'Scammers struck as my mum was dying'

- Published

Mrs Bungay thought she was transferring money to her builder

A victim of fraud was tricked out of £13,000 in a sophisticated scam as she cared for her dying mother.

Angelene Bungay, 42, transferred money to a fraudster posing as the builder who was preparing to convert the loft of her Shrewsbury home.

Her bank said that despite Mrs Bungay being one of a growing number of victims of "push payment fraud", she would not be refunded.

New rules aimed at protecting people are being introduced soon.

'Life-changing loss'

Mrs Bungay and her husband Richard Lea had decided to extend the family home as they were unable to afford the cost of moving.

They found a legitimate builder, paid a deposit, and had a date agreed for the work to start. They extended their home loan to cover the cost.

Keen to get started with the work as soon as possible, Mrs Bungay was delighted to receive a reply to the previous email exchanges telling her another customer had cancelled so the builder could begin at an earlier date.

What she did not know was that the email, identical to the previous thread, was a hoax and the sender was not her builder but a fraudster. Typical of this kind of scam, it seems the con-artist had hacked into one of their email accounts to pose as the builder.

The email, seen by the BBC, gives details of the work to be completed and has nothing to signal it is a deception.

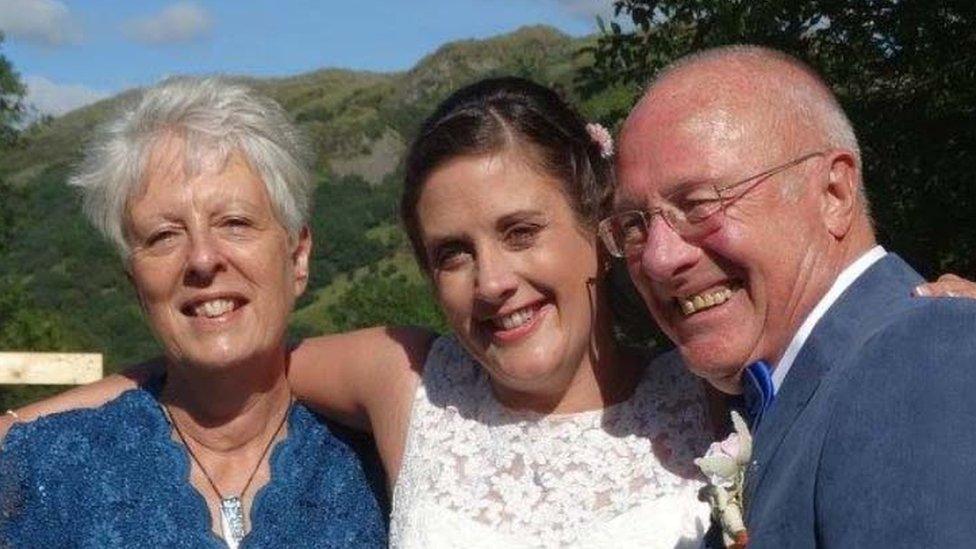

Angelene Bungay (centre) with her mother and step-father in happier times

The timing of the scam could not have been worse. Mrs Bungay's mother - Susan Ashford - was gravely ill.

"I was spending a week at home caring for my mother when the emails started coming through," she said.

"It was a difficult time. My mum had pancreatic cancer. We thought she had beaten it this time last year, but it returned and she passed away having just turned 65."

A second email asked for £7,000 to be paid for supplies needed for the work, to be paid into a separate account specifically for materials.

Mrs Bungay made the payment, but it was blocked. When she retried, her bank, First Direct, called to discuss the planned payment.

That conversation, during which First Direct said followed all the correct procedures, led on to the payment being pushed through to an alternative account supplied by the fraudster.

More emails followed, including discussions of the kind of insulation to be used, and so did another payment for £6,000.

No refund

Only then did the fraud become clear to Mrs Bungay. Following a call to her actual, legitimate builder, she found out he had not changed the starting date or asked for any money. She had paid an imposter.

Two days after the death of her mother, she was back on the phone to First Direct to report the fraud. She called again the next day, but the money had already disappeared from the bank account it had been paid into.

A spokesman for First Direct said: "We are sorry Mrs Bungay was a victim of fraud. The financial security of our customers is always our number one priority, and we aim to do everything we can to keep their money safe.

"Once we were notified by Mrs Bungay, we contacted the beneficiary bank to make them aware of the fraudulent activity, however we processed the payment in this case following Mrs Bungay's authorisation which means unfortunately we cannot recall the funds."

For her part, Mrs Bungay argued that more searching questions could have been asked by the bank, that could have exposed the fraud, when she first called them to push the payment through. She has taken her case to the financial ombudsman and Action Fraud.

How to protect yourself against "push" fraud

When you transfer money from your bank account, you are asked to enter three pieces of information: the name of the payee, their account number, and the sort code. However, only the last two are cross-checked by the bank. So putting in the correct name is no guarantee that person will get the money.

UK Finance offers the following advice:

Never disclose security details, such as your PIN or full banking password

Don't assume an email, text or phone call is authentic. Call the business's official number to check

Don't be rushed - a genuine organisation won't mind waiting

Listen to your instincts - you know if something doesn't feel right

Stay in control - don't panic and make a decision you'll regret

Learn more on protecting yourself from financial scams through the Take Five campaign, external.

This type of scam, known as authorised push payment fraud, is on the rise. Victims, on occasions, have lost hundreds of thousands of pounds.

Last year, a total of £236m was lost, according to banking trade body UK Finance. There were 43,875 reported cases of these scams.

Nearly nine in 10 (88%) of these were consumers, who lost an average of £2,784. The rest were businesses who lost on average of £24,355 per case.

In November, the BBC spoke to Kate Blakeley, who described the "sheer horror" of discovering the loss of almost £300,000 through such a scam.

Ms Blakeley, who was in the process of buying a house with her partner, thought she was transferring money to her conveyancing solicitor, but it was actually going to a fraudster.

Kate Blakeley: 'We lost £300,000 through payment scam'

Unlike other frauds, three-quarters of victims do not receive compensation from the banks as, in effect, they have given their consent to the payments being made.

This type of scam was the subject of a "super-complaint" made in September 2016 to regulators by consumer group Which?, which has been calling for banks to shoulder more responsibility when victims are tricked in this way.

It said victims had no legal right to get their money back from their bank, and far less fraud protection than was seen with other types of payments, such as card payments and direct debits.

It had seen cases of people being scammed when buying a house, during building work, but also during holiday lettings and, particularly recently, when buying cars or caravans.

The super-complaint has prompted new rules from the Payment Systems Regulator, in place by September, which will see the financial ombudsman consider ordering compensation if a bank or building society fails to keep to high standards when dealing with a report of fraud.

Other work should also lead to more protection for consumers.

For example, new technology is in the pipeline that will allow customers to confirm a payee - verifying that they are paying the person they intend.

All of which is too late for Mrs Bungay who, if nothing else, is desperate for nobody else to suffer in the same way she has.

- Published15 March 2018

- Published3 November 2017

- Published7 November 2017

- Published16 May 2017