Lehman anniversary: The five most surprising consequences

- Published

- comments

Was 2008 the worst time to graduate?

In 2008, I was one of the 1.5 million students who graduated from university in the US.

And, like everyone else, I was caught off guard.

Whatever we expected then, the reality today is that as a generation, we have more debt, fewer children and quite a few scars.

A decade on, there has been quite a bit of handwringing about what's changed since the financial crisis.

And I'm convinced that the biggest fallout isn't the increased regulation, or the jailed bankers (or lack thereof), but the impact it had on those of us who were just entering the workforce in 2008.

To find out more, I've travelled around the country asking experts and fellow 2008 graduates - what happened to us?

1. We have fewer children, if we have them at all

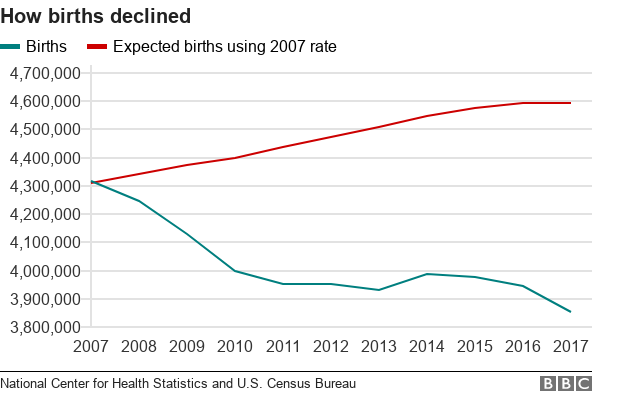

In the decade since the recession, American women had 4.8 million fewer babies than demographers were expecting, external.

No, that isn't a typo.

"Every year when I look at the fertility data I expect the number of births to go up and it hasn't," says University of New Hampshire Professor Kenneth Johnson.

Prof Johnson says part of the fertility decline is attributable to women in their early and late 20s having fewer children than expected - in other words, my classmates and those who came after us.

And it's not getting better. The gap is getting wider - which is why he brings up a historical parallel.

"There were a group of women who were in their early 20s at the beginning of the Great Depression who never made up for the births that they didn't have.

"More of them are childless than any group of American women before or since."

The question, says Prof Johnson, is if we too will simply forego births like the women of the Depression or if we're simply just waiting longer.

Nora Carroll graduated from the University of Nevada Las Vegas in 2008 and says she delayed starting a family due to the crash.

"I spent the last decade really concentrating on getting a stable career, saving enough money so I can purchase a house," she says.

"All of that just takes time [especially because] being in a lower paying job [it] takes a little bit longer."

She is now expecting her first child.

