Is Tesla heading for trouble?

- Published

- comments

Tesla chief executive Elon Musk also runs the SpaceX rocket venture

Tesla is facing more questions about its financial viability ahead of its latest results on Wednesday.

The electric car-maker is facing a cash crunch, caused by a combination of a major debt load and heavy spending.

Tesla boss Elon Musk says the firm could be profitable this year and dismissed concerns with an April Fool's Day joke about bankruptcy.

However, analysts are less jovial and say Tesla's problems are serious.

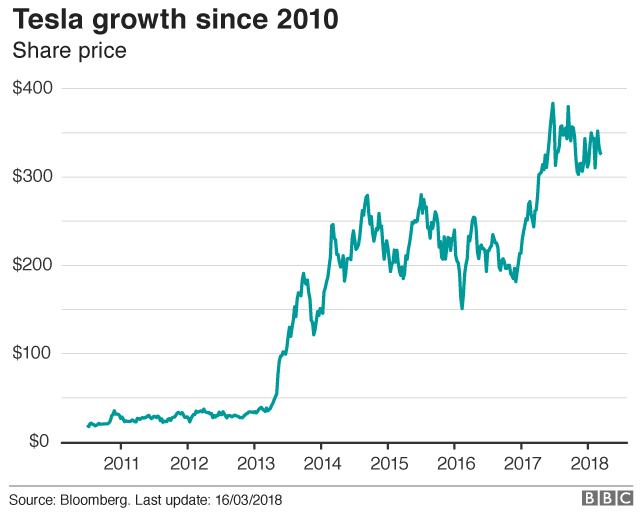

Since September, the firm's shares have fallen by about a quarter to $296 - and many investors think they will continue to drop.

As of April 25, Tesla was the most shorted company in the US, according to S3 Partners, a financial data and analytics firm.

John Thompson, chief executive of Vilas Capital Management, is one of the people who has put money on the idea that the share price will collapse, placing pressure on the company and eventually leading to bankruptcy.

"Over the next three to six months, I've said I think the stock will fall significantly, at which time the capital markets will close to Tesla entirely," he said. "Then it's just a matter of time given their losses and their capital expenditure needs."

Tesla, which has not made an annual profit in its 15-year history, had more than $10bn in debt at the end of 2017 and $3.4bn in cash.

Tesla shares started trading at $17 and now are worth roughly $325

The firm has been spending heavily to increase production of its newest car, the Model 3, but continues to fall short of manufacturing forecasts despite robust customer demand.

It made just 9,800 Model 3s in the first three months of the year, compared to an earlier goal of 5,000 vehicles a week.

Last summer, Mr Musk said Tesla was spending about $100m a week to ramp up production. Bloomberg recently calculated, external that it continues to spend more than $6,500 per minute.

"I don't see how Tesla's going to survive, given their capital structure, meaning they have a ton of debt and continued massive losses," Mr Thompson said.

Tesla is facing a cash crunch

Tesla has previously tapped investors for more money, as well as collecting deposits from customers lining up for its cars.

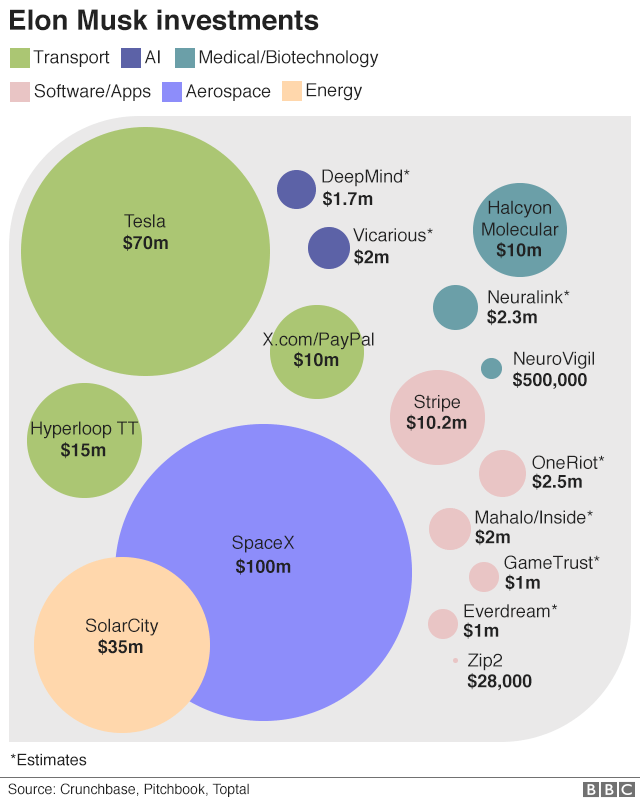

It raised more than $3bn on Wall Street last year, largely by issuing debt, cashing in on the enthusiasm for the firm and Mr Musk, 46, also known for his SpaceX rocket venture, punchy Twitter personality and tortured personal life.

This year, Tesla has maintained that it does not need to raise money apart from its "standard credit lines", citing improving production.

But in March Moody's said it expects the firm will need to raise about $2bn in the near-term. At the same time, the credit rating agency downgraded Tesla debt, external, citing the production struggles.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Tesla fans, who include celebrities such as Kanye West, remain legion, and demand for both its debt and shares was strong last year.

Mr Thompson, for one, thinks sentiment is shifting: "I think the story of, 'the next car is profitable, the next great thing is going to save the company', is sort of getting old and ... people are starting to realise that."

In addition to the manufacturing issues, Tesla has faced negative publicity for conflicts of interest on its board, as well as working conditions.

Its autopilot feature is under scrutiny after fatal accidents and the company recently recalled more than 100,000 Model S cars for an issue with the power steering.

Tesla has said its high public profile makes it a target for critics and Mr Musk, who has dubbed short-sellers "jerks", recently told CBS, external he is optimistic about the firm's "path out of hell".

Tesla's challenges did not stop shareholders from awarding Mr Musk a record pay package earlier this year.

"It should be pretty obvious, I think, that I'm not gonna joke about bankruptcy if I think it's remotely real," Mr Musk said.

"I'm feeling pretty optimistic about where Tesla is at this point. At this point I can have a clear understanding of the path out of hell, and I did not, until recently, have a clear understanding."

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

- Published16 March 2018

- Published10 February 2018

- Published8 February 2018