Aldi and Lidl included in Sainsbury's-Asda competition probe

- Published

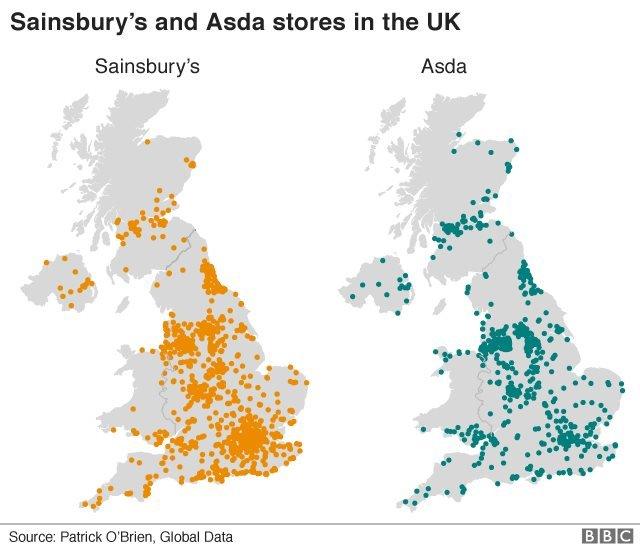

Regulators will widen their investigation into Sainsbury's planned merger with Asda to take account of the rapid rise of Aldi and Lidl.

The Competition and Markets Authority will also assess the rise of online firms in its probe of a deal that would create the UK's largest grocer.

The ongoing rise of Aldi and Lidl was underlined on Tuesday as they continue to win a bigger slice of the UK market.

Tesco, Sainsbury's and Asda all lost out, Kantar Worldpanel data showed.

There had been speculation that the rapid growth of the German discounters might not be considered in the CMA's review.

But its latest update, the CMA said it has broadened its scope to include Aldi and Lidl as well as non-grocery competitors such as B&M, Amazon and John Lewis & Partners.

Stuart McIntosh, chairman of the CMA's inquiry group, said: "Millions of people shop at Asda and Sainsbury's every week, so it is essential we carry out a thorough investigation into their proposed merger.

"Our job is to find out whether the merger will result in people paying more, or being faced with less choice or a poorer quality shopping experience."

In their own submission to the CMA, Sainsbury's and Asda said that Aldi and Lidl "have had the most profound impact" on the grocery market over the past decade.

The two companies also pointed to the launch of Jack's, Tesco's new cut-price chain.

The continuing growth of Aldi and Lidl came in latest closely-watched Kantar Worldpanel data for the three months to October.

Aldi and Lidl increased sales by 15.1% and 10% respectively compared with the same quarter last year. Aldi's growth was its fastest since January last year and helped it to a market share gain of 0.8 percentage points to 7.6%, while Lidl's share was slightly up at 5.6%.

Tesco, the UK's biggest supermarket, saw its market share fall 0.6 percentage points to 27.4% despite sales rising by 0.9%.

Sainsbury's was down 0.4 points compared with the three months last year at 15.4%, while Asda dropped 0.2 points. Co-op was the only other bricks-and-mortar retailer to gain market share with sales up 7%.

Overall grocery sales rose by 3.2% compared with the same 12 weeks last year - a slight slowdown from the highs reached during the summer.

Fraser McKevitt, head of retail and consumer insight at Kantar Worldpanel, said: "Consumer spending often slows in early autumn, after the excesses of summer barbecues and before the festive season kicks off.

"Christmas will be here before we know it and some families seem to be getting into the spirit already - 8% of households bought mince pies last month, spending a total of £4m with 70 days still to go before the big day."

- Published1 October 2018

- Published19 September 2018

- Published19 September 2018