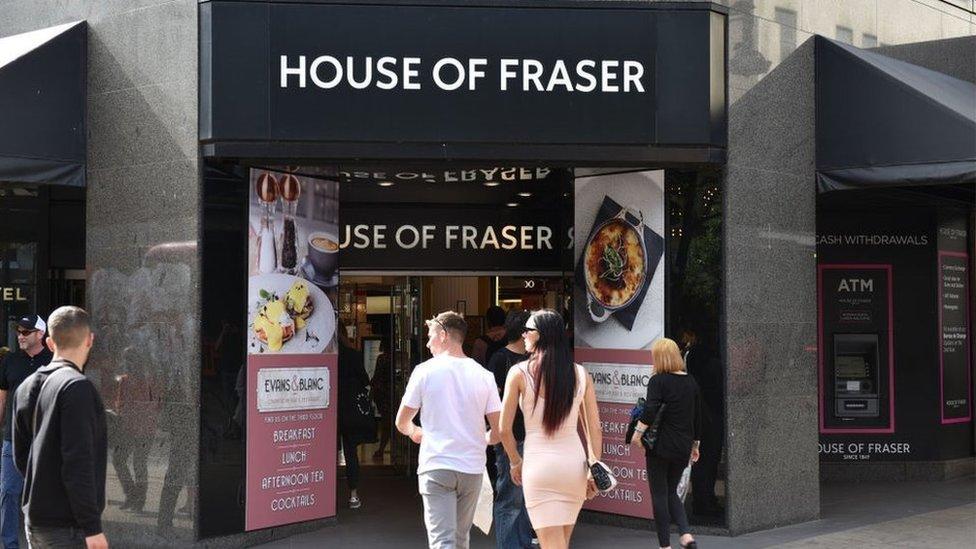

House of Fraser suppliers face anxious wait

- Published

Suppliers to House of Fraser are among those anxiously awaiting the fate of the struggling department store chain.

House of Fraser (HoF) has said it needs to find fresh funding by 20 August, when payments to concessions in the stores need to be paid.

An outcome from the discussions is expected before then. The store chain said all suppliers are being paid.

But one supplier told the BBC if HoF went into administration, he would regain a fraction of what he is owed.

House of Fraser employs 17,500 people - 6,000 directly and 11,500 concession staff.

Around 6,000 jobs - 2,000 from House of Fraser and 4,000 brand and concession roles - will be lost as a result of a restructuring planned announced in June to close 31 of its 59 shops.

House of Fraser has already issued a statement to thank "all of its employees, suppliers and other stakeholders for their ongoing support".

A spokesperson for House of Fraser said: "Suppliers have and are being paid as per their terms and conditions."

'Willing to lose £20,000'

Nigel Lugg, group executive chairman of Prominent Europe, which supplies Chester Barrie menswear to House of Fraser, said the company was still supplying clothes.

Mr Lugg said that if House of Fraser went into liquidation his company would receive between 3p and 4p in the pound of what he is owed. "And there is nothing you can do."

Suppliers are notoriously reluctant to discuss their relations with the companies that sell their products. The BBC contacted many who would not talk about the situation - even anonymously.

Another supplier, who spoke to the BBC on condition he not be named, said he had been in business for 30 years but had never known the state of the retail industry to be so bad.

He said he would not have an alternative store to go to if House of Fraser went under, saying: "Who is there who is left? That is the trouble. Everybody seems to have a problem."

He said that he was sending the retailer one invoice at a time and only supplying more stock when that was paid. He said he was worried his August bill may not get paid.

He added: "I am willing to lose around £20,000 and you have got to take chances in this business, but nobody seems to know what is happening."

Another supplier, who also did not want to be named, said they were "definitely concerned", but that the situation was not yet having an impact on its decisions.

Possible buyers?

A key question is whether the business can be saved without being put into administration first.

Among the potential investors in House of Fraser are Philip Day, the owner of Edinburgh Woollen Mills whose retail empire also includes Peacocks, Jane Norman, Austin Reed and Jaeger.

Sports Direct boss Mike Ashley, who already owns an 11% stake in the department store business, is also in the frame.

And the investment fund Alteri, an offshoot of US hedge fund Apollo, is said to be interested.

House of Fraser's Chinese owners Nanjing Cenbest - also known as Nanjing Xinjiekou - had agreed to sell a 51% stake to the Chinese owner of Hamley's, C.banner. But earlier this month, C.banner pulled out of the deal to take the stake in the 169-year-old department store chain, leaving it and its creditors to seek alternative sources of finance.

On Thursday House of Fraser told the Luxembourg stock exchange that "discussions continue" with potential investors.

The talks are "focused on concluding as quickly as possible to enable receipt of an investment required by no later than 20 August 2018".

- Published9 August 2018

- Published10 August 2018