Premier Foods boss survives investor revolt

- Published

Premier Foods boss has survived a bid to oust him at the company's annual meeting after 41% of shareholders voted against his re-election.

Activist hedge fund Oasis Management, the firm's second-largest shareholder, had called for Gavin Darby to resign.

It claimed he had destroyed shareholder value by rejecting a takeover bid.

More than a quarter of investors also rejected the remuneration report, with a similar number voting against chairman Keith Hamill.

After the meeting, Mr Hamill said it was clear that the board lacked the support of some shareholders. "We need to continue to discuss that with them," he said, adding that the board wanted Mr Darby to remain chief executive.

"If 40% of people want you to do something, and 60% don't, you need to think about and talk to the 40% - but there's no reason for ignoring the 60%."

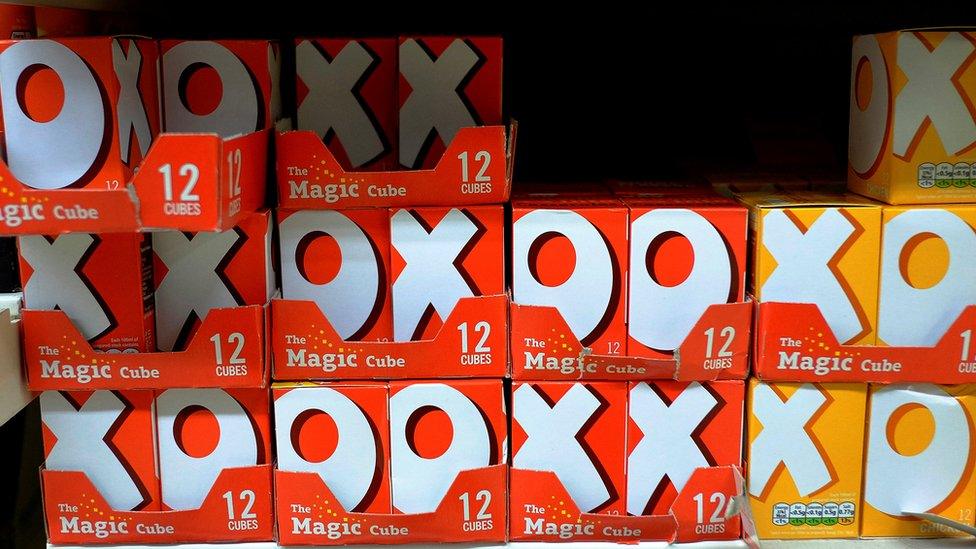

Premier Foods owns brands including Mr Kipling, Ambrosia, Oxo and Batchelors and Lloyd Grossman.

The Premier boss has been under fire since the firm rejected a takeover bid from US company McCormick two years ago 2016.

The company then announced a deal with Japan's Nissin Foods, which took a seat on Premier's board and is now its largest shareholder with a 23% stake.

Oasis said Mr Darby was only saved by what it called his "cosy relationship with conflicted shareholder Nissin".

It added: "The message from today's huge negative vote could not be clearer - Gavin Darby has no credibility and he should step down immediately.

"If he is unwilling to resign, we urge the other directors to discharge their duties and act in the best interests of the shareholders as a whole to remove him."

Shinji Honda, the director who represents Nissin on Premier's board, also suffered a 25% vote against his reappointment.

However, shareholder advisory groups ISS, PIRC and Glass Lewis backed Mr Darby.

In a trading update on Wednesday, Premier Foods said the 1.7% rise in first quarter sales and a 4.5% increase over the past six months proved the company was on the right track.

Its performance was boosted by a 14% surge in UK sales of Mr Kipling cakes thanks to a recent advertising campaign and brand refresh.

In May, Premier posted a 74% rise in pre-tax profits to £20.9m.

Shares fell 4% in afternoon trading in London to just under 45p, valuing the company at £378m.

The stock was above 70p a share in April 2014 and McCormick offered 65p a share after raising its bid for the third time in March 2016.

- Published30 March 2016