Tesco and Carrefour say 'strategic alliance' will cut prices

- Published

- comments

Tesco says it is planning a "strategic alliance" with French retail giant Carrefour, as the two try to use their joint buying power to cut costs and offer lower prices to customers.

The two plan a "strategic relationship", external when dealing with global suppliers, and the tie-up will also mean sharing their own-brand products.

The move comes as retailers face an increasingly competitive environment.

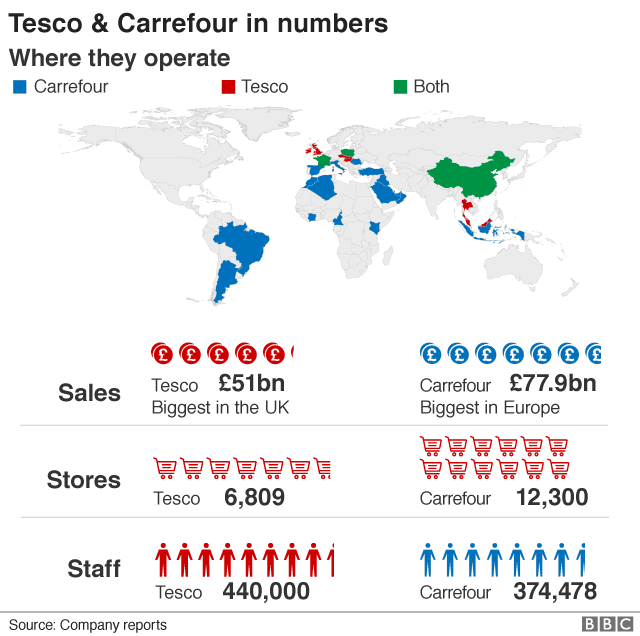

Tesco is the UK's largest retailer while Carrefour is Europe's largest.

Last year, Tesco - which employs 440,000 people - reported profits of £1.3bn with sales of £57.5bn.

Carrefour operates 12,300 stores across more than 30 countries, employing about 375,000 people worldwide. Last year, it had sales of €88.2bn (£78bn).

The two have been talking for two years and, although no formal agreement has yet been signed, they said they were hoping to confirm a deal in the next two months.

Tesco chief executive Dave Lewis said: "By working together and making the most of our collective product expertise and sourcing capability, we will be able to serve our customers even better, further improving choice, quality and value."

The grocery sector is currently going through a period of rapid change. Tesco itself recently completed the purchase of wholesaler Booker, and in April, Sainsbury's said that it was in advanced talks to buy Asda from US retail giant Walmart.

The traditional big four UK supermarket chains - Tesco, Sainsbury's, Asda and Morrisons - have faced increasing competition from the rapidly-expanding budget chains Lidl and Aldi over the past few years, and there is now the added threat of internet giant Amazon moving into the sector.

Last year, Amazon bought upmarket grocer Whole Foods. In the UK, Amazon offers food sales through its Amazon Fresh service, although currently that is still focused on Greater London and parts of the South East.

Analysis:

Emma Simpson, business correspondent

This tie up would have been unthinkable a decade ago, given the past rivalry of these two supermarket giants, but these days they're both under pressure from the increasing competition.

Aldi and Lidl have vast operations and sales across Europe. This gives them huge buying power with suppliers. With their no-frills stores and limited, mostly own-branded, product range, their business model makes it very difficult for the big, traditional retailers to match their prices.

It's not the first alliance of its kind. There are a number of big buying groups in Europe. For instance, Morrisons is part of the AMS Sourcing group which enables it to buy some own branded products with other companies.

Sainsbury's and Asda also want to buy better together, securing better terms from suppliers, with their mega merger.

All the big traditional supermarkets are trying to cut costs and improve profitability as they adapt to an array of pressures and changes which are reshaping the industry.

Tesco will be hoping this move will improve its offer.

Harder fight

"Another price war is now looming in the UK supermarket sector," said Laith Khalaf, senior analyst at Hargreaves Lansdown. "The latest Tesco partnership looks like a direct response to the threat posed by the proposed merger of Sainsbury's and Asda, who will have access to the global buying power of Walmart as a result."

Patrick O'Brien, UK retail research director at GlobalData, noted that a key focus of the tie-up "is to reduce prices on own-brand products, and this is more of a direct response to Aldi and Lidl, whose offers are heavily weighted towards own-brand".

Own-brand ranges give supermarkets greater control and the potential for higher margins, he added. Across the British supermarket sector there is a shift towards more own-label products, suggesting the big brands will have to fight harder for shelf-space.

The potential squeeze on suppliers is a big worry for FoodDrinkEurope, the trade organisation for Europe's food and drinks suppliers.

"Buying alliances have a detrimental effect on the whole food supply chain," said FoodDrinkEurope's director general, Mella Frewen. "They increase the buying power of the retailers in the alliance thus putting the manufacturing industry, and other suppliers, under increasing price pressure.

"On top of the recent Sainsbury's-Asda alliance, this will have a huge impact on the balance of power along the food chain, to the detriment of all suppliers, regardless of size."

The chairman of the Federation of Small Businesses, Mike Cherry, said some small businesses would be worried about Tesco's planned deal.

"Small suppliers that supply to Tesco need assurances that they will still be treated fairly and correctly in any large operation that now emerges." he said.

Tesco's performance has steadily improved since 2014, when it posted the worst results in its history with a record pre-tax loss of £6.4bn. It recently recorded its 10th consecutive quarter of rising sales and said its growth plans were on track.

In January, Carrefour announced a major transformation plan that involved making cost cuts of €2bn by 2020, and investing €2.8bn in e-commerce by 2022.

- Published29 June 2018

- Published15 June 2018

- Published28 April 2018

- Published22 May 2018