Don't bank on it: Why we fail to switch our accounts

- Published

- comments

The numbers tell it all. The Competition and Markets Authority's (CMA) investigation into the banking industry in 2016 found that just 3% of current account customers had moved their account in the past year.

On a three-year time scale, 8% had switched while three-quarters of customers had never switched at all.

More than half of customers had been with their bank for more than 10 years.

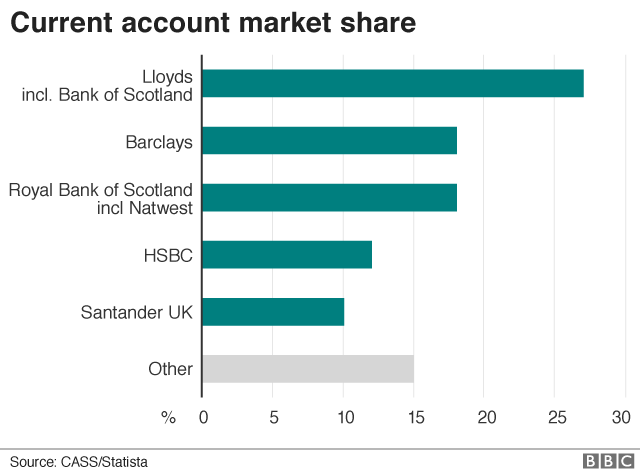

So while the head of CYBG said its takeover of Virgin Money would make it a "competitor of scale", it still faces a tough task in breaking the dominance of the big four - Lloyds Banking Group, Barclays, Royal Bank of Scotland and HSBC.

The CMA found the big four's 70% share of current accounts has barely budged despite attempts by various challengers - Clydesdale, Yorkshire and Virgin Money included.

Since 2005 the total market share of Lloyds, Barclays, HSBC and RBS has fallen by just 5%, the CMA said.

The financial crisis led to more concentration, with Lloyds taking over HBOS, one of those challengers, and smaller banks such as Alliance & Leicester being absorbed by the UK arm of Spain's Santander.

Mechanisms have been introduced to make it easier for customers to switch and fuel competition.

A seven-day switching service - promising automatic transfer of direct debits - was launched in 2013 - along with the Open Banking initiative earlier this year to make it easier to compare the accounts on offer.

There are about 70 million current accounts in the UK, and since that switching service began some five million accounts have been switched - although that is still less than 10% of the total.

Those customers who do switch are more likely to "have higher income, higher balances and higher education levels than those who did not", according to the CMA.

Those with unarranged overdrafts are less likely to move, even though they potentially have more to gain by switching providers.

But the CMA found customers do not switch unless they have a problem with their bank and most think they have little to gain financially by moving.

Current accounts are not like car insurance policies that need renewing, so customers have no reason to think about which account might be best for them. And if they do, they need to know specifics such as account charges, their overdraft usage and other items relevant to them.

The small business banking market is even more focused on the big four, which have an 80% market share of the 5.5 million accounts. Just 4% of customers shift their accounts annually and even dissatisfied customers are reluctant to move, according to the CMA.

But there are expectations this will change as Royal Bank of Scotland must lose some 120,000 small business accounts - 3% of the total - because of arrangements linked to its taxpayer-funded bailout.

CYBG - the owner of Clydesdale Bank and Yorkshire Bank - has its sights on these customers and is already a big player in Scotland and Yorkshire, where it has 15% market share of small business accounts.

- Published18 June 2018

- Published24 May 2018