Five things to watch for in the Budget

- Published

- comments

Today is Budget day and certainly a tricky one for the Chancellor.

He has a number of competing challenges.

Some of them are economic - can he really "end austerity" by spending more and at the same time keep his promise to control the government's £1.8tn debts?

Some of them are political - don't forget the government does not have a majority and pushing any big tax rises, for example, through Parliament would be very difficult.

Mr Hammond is also being lent on to be "more positive" on the economy by his next door neighbour at Number 10, Theresa May.

With those caveats, here are the five key issues to look out for.

1. Will taxes rise?

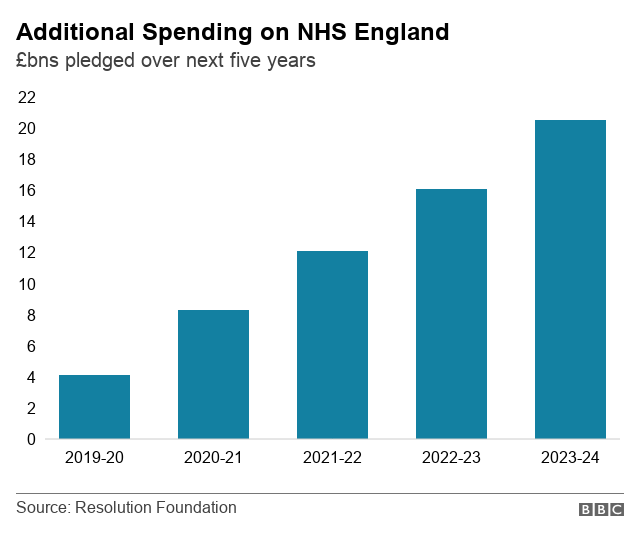

Ever since the Prime Minister announced billions of pounds of extra spending a year on the NHS in England, both Mrs May and the Chancellor have suggested that taxes will have to rise to pay for the pledge.

Keep an eye on what Mr Hammond says about thresholds - that is the amount people are able to earn before they start paying tax.

If they are frozen that is effectively a tax increase as annual wage inflation means more of our income will be subject to income tax.

Mr Hammond knows that freezing thresholds could draw criticism as it was a Conservative manifesto pledge last year to increase thresholds.

And with no Parliamentary majority, anything too radical in this area is likely to be voted down, just as plans to increase national insurance contributions for the self employed were voted down last year.

More likely is a tightening of the rules on self-employment status which will mean more self employed people paying tax. I have written about that issue here.

There are also likely to be more taxes on gambling firms.

The Treasury signalled earlier in the year the betting industry would take a tax hit after the bets people could make on Fixed Odd Betting Terminals were reduced, limiting the amount of tax paid to the government.

But overall, expect nothing too radical on tax.

For example, I don't believe the Treasury is yet ready to announce a new tax on global technology companies.

It is a complicated issue and America has expressed its displeasure at countries which it believes are targeting its success stories such as Google and Facebook.

Far more likely are a number of small and relatively technical changes which will increase the overall tax burden on individuals and businesses.

Check the forecasts for tax changes in the future - they may signal larger rises ahead in order to pay for higher public spending.

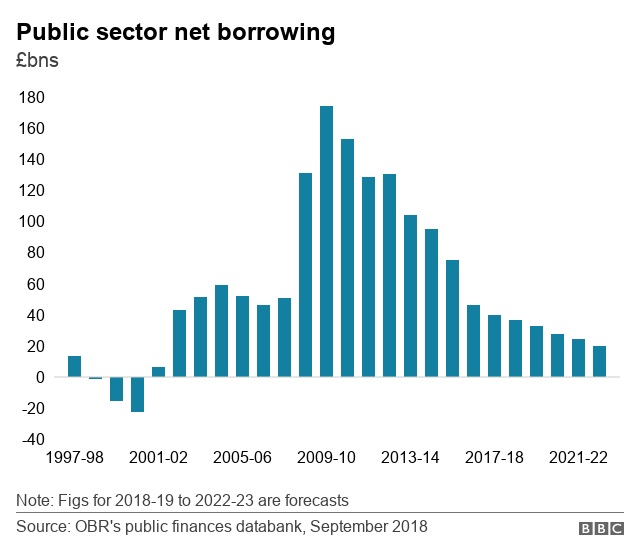

2. How are the public finances?

A lot better than Mr Hammond believed they would be this time last year.

