Brexit deal could accelerate interest rate increases

- Published

- comments

The Bank of England has indicated there could be a faster pace of interest rate increases if the UK manages a smooth exit from the European Union.

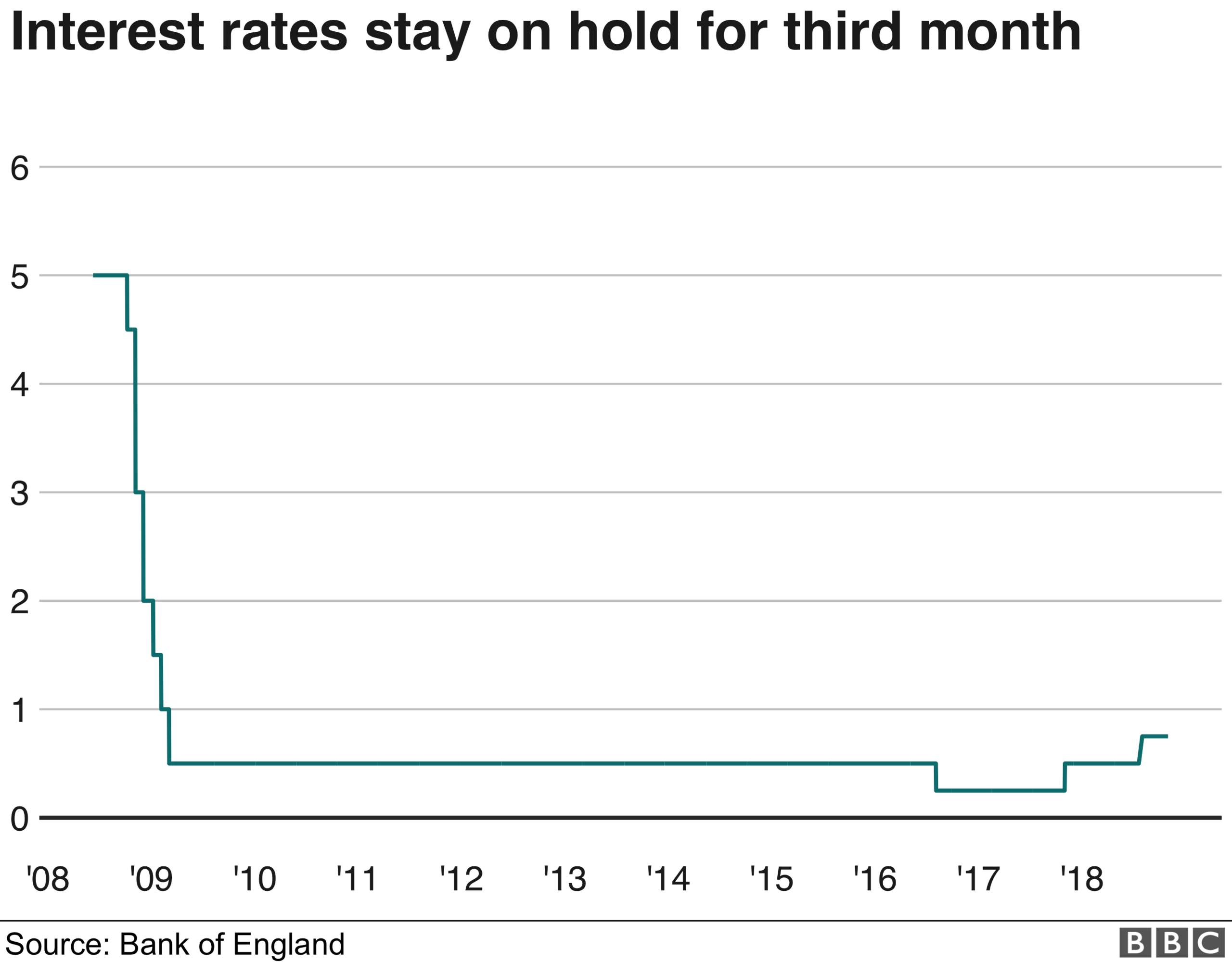

Although the Bank kept rates unchanged at 0.75% this month, its latest forecasts suggest that rates could rise to 1.5% over the next three years.

It said that Brexit uncertainty was preventing some firms from investing.

However, Bank governor Mark Carney said a smooth Brexit could see a rebound in that investment.

"We do expect a rebound in demand. Business is taking a cautious approach right now as we are at a point of maximum uncertainty, so we have some sense of what is being held back, so we will see a rebound in investment," Mr Carney said.

Some economists think the Bank might have to be even more aggressive on interest rates.

Ruth Gregory, UK economist at Capital Economics, believes that if the UK strikes a deal soon, rates could rise three times in 2019.

Bank of England Governor Mark Carney.

Samuel Tombs at Pantheon Macroeconomics says two rate increases next year "remain a good bet".

While the Bank sees a Brexit deal as the most likely scenario, in its Quarterly Inflation Report, external it also warned of damage to business if there was no deal.

"An abrupt and disorderly withdrawal could result in delays at borders, disruptions to supply chains, and more rapid and costly shifts in patterns of production, severely impairing the productive capacity of UK business," the Bank said.

It also thinks the pound would fall and there would be a "large" and "immediate" fall in economic activity.

The Bank's comments came as its Monetary Policy Committee (MPC) voted 9-0, external to leave rates unchanged at 0.75%.

Interest rates were last raised in August as the Bank reacted to stronger data on the economy.

The latest decision to keep rates on hold will come as relief to the 3.5 million holders of mortgages that track interest rates, but savers will be disappointed.

Analysis:

Szu Ping Chan, BBC economics reporter

With just a few months to go until the UK leaves the European Union, there was a clear message from the Bank of England today.

The Brexit deal will determine the next move in interest rates.

The Bank expects it to be a smooth one. In this scenario households are expected to keep on spending, with businesses unleashing the money they're currently holding back.

But Mr Carney made it clear that if the UK crashed out of the EU without a deal, policymakers wouldn't automatically cut rates as they did in the wake of the Brexit vote.

Back then, the outlook was uncertain and the UK's exit date was still far away.

The no-deal scenario would have a more immediate and permanent impact on prices and the economy, Mr Carney said.

So an interest rate cut might not be the appropriate response, although it would still be an option.

The Bank's quarterly survey of business leaders indicated that Brexit had become a more important source of uncertainty for them in recent months.

As a result, the Bank has slashed its forecast for growth in business investment this year to 0%.

However, a smooth Brexit would release that brake on investment, and would come at a time when there is little slack in the economy.

In addition, wages are rising, which is supporting consumer spending.

All that could force the Bank to raise interest rates to curb inflation.

The Bank is forecasting growth of 1.3% this year and 1.7% next year.

- Published1 November 2018

- Published16 October 2018

- Published29 October 2018