Budget 2018: Everything you need to know

- Published

What a way to start the week - settling down to watch one of the major events of the year that affects your finances.

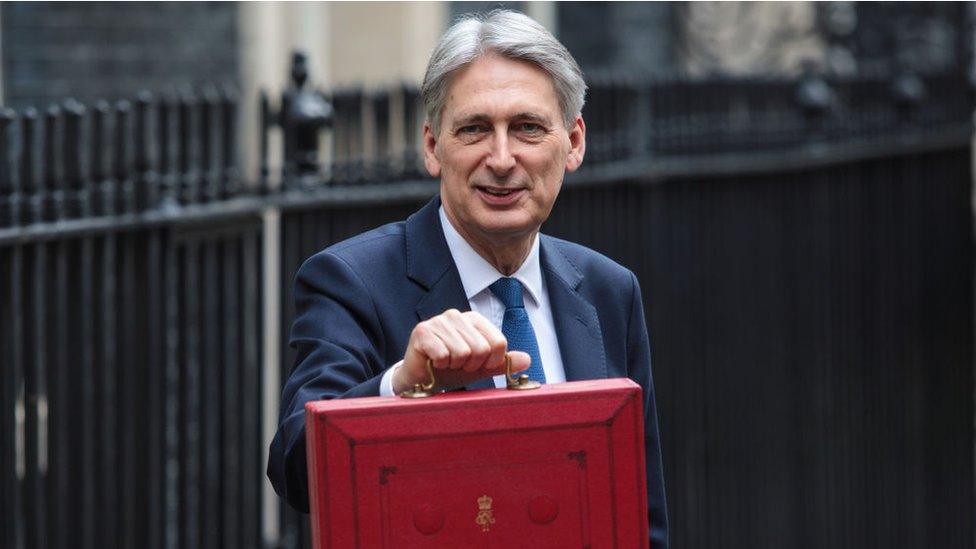

In his speech, the chancellor will announce the government's plans for tax and spending for the financial year which starts in April 2019.

Here is your essential guide.

When is the Budget?

It is on Monday, 29 October, at about 15:30 GMT.

Three aspects of the timing are relatively unusual.

Firstly, it is earlier in the year than usual to avoid clashing with the final stage of Brexit negotiations in November.

Secondly, the Budget is being presented on a Monday, normally it is revealed on a Wednesday after Prime Minister's Questions. This year that would mean it would fall on Halloween - a gift to headline writers - although the government denies that was a factor in choosing the day.

Thirdly, the Chancellor will start his speech at about 15:30 GMT, three hours later than usual. That's because Parliamentary business starts later on a Monday because MPs have to travel to London from their constituencies.

The speech usually lasts about an hour, although the longest continuous Budget speech was by William Gladstone in 1853, lasting four hours and 45 minutes.

Labour leader Jeremy Corbyn then gets the first response, before MPs debate the Budget.

Who is the Chancellor, Philip Hammond?

Arguably, the second most powerful person in government, behind the Prime Minister.

He was appointed as chancellor - known in many countries as the finance minister - in July 2016.

Philip Hammond (right) has not got much spare cash (left) to spend

Mr Hammond entered Parliament at the relatively late age of 41 as a millionaire. He has been the Conservative MP for Runnymede and Weybridge since 1997.

He has been dubbed "Spreadsheet Phil" owing to his love of numbers, including running over finances while on the beach on holiday.

Is this the only Budget that matters?

No. Many powers, as well as some tax issues, are devolved to the nations of the UK. Expect more on those in the coming weeks.

One big announcement will be the Scottish government's intentions on income tax levels, to be outlined at its Budget on 12 December.

What are the big themes?

The Budget comes hot on the heels of the Conservative Party conference, during which Prime Minister Theresa May claimed that austerity is coming to an end.

"The British people need to know that the end is in sight," she said.

That could be rather restrictive for Mr Hammond, who needs to raise extra money somehow.

The government has committed to finding an extra £20bn for the NHS by 2023. Ministers have indicated it will be partly funded by tax rises, so all eyes are on the chancellor for a solution.

Mrs May also said that the borrowing cap for local councils wanting to build new homes will be scrapped, potentially adding to the national debt.

As usual, there have been a host of Treasury announcements in the run-up to the speech ranging from potholes to interest-free loans.

... and Brexit?

Of course. This is the final Budget when the UK is part of the European Union, so how the economy is prepared for the UK's exit will clearly be a significant, and closely watched, part of the speech.

Arguably, the nature of any deal struck with the EU - or the failure to reach any kind of deal - would have a much bigger impact on the nation's finances than anything Mr Hammond says in the Budget. The chancellor has already said a new Budget would be needed if the UK and the EU cannot agree a Brexit deal.

Will I be paying more for a pint?

The Chancellor sets the so-called "sin taxes" on cigarettes and booze.

So, at the end of Budget day, any change in these duties will come into effect and is likely to have an immediate impact on prices.

The Chancellor has special permission to drink alcohol during the speech, although the last one to do so was Kenneth Clarke, who had a whisky.

What about driving costs?

In her party conference speech, Mrs May scotched speculation that fuel duty could go up for the first time in nearly a decade, saying she was extending the duty freeze for a ninth year in a row, a move costing the Exchequer £800m.

That said, petrol prices are relatively high, so drivers are already feeling the pinch.

How will pay and benefits be affected?

There is some speculation that the level of income at which workers pay income tax could be frozen, despite a Conservative pledge at the 2017 election that the thresholds would rise to £12,500 by 2020. The starting point for the higher rate of tax was also pledged to rise to £50,000 by 2020.

Many working-age benefits are nearly three years through a four-year freeze. These include Jobseeker's Allowance, Employment and Support Allowance, some types of Housing Benefit, and Child Benefit.

The cap on public sector pay rises in England and Wales has been in place in some form since 2010, although there is now some flexibility in pay awards for public servants. The cap has effectively been lifted, with more significant pay rises for police, NHS workers and others. However, these increases have needed to come from departmental budgets so a squeeze on funding still exists.

The real detail on all of these plans, and how much they will cost or save, is in the Budget red book - a fat document published as soon as the chancellor has sat down after his speech.

When is the next Budget?

At about the same time next year.

If you cannot wait that long, then there is the spring statement, usually in late February or early March, which updates the state of the nation's finances.

There is always the chance of a mini-Budget, or a major financial statement of some kind, if and when a Brexit deal is announced.

- Published26 September 2018

- Published11 October 2018