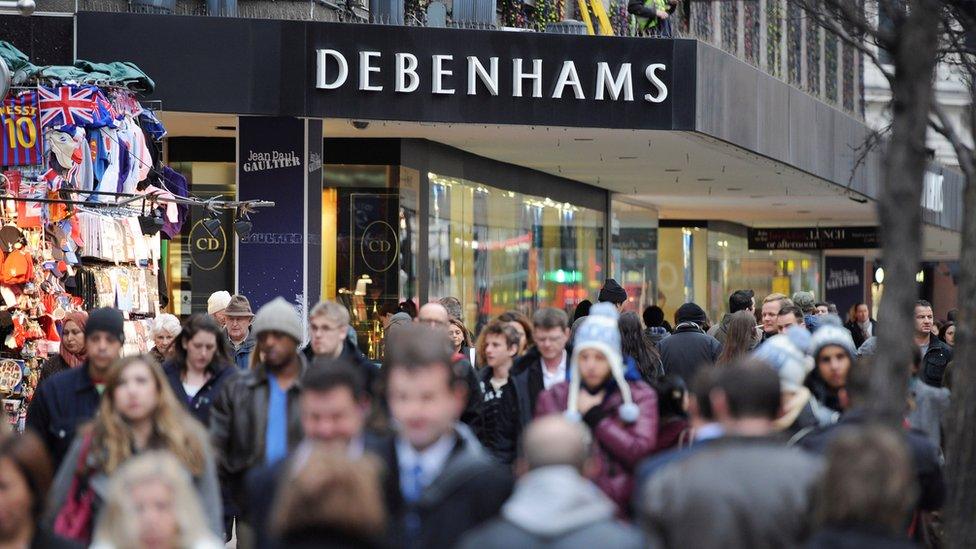

Debenhams shares hit by insurance fears

- Published

Shares in Debenhams have fallen again in a rocky day for its shares.

Reports some insurers reduced cover for its suppliers sent the department store chain's share price down 6.5%.

The Sunday Times said, external the retailer was facing "a cash crunch" because some credit insurers had tightened their terms for Debenhams suppliers.

Suppliers use credit insurance to cover them from the risk of not being paid but Debenhams said that its balance sheet and cash position were "healthy".

The retailer, which is in the midst of a turnaround plan designed to cut costs and boost sales, said its relationship with credit insurers was "constructive" and all were continuing to provide cover to its suppliers.

One major insurer, Euler Hermes, is understood to have reduced the amount of credit insurance it will provide.

Meanwhile, some new suppliers are believed to have found it difficult to get credit insurance for Debenhams' orders.

When insurance firms reduce their cover or withdraw it altogether, it means they are concerned about the ability of their customers to pay their debts.

Debenhams acknowledged market conditions were "challenging", but said it had "a clear strategy in place" and was taking "decisive actions to strengthen the business".

Debenhams's shares closed down at 13.75p.

The chain's statement comes a month after it issued its third profit warning this year, saying full-year profits would be lower than expected.

Chief executive Sergio Bucher, who joined Debenhams in 2016, aims to put more emphasis on food and beauty and improve the firm's online platform.

Debenhams is not the only retailer struggling.

Last week, rival Marks and Spencer, which has already said it will close 100 shops, warned it could be forced to close more stores as it battles to improve its fortunes.

Meanwhile, administrators in charge of finding a buyer for the stricken Poundworld chain said on Friday a further 80 stores would close, resulting in 1,024 job losses.

- Published15 July 2018

- Published19 June 2018

- Published19 April 2018

- Published8 February 2018