UK inflation falls to lowest in a year

- Published

- comments

Prices for clothing and footwear, in particular womenswear, rose at a slower rate

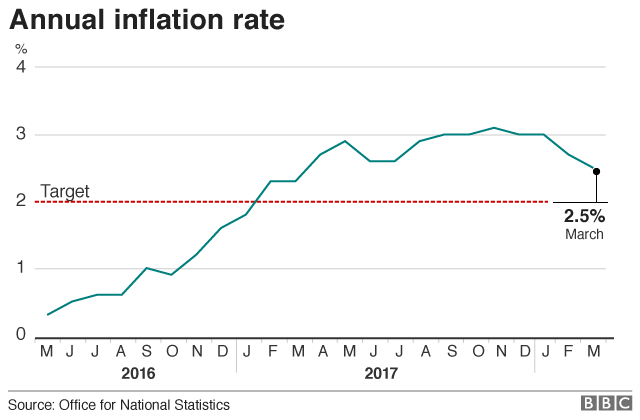

UK consumer price inflation fell in March to 2.5%, the lowest rate in a year, according to the Office for National Statistics.

It fell from 2.7% in February after prices for women's clothing rose at a slower pace than last year.

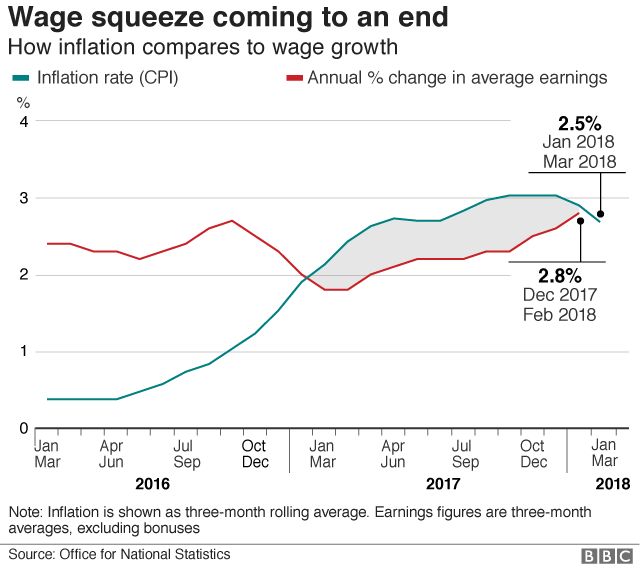

The data appears to show that the squeeze on UK households may be coming to an end as wages rise.

Despite the inflation fall, economists still expect the Bank of England to raise interest rates in May.

According to the most recent figures, UK wages rose by 2.8% in February.

The Bank is forecast to lift the interest rate to 0.75% from 0.5% next month.

Laith Khalaf, senior analyst at Hargreaves Lansdown, said that while he expected the Bank to proceed with the increase, he believes the Monetary Policy Committee will move slowly.

He said: "Wage growth remains surprisingly lacklustre in the face of such low levels of unemployment, though it is now heading in the right direction, and the recent political shift on public sector pay suggests there's some more momentum in the post.

"While an interest rate rise now looks odds on in May, the Bank will still be wary of moving too fast and too soon, so beyond that monetary policy is still likely to move at a slovenly pace."

The pound fell by 0.74% against the dollar to $1.4183.

The ONS said the biggest downward contribution to inflation came from clothing and footwear, mainly women's clothing.

Prices rose by 0.7% between February and March 2018 compared with a 2% increase between the same months last year.

Alcohol and tobacco also helped ease inflation pressures.

ONS head of inflation Mike Hardie said the new autumn Budget means tobacco duty rises no longer appear in March.

Analysis: Andy Verity, economics correspondent

Economists had been expecting the consumer prices index to be 2.7%, the same as last time. It came in at 2.5%.

Yet in the City, the probability that traders put on an interest rate rise next month barely shifted - from 90% to 80%.

The currency markets reacted a little more strongly - marking the pound down by about a cent against both the euro and the dollar.

The reason is simple: the Bank of England appears determined to raise the official rate next month to 0.75% - not so much to tame this relatively mild inflation, as to normalise interest rates.

That way, when the next downturn comes, there'll at least be some room to cut them again.

Ranko Berich, head of market analysis at Monex Europe, said the inflation figure "will be a spanner in the works for the Bank of England".

He points out that the "pace and breadth" of the fall in inflation during March means it could fall below the Bank of England's 2% target earlier than expected.

He said: "Investors are still treating a May rate hike as a done deal, after the Bank of England just about spelled it out in a confident series of statements and inflation projections that may now be revised.

"[Governor Mark] Carney risks once again being labelled an "unreliable boyfriend" should the Bank of England hold fire in May or even August."

- Published17 April 2018

- Published13 March 2018

- Published1 March 2018