Italy political crisis hits financial markets

- Published

Former IMF official Carlo Cottarelli was named prime minister-designate

Fears over Italy's political upheaval spread to Wall Street after Europe's financial markets closed lower.

The prospect of fresh elections and the possibility of eurosceptic parties strengthening their position has raised concern about the eurozone's stability.

The Dow Jones index shed 1.6% and the S&P 500 lost 1.2%, coming after Italy's FTSE MIB closed down 2.7% and Europe's other main markets shed well over 1%.

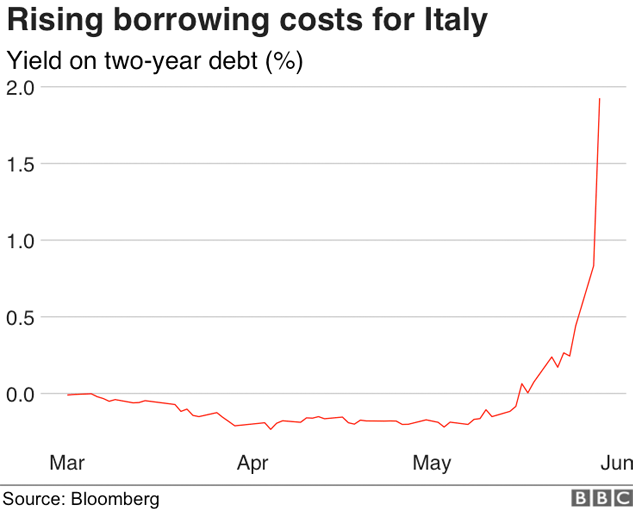

A sell-off in Italian bonds saw the yield on two-year debt breach 2%.

It meant that short-term Italian bonds suffered their biggest one-day jump in 26 years.

Movements in bond prices are important as they affect the cost of borrowing for the government. Italy's debt currently stands at 130% of its economic output.

The bond sell-off hit the share prices of European banks exposed to government debt, especially those in Italy. Banco BPM, Banco Generali, Unicredit and BPER Banca closed down between 5% and 6.7%.

On Wall Street, JP Morgan was down 3.7%, and Bank of America and Citigroup were just more than 3% lower. Morgan Stanley fell 5.3%.

Falling bank shares dragged down Europe's main share markets. At the close the UK's FTSE 100 fell almost 1.3%, while Germany's Dax was down 1.5% and France's Cac 1.3% lower.

"It's a market that is totally in panic", said Giuseppe Sersale, a fund manager at Anthilia Capital Partners, who noted "a total lack of confidence in the outlook for Italian public finances".

Mohamed El-Erian, chief economic adviser at Allianz in the US, said: "If the political situation in Italy worsens, the longer-term spillovers would be felt in the US via a stronger dollar and lower European growth."

What is Italy's political crisis all about?

'Troubles deepen'

The turmoil was precipitated after the anti-establishment Five Star and League political parties abandoned their attempts to form a ruling coalition after a standoff with President Sergio Mattarella.

He had vetoed their choice of a eurosceptic economy minister, and appointed former International Monetary Fund official Carlo Cottarelli as interim prime minister with the task of trying to form a government.

But his term is likely to be cut short, as he will almost certainly lose a parliamentary vote of confidence. If he does, then new elections would soon follow.

Analysis: Andrew Walker, BBC World Service economics correspondent

How bad is the financial situation in Italy? There is no question that the political crisis has led financial market investors to judge that the risks have increased markedly. The rise in Italian government bond yields has been very sharp and tells us that there is increased nervousness about the outlook.

But we are not - not yet at least - anywhere near the levels of financial stress that were evident in the peak of the eurozone financial crisis in 2011-12.

At the time there was an informal rule of thumb sometimes used, that countries were likely to need a bailout if the yield on their ten year bonds - essentially the annual cost of borrowing money for ten years - was sustained at more than 7%.

Italy did hit that level briefly in that earlier episode. But it's currently around 3%. Higher than it was - but not yet flashing red.

Five Star and the League won 33% and 17% of votes respectively in March's election, and could increase their combined majority in a new national poll.

"We've seen a steep sell-off in risk assets as the Italian political troubles deepen, with investors seemingly dumping their exposure to Italy," said Neil Wilson, chief analyst for Markets.com

"The moves this morning warrant attention as we are seeing some incredible price action in Italian bonds with the market moving at speeds not seen since the worst of the eurozone debt crisis.

"The big question is whether this is just an Italian problem or one that risks significant spill-over into the rest of Europe."

New PM in for a rough ride - Italian press

Italian papers predict that Carlo Cottarelli will have a tough time forming a government, and that once in power he will struggle to execute his plans.

The leftist Manifesto newspaper says: "It is not easy to find people ready to stay in the government for several months, without trust in parliament, and crucified by the two strongest parties ready to open fire."

The centrist daily Corriere Della Sera suggests that Mr Cottarelli will be a "steady hand at the wheel, in market waters that promise to be rough", but that it will be difficult for him operate because he will be "a prime minister without trust".

- Published28 May 2018

- Published28 May 2018

- Published1 June 2018

- Published2 March 2018