Interest rates: Bank of England expected to increase base rate

- Published

Mortgages can become more expensive when the Bank of England raises the base rate

At midday on Thursday the Bank of England is expected to raise interest rates for only the second time in a decade.

Economists and investors expect the Monetary Policy Committee (MPC) to increase rates from 0.5% to 0.75%.

Changes to the Bank rate affect tens of millions of savings accounts, loans and mortgages.

This is because banks use it as a reference point for the amount they pay savers and charge borrowers.

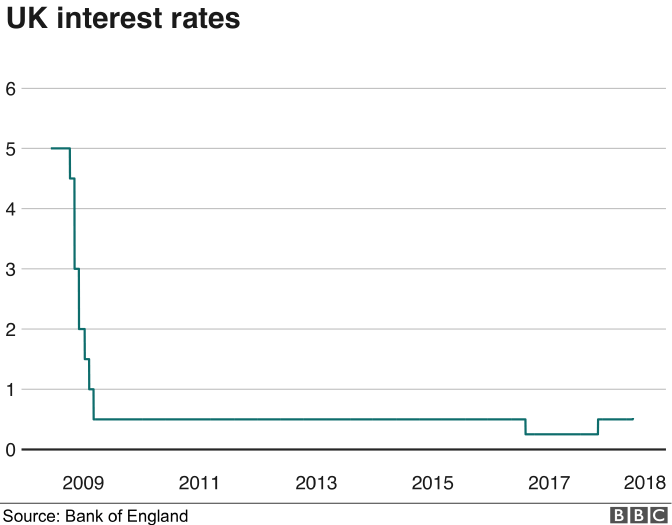

Any increase on Thursday would follow a similar rise in November 2017, when the MPC raised rates from a record low of 0.25%.

It would also take the so-called Bank Rate to its highest level since 2009.

Investors are betting there is more than a 90% chance that interest rates will rise to 0.75%.

Many economists had expected rates to rise earlier.

However, weak economic data, partly due to the freezing winter temperatures caused by the "Beast from the East" have seen the Bank keep rates on hold this year.

The UK economy expanded by just 0.2% in the first three months of the year. Bank staff believe this weakness was temporary and expect the economy to expand by 0.4% in the second quarter.

In June, three out of nine policymakers, including the Bank's chief economist Andy Haldane, voted for rates to rise to 0.75%. Five votes are needed to change policy.

While many analysts expect another split decision on Thursday, solid employment growth, steady pay growth and a rebound in consumer spending are expected to justify an increase.

Economists at Goldman Sachs expect Mark Carney, the Bank of England governor, to "stress that the August hike is a slow and steady step on the MPC's path to normalisation".

I'm a saver or a borrower - what does it mean for me?

When the Bank Rate goes up, so should rates on mortgages and savings accounts.

When policymakers raised interest rates last November, it predicted that savers would reap the benefits of a rate rise more quickly than borrowers would feel the pinch.

In reality, however, it's not so simple.

Sir Dave Ramsden, one of the Bank's deputy governors, warned savers "never" to expect banks and building societies to fully pass on rate rises.

He said the financial crisis had triggered a change in the returns savers should expect. While rates remain low, he said many savings accounts were now offering higher returns than Bank Rate.

Cheaper mortgage deals in recent years have also encouraged people to lock in promotional rates.

Those on fixed-rate deals will feel no immediate impact from a rate rise.

Back in 2010, just 38% of people who took out a new mortgage fixed their rates, according to the Financial Conduct Authority. That figure is now 90% for new mortgages, and two-thirds of all home loans.

The Bank of England is expected to raise interest rates to 0.75%

How has the economy performed?

The Bank of England will also release its latest forecasts for economic growth, jobs and inflation on Thursday.

While pay is finally starting to outpace price rises, wage growth remains modest by historical standards.

Inflation, as measured by the consumer prices index (CPI), rose by 2.4% in the year to June. This is slightly lower than the 2.5% rate expected by the Bank in its forecast three months ago.

Unemployment, at 4.2% in the three months to May, is slightly higher than the 4.1% predicted by the Bank.

How many more rate rises can we expect?

On Thursday, the Bank will provide an indication of the level of the rate we should expect in normal times. In other words: when inflation is steady at the Bank's 2% target and the economy is running at its maximum speed limit.

Of course, these are not normal times.

While any interest rate rises are expected to be "limited and gradual", Mr Carney has warned that "guidance is not a promise of the future path of policy".

He said the final Brexit deal was "potentially the most important" factor that would influence monetary policy in the coming months and years, and added that the Bank was ready for all outcomes.

In short, guidance is good, but not gospel - and all bets are off in the event of a Brexit shock.

Five interest rate facts

More than 3.5 million residential mortgages are on a variable or tracker rate

The average standard variable rate mortgage is 4.72%

On a £150,000 variable mortgage, a rise to 0.75% is likely to increase the annual cost by £224

A Bank rate rise does not guarantee the equivalent increase in interest paid to savers. Half did not move after the last rate rise

No easy access savings account at a major High Street bank pays interest of more than 0.5%

What would a rate rise mean for you?

Sources: UK Finance, Moneyfacts, Nationwide Building Society

- Published2 August 2018

- Published1 August 2018

- Published2 August 2018

- Published2 August 2018