2. We've accumulated a lot less wealth than prior generations

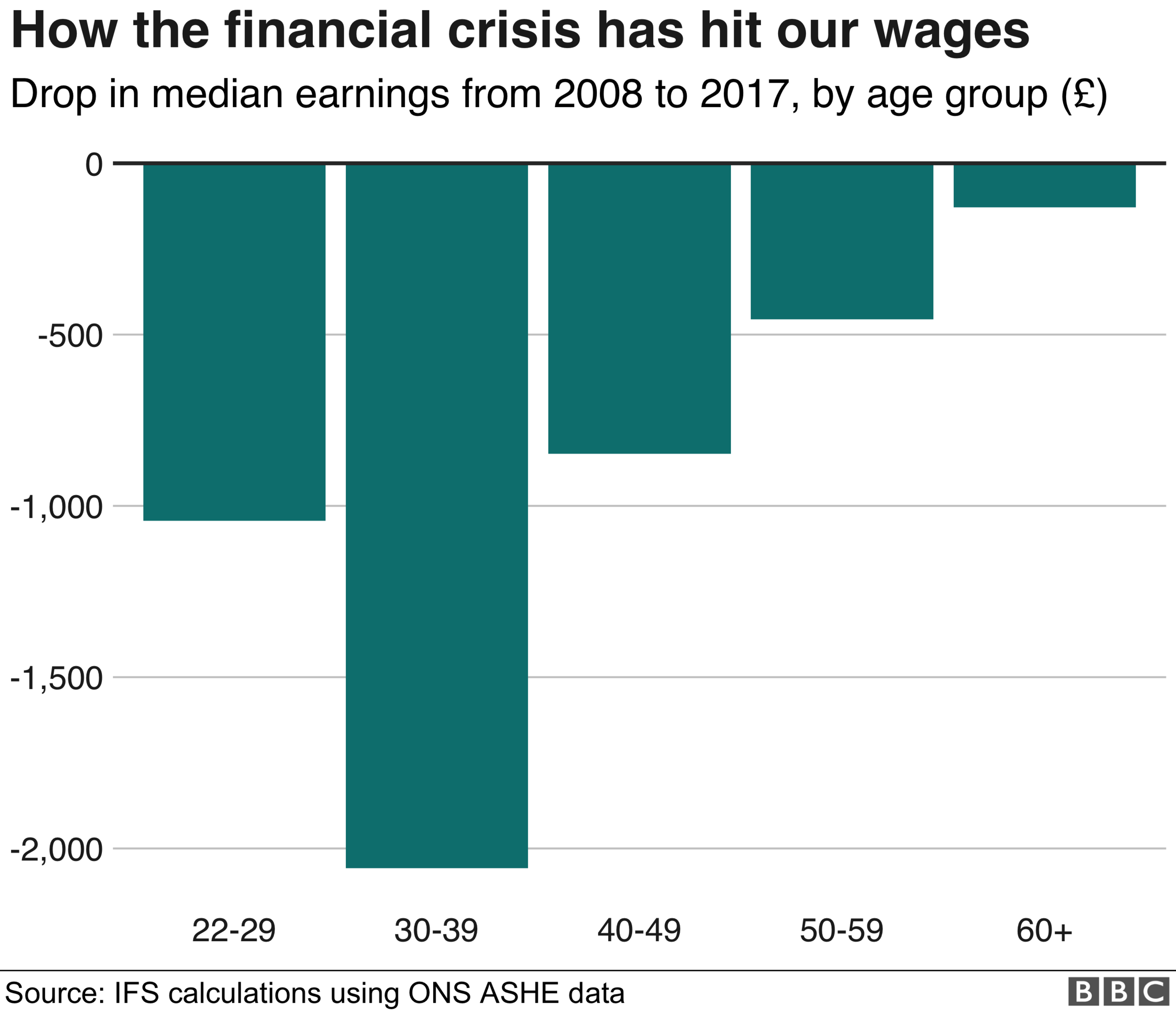

In the UK, research commissioned by the BBC found that people who are 30-39 years old now were worst affected by the financial crisis - losing on average 7.2% in real terms, or £2,057 ($2,684) a year between 2008 and 2017.

That's pretty similar to what happened in the US.

Americans born in the mid-1980s have accumulated 34% less wealth than predicted based on previous generations, the St Louis Federal Reserve, external found.

One reason? We started out with less.

The average salary of a newly-minted college graduate in 2008 was $46,000, according to the Bureau of Labor Statistics, external.

That was 8% less, adjusted for inflation, than college graduates aged 25 to 34 earned in 2002.

3. We hate the stock market

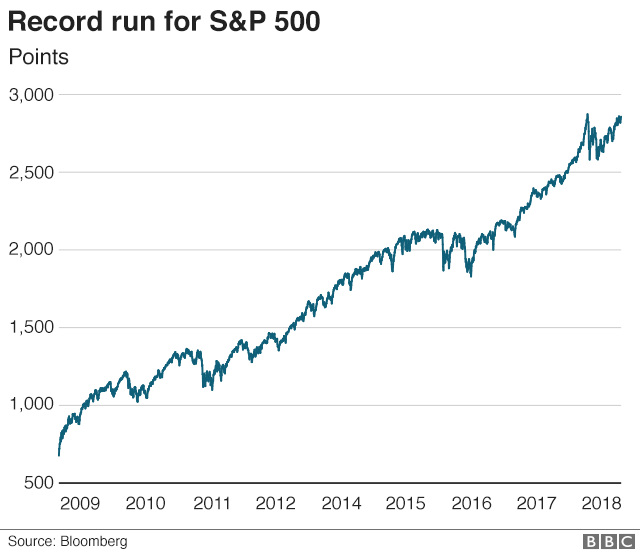

Just two out of five millennials are invested in the stock market.

And even those of us who do invest have ventured only about $7,000, according to the Federal Reserve.

That's not simply because we're money-strapped.

"Investors' willingness to bear financial risk depends on personal experiences of macroeconomic history", economists at the University of California-Berkeley have found, external.

In other words, if you are a young person who, say, watched the Dow Jones plummet over 500 points in one day, external - your appetite for risk is slim.

So even though the S&P 500 officially entered the longest bull market in history this summer - rising over 325% since the depths of the financial crisis - well, we haven't really benefited from all those stock market gains.

4. We don't buy homes

The homeownership rate of millennials between the ages of 25 and 34 was 37% in 2015 - 8% lower than that of prior generations, according to the Urban Institute, external. In the UK, the home-ownership rate for millennials has nearly halved.

There are plenty of explanations - not least fewer children, less wealth and coming of age after the housing market imploded.

When we do manage to buy property, it's worth a lot less than the average first-homes of prior generations.

The average median home value for someone aged 18-33 in 2013 was $133,000, external compared to $197,000 for the same age group in 2007.

5. We trust no-one

Trust in institutions was on the decline well before the financial crisis, but as a generation, our faith is especially low.

Just 19% of millennials agree with the statement that "generally speaking, most people can be trusted" - compared to 31% for the generation before us, and 40% for our parents' generation, according to the Pew Charitable Trusts. , external

And, no surprise here, when it comes to institutions, we trust Wall Street least of all, external.

"Wall Street certainly took a hit," says Eric Fraser, who graduated from the University of Central Florida in 2008 and took what he thought was an innocuous job in the financial services industry.

"At that time it didn't seem villainous until these names and faces started hitting the news."

That caused him to re-think what it was like to work in the industry.

"I had a bit of hesitation to explain, 'yes I do work in financial services but no I'm not a subprime mortgage lender or anything like that.'"

Today, he says there is one silver lining to having had a front row seat to that dissolution in trust.

"I think entering the workforce around that time really gave me a sense of humility and I don't know if I would have had that same mindset if I had graduated earlier."