Tax revenues have been stronger than expected and local council spending lower.

That means the amount the government has borrowed could be as much as £13bn less this year than the official watchdog, the Office for Budget Responsibility, predicted.

That gives the Chancellor some headroom to support increased spending without raising taxes substantially or risking the Conservative pledge that the government plans to "balance the books" (match tax revenues with spending) by the middle of the 2020s.

Those close to Mr Hammond point out that annual public finance numbers are volatile and that if there is a "no deal" Brexit he will need some fiscal fire power to support the economy.

The Chancellor won't want to use up all his wriggle room - just in case - but expect a loosening of the purse strings to support the controversial transition to the new benefits system, universal credit.

More positive signals, again in what he plans to spend in the future rather than immediately, are also likely for social care and local authorities.

It is not a good look when a Conservative government is experiencing its own local councils putting in place emergency measures to save money.

3. Is austerity over?

Mrs May announced that "austerity is over" in her conference speech last month.

For Treasury officials such an announcement might be considered "heroic".

As the IFS has said ending a long period of public sector cuts is likely to cost at least £19bn a year by 2022.

And with Mr Hammond also pressed to find that £20.5bn for the NHS in England by the same year, it is difficult to see how he can "end austerity" and boost spending so significantly all at the same time.

Day-to-day spending for departments such as the Home Office and the Ministry of Justice is set to fall by £4bn next year.

Benefit cuts totalling £7bn are also scheduled to be implemented before 2022.

It is unlikely this Budget will do much to reverse those.

What to look for is the spending "envelope" Mr Hammond sets for the next five years.

Will it be more generous than the one set this time last year?

If it is, then the government might be able to make the argument that austerity will end in the future.

Even if the Prime Minister did make her pledge in the present tense.

4. Will there be a rabbit?

Chancellors always like to have something of a surprise up their sleeve for Budget day and many people I have spoken to believe that this year it will be on housing.

Mr Hammond is keen to show that the government is doing something for "generation rent" - often younger people who cannot afford to clamber on the housing ladder.

I expect that Sir Oliver Letwin's final report on the substantial disconnect between the amount of land granted planning permission and the number of actual houses built to be published alongside the Budget.

The former Tory government minister is likely to recommend speeding up the "build out permissions" process which could help the government hit the target of constructing 300,000 new houses a year.

The Treasury is also considering splitting the huge revenue gains landowners receive when a piece of land is granted planning permission with local authorities.

Councils could then use that money to build social housing, alongside the extra funds for house building Mrs May has already said councils will be allowed to borrow.

Another move giving more rights to tenants to buy homes they have been renting long term is also on the cards.

This set of measures could well be brought together in an effort to show the government "gets" (and is doing something about) the housing crisis.

5. It's the economy, stupid

Alongside the Budget, the Office for Budget Responsibility publishes its forecasts for growth over the next five years.

It substantially downgraded its forecasts a year ago.

Will it be more positive this time?

Maybe a little.

But more importantly, will it admit that it has been too negative on government borrowing, showing that the government is on course to hit its target of eliminating the deficit by early in the next decade?

That is likely.

And a fact that Mr Hammond will trumpet, with the usual cautious warnings that a man known as "spreadsheet Phil" is renowned for.

One of those warnings will be about Brexit.

If there is a deal on Brexit, expect some kind of economic "dividend" - a boost to the economy as business demand, for example, held back by the uncertainty of the negotiations is released.

If there isn't a deal, expect Mr Hammond to warn that the economy could suffer and that all his plans to "end austerity" and boost spending are likely to end up on the floor in a tattered pile.

- Published28 October 2018

- Published26 October 2018

- Published28 October 2018