Wall Street recovers from trade war fears

- Published

Trade tensions between China and the US have been ramped up after Beijing responded to US plans for putting new taxes on hundreds of Chinese imports.

China said it would place 25% trade tariffs on 106 US goods, including soybeans, aircraft and orange juice.

The tit-for-tat action comes hours after Washington detailed about 1,300 Chinese products it intended to hit with tariffs - also set at 25%.

Wall Street opened sharply lower, before rebounding to close higher.

After starting down more than 400 points, or 1.75%, the Dow ended almost 1% higher.

The S&P 500 did not fall as far and also rose about 1%, while the Nasdaq added 1.4%.

Boeing - among the firms that investors expect to be most affected by the plans for tariffs - fell 1.4%.

Stock markets in Europe also fell, with investors taken aback by the speed of China's response, but closed only modestly lower.

The FTSE 100 in London was almost flat at 7,034 points at the close.

Beijing said it "strongly condemns and firmly opposes" the proposed US tariffs, calling them "unilateralistic and protectionist", and vowing to retaliate.

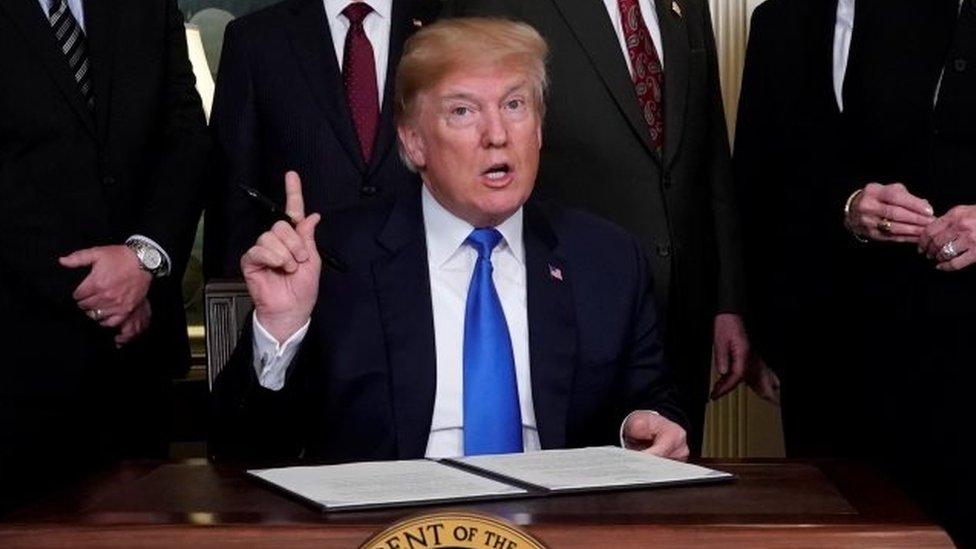

But US President Donald Trump tweeted the US was not in a trade war with China.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

This is the second wave of tariffs put forward by the US. Earlier this year, Mr Trump announced import taxes on aluminium and steel.

The White House said its new plans were a response to unfair Chinese intellectual property practices, such as those that pressure US companies to share technology with Chinese firms.

It has proposed tariffs on a wide range of items, including Chinese-made communication satellite parts, flat screen televisions, semiconductors and industrial machinery, as well as more niche products such as bakery ovens and rocket launchers.

A final list will be determined after a public comment period and review, expected to last about two months.

The Office of the US Trade Representative, which is handling the negotiations, said the tariffs were "appropriate both in light of the estimated harm to the US economy and to obtain elimination of China's harmful acts, policies and practices".

'No winner'

China's tariffs are more narrowly aimed at politically important sectors, such as agriculture.

US chemicals, some types of aircraft and corn products are among the goods facing the taxes, China's finance ministry said.

Tariffs would also be placed on whiskey, cigars and tobacco, some types of beef, lubricants, and propane and other plastic products.

US orange juice, certain sorghum products, cotton and some types of wheat, as well as trucks, some SUVs and certain electric vehicles, will also be subject to the new duties, the ministry added.

Beijing has been adamant that it did not want a trade war, but that it would not back down under US pressure.

"Any attempt to bring China to its knees through threats and intimidation will never succeed," foreign ministry spokesman Geng Shuang said.

"There is no winner in a trade war, and an initiator will harm itself as well as others."

Mr Geng said China had referred the US to the World Trade Organization.

'No certainty'

Neither set of tariffs goes into effect immediately.

US economists said they expect the broader economic impact of the measures to be limited if they move forward, but warned that the risk of further escalation could weigh on business activity.

The US and China exchanged more than $700bn in goods and services last year, according to US figures.

Economists had warned the Trump administration's move could prompt Beijing to retaliate

Each list of products represents an estimated $50bn (£35.5bn) in annual trade, officials said.

"It's the tit-for-tat uncertainty that shakes business confidence," said Satyam Panday, senior economist at S&P Global Ratings. "Why should I invest when there's no certainty?"

China's economy has become less dependent on selling goods abroad in recent years, which is likely to blunt the effect of the US tariffs, according to analysts for S&P Global Ratings.

In 2016, the US was the destination for about 18.2% of all Chinese exports.

American business groups have urged the two sides to try to resolve the issues through talks, expressing concern that threatening tariffs could lead to a dispute that hurts the US economy.

- Published4 April 2018

- Published3 April 2018

- Published22 March 2018