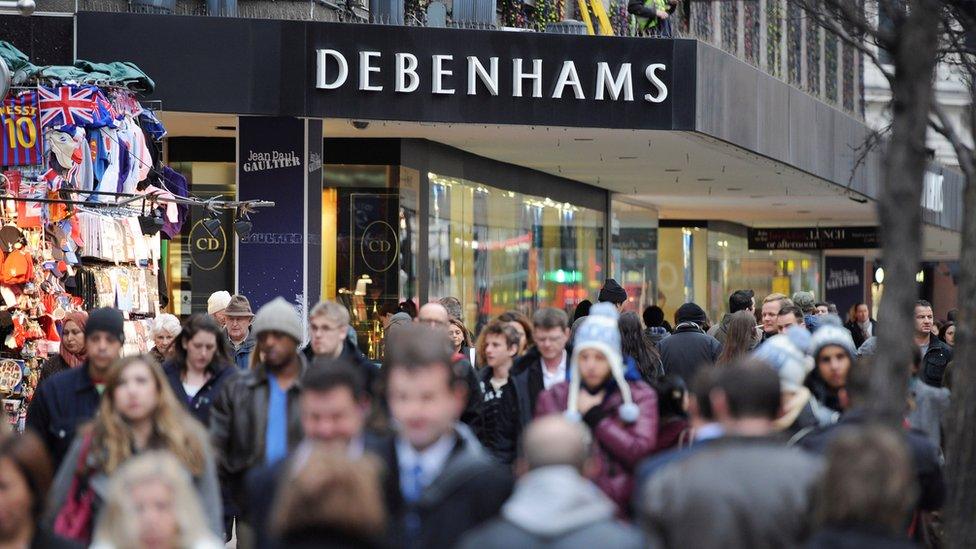

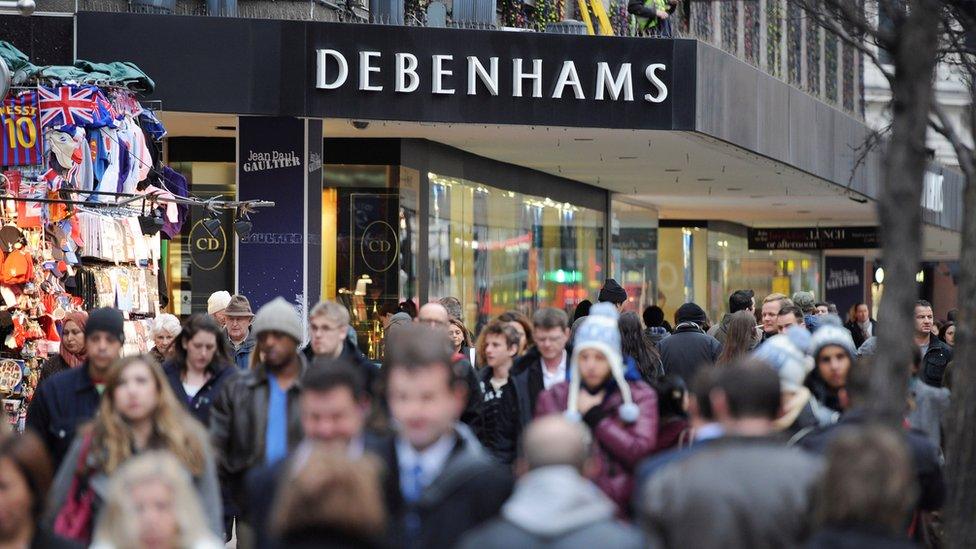

Debenhams sales hit by 'Beast from the East'

- Published

- comments

Debenhams has reported another slide in profits and sales after freezing weather in late February temporarily closed 100 stores in the UK.

The retailer said like-for-like sales fell by 2.2% in the 26 weeks to 3 March, while profit sank 84% to £13.5m.

