of young people face living in private rented accommodation all their lives.

It called for more affordable homes for first-time buyers to be built, as well as better protection for those who rent, and said the tax system should be changed to discourage second-home ownership. It also suggested "light touch" stabilisation policies to limit rent increases to the rate of inflation over a three-year period.

But one landlords' trade body said any kind of rent control would be a disaster for the sector.

Where can you afford to live? Try our housing calculator to see where you could rent or buy

This interactive content requires an internet connection and a modern browser.

- Published9 July 2020

- Published11 May 2018

- Published11 May 2018

- Published11 May 2018

- Published11 May 2018

- Published11 May 2018

- Published11 May 2018

- Published3 December 2017

- Published19 February 2018

- Published25 March 2018

- Published17 April 2018

- Published10 November 2017