UK interest rates rise for first time in 10 years

- Published

The Bank of England may lift rates twice more over three years

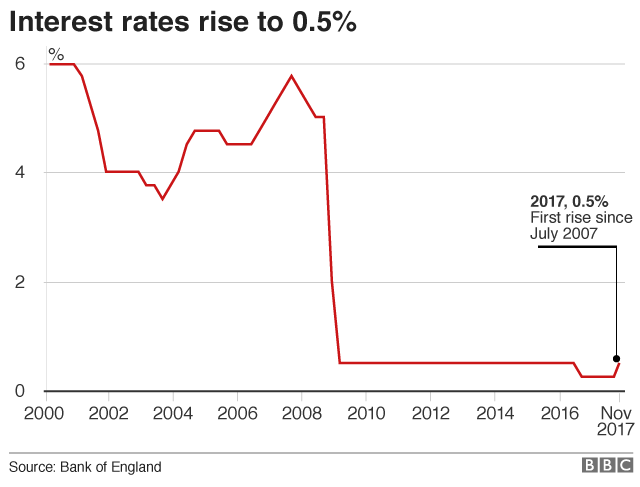

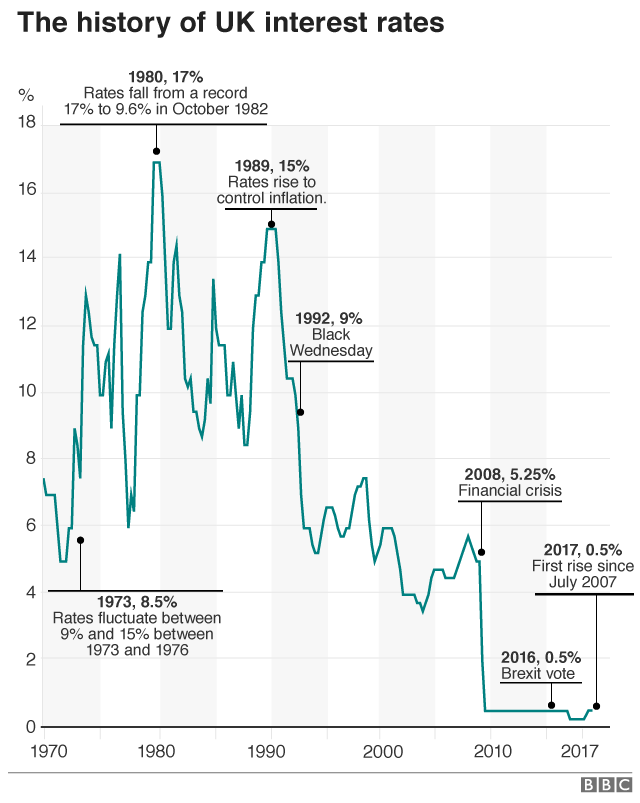

For the first time in more than 10 years, the Bank of England has raised interest rates.

The official bank rate has been lifted from 0.25% to 0.5%, the first increase since July 2007.

It is likely to rise twice more over the next three years, according to Bank of England governor Mark Carney.

The move reverses the cut in August of last year, which was made in the wake of the vote to leave the European Union.

Almost four million households face higher mortgage interest payments after the rise, but it should give savers a modest lift in their returns.

As well as many of the country's 45 million savers, anyone considering buying an annuity for their pension will also see better deals.

The main losers will be households with a variable rate mortgage.

Mr Carney expects banks to pass on the rate rise to savers, but said many mortgages, loans and credit cards would not see an immediate impact.

He said that British households have been "savvy" with their finances and have mostly taken out fixed-rate mortgages, which means it will take some time before the rise has an impact on them.

The Bank estimates that almost two million mortgage holders have not experienced an interest rate rise since taking out a mortgage.

Of the 8.1 million households with a mortgage, 3.7 million - or 46% - are on either a standard variable rate or a tracker rate - which generally move with the official bank rate.

The average outstanding balance is £89,000 which would see payments increase by about £12 a month, according to UK Finance.

The panel which sets interest rates, called the Monetary Policy Committee (MPC), justified the rate increase by pointing to record-low unemployment, rising inflation and stronger global economic growth.

Seven out of the nine members voted in favour of higher rates.

Mr Carney told the BBC that the Bank expected the UK economy to grow at about 1.7% for the next few years, which he said would require "about two more interest rate increases over the next three years".

We challenged some ten year olds to explain a system that baffles many adults…

The pound fell about 1% against the dollar and euro, as some investors had hoped to see hints of more rate rises. Sterling dropped more than a cent against the two currencies to $1.3130 and €1.1280 respectively.

Brexit impact

The financial markets are indicating two more interest rate increases over the next three years, taking the official rate to 1%.

Howard Archer, chief economic adviser to the EY Item Club consultancy, said: "The Bank of England seemingly sees the hike to 0.50% as more likely to be a case of 'one and a little more to come' rather than 'one and done'."

The MPC also said that the decision to leave the European Union is having a "noticeable impact" on the economic outlook.

Mr Carney said "Brexit-related constraints" on investment and workers appeared to be holding back the potential growth of the economy.

Looking ahead, he said: "The biggest determinate of our outlook is going to be those negotiations ongoing on Brexit - both a transition deal to a new arrangement and what is the longer form arrangement with the European Union."

The Bank of England is tasked with keeping consumer price inflation at around 2%.

However, inflation has been running higher than that since February, and in September it hit 3% - the highest rate since April 2012.

Mr Carney said inflation was unlikely to return to 2% without raising rates, because the economy was growing at levels "above its speed limit".

Where were you when interest rates last went up?

Business bodies said the rise was expected, but warned that companies could be hit if further increases came too soon.

The Federation of Small Businesses said some would struggle to "absorb more hikes in the short term", while the CBI said "what's important is the pace of any future rises".

Economists said the rise was unlikely to have a big effect on the economy, because rates are still at the lows seen since the financial crisis.

Lucy O'Carroll, chief economist at Aberdeen Standard Investments, said: "The symbolism of this hike is more significant than its economic impact."

Price pressures

The Bank has been reluctant to raise interest rates until now, arguing that inflation had been boosted by the fall in the value of the pound since the Brexit vote in June of last year.

That weaker pound has driven up the costs of imported food, fuel and other goods. The Bank says this effect is probably at its peak at the moment.

The other issue holding back the Bank has been the weakness in wage growth. While inflation hit 3% in September, wage growth was only 2.1%.

However, the Bank sees wage growth "gradually" increasing over the 2018 and says there are signs of that happening already.

In its Quarterly Inflation Report, released with the announcement on rates, the Bank estimated inflation was likely to peak this month at 3.2%.

- Published2 August 2018

- Published2 November 2017

- Published2 November 2017

- Published2 November 2017

- Published2 November 2017

- Published2 November 2017

- Published2 November 2017