The retailer also lowered expectations for annual profits and said its chief financial officer was leaving., external

The cold weather also hit the wider retail market, with UK sales volumes falling 1.2% in March, figures show.

For the first three months of 2018, sales volumes were down by 0.5% compared with the previous quarter the Office for National Statistics (ONS) said, external - the biggest quarterly fall since the first three months of 2017.

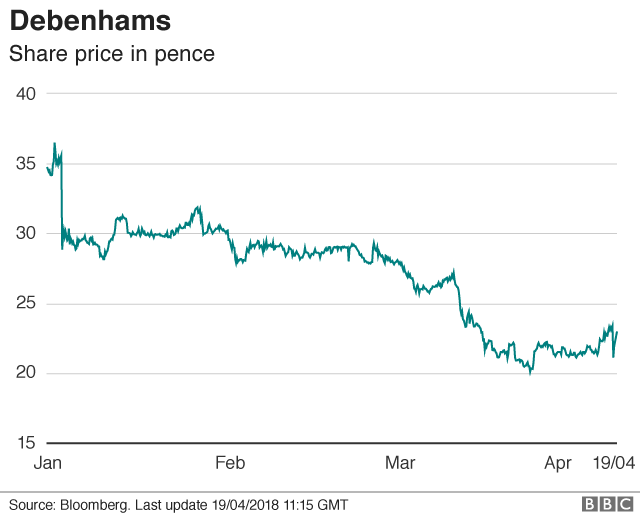

Shares slump

Debenhams said profits for the full year would now be at the lower end of brokers' forecasts of £50m to £61m, compared with £95.2m for the previous year.

It also announced that its chief financial officer, Matt Smith, had resigned to join rival Selfridges.

Shares in the company fell almost 10% in morning trading before recovering to be 1.1% lower at 23p.

While Debenhams was affected by the extreme cold caused by the "Beast from the East", the retailer had already been struggling.

It issued in a profit warning in January after disappointing Christmas trading, and in February the company said it planned to cut 320 store management jobs in an attempt to cut costs.

Debenhams is using its new Stevenage store as a test bed

Chief executive Sergio Bucher said it had "not been an easy first half" and that the retailer was concentrating on its Debenhams Redesigned strategy, which aimed to mitigate difficult trading conditions.

In the six-month period, sales of beauty products and food had risen, while it had maintained its market share for clothing in a weak market, he said.

However, Nicholas Hyett, an analyst at Hargreaves Lansdown, said that despite rising online sales and clothing holding up, margins had been "totally shot to pieces" because of heavy discounting and the fall in sterling.

"The Debenhams Redesigned strategy is seeing the group invest heavily to try and get itself back on an even footing, but that's driving debt upwards, and has ultimately cost investors over half the interim dividend," he said.

"The worry is that this is too little too late. Store improvements may get some customers back into shops, but it won't do anything to offset the broader shift away from the High Street."

The 1.2% fall in retail sales in March reported by the ONS was bigger than expected as the exceptionally cold weather kept shoppers at home.

Samuel Tombs of Pantheon Macroeconomics said retail sales were already suffering before the bad weather struck, with average volumes in January and February down 0.2% on the figure for the last three months of 2017.

However, he added: "Sales should rebound in April as people jumped back in their cars and finally started to buy spring clothing."

Store revamps

Debenhams is using its new Stevenage store as a "test lab", Mr Boucher said, with a cheaper and more flexible operating model.

Sales at its four food outlets, including its first Nando's, had far exceeded expectations, the chief executive said, accounting for almost a third of sales at the store.

Debenhams has revamped its Uxbridge store in west London along similar lines to Stevenage, boosting sales. The size of the store has been cut by a fifth, with a similar reduction in rent.

Last month, Mike Ashley's Sports Direct revealed that it had a stake of almost 30% in Debenhams - just below the level at which it would be required to make a takeover offer.

- Published19 April 2018

- Published8 February 2018

- Published1 March 2018

- Published14 April 2018

- Published4 January 2018