Argos takeover boosts Sainsbury's trading

- Published

Sainsbury's Mike Coupe tells BBC Breakfast food "can't be stockpiled" for a no-deal Brexit

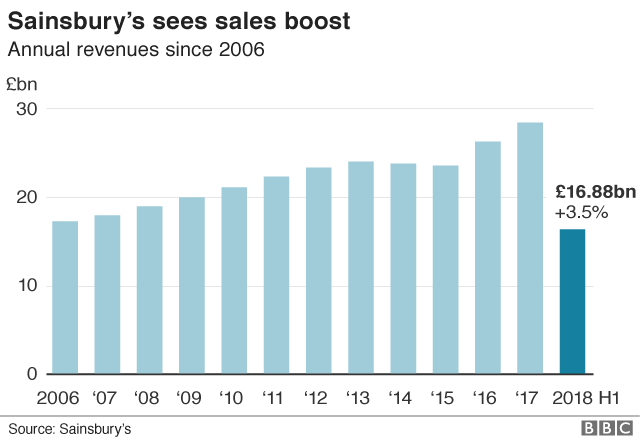

Half-year results at Sainsbury's have been boosted by its takeover of catalogue retailer Argos.

Cost savings improved profits, while adding Argos outlets to Sainsbury's stores was "driving an increase in trading intensity", the retailer said.

Sainsbury's, which plans to merge with rival Asda, said half-year underlying profits rose by a fifth to £302m.

However, when a host of exceptional costs are taken into account, profits nearly halved.

The UK's second-largest supermarket said pre-tax profits for the 28 weeks to 22 September were £132m, compared with £220m a year earlier.

Profits were hit by costs related to restructuring store management teams, the Argos integration and preparation for the Asda deal, which is still being considered by the competition watchdog.

Like-for-like sales growth for the period - which strips out the impact of new stores - was 0.6%, which disappointed analysts.

Sainsbury's chief executive Mike Coupe said the grocery market remained "extremely competitive".

He told BBC Radio 4's Today programme: "It's a pleasing set of results against a difficult market backdrop, largely driven by the acquisition synergies from the Argos business."

Mr Coupe said Brexit posed a challenge, since 30% of the goods that Sainsbury's sold came from the EU. He urged the government to "get to a settlement" with the EU, but added: "I'm a pragmatist and I believe that one way or another, an agreement will be arrived at."

He also admitted that availability of stock had been "bumpy" in early summer, but had now returned to normal.

Analysis

By Emma Simpson, BBC business correspondent

The big game changer for Sainsbury's is its proposed merger with Asda.

The fate of this controversial megadeal is now being decided by the Competition and Markets Authority and a decision is expected early in the year.

Chief executive Mike Coupe says he is confident in the company's future with or without the Asda deal.

Sainsbury's divided opinion when it announced the Argos deal, but that now looks to have been a pretty smart move.

Despite a good summer for the supermarkets, grocery sales at Sainsbury's still lag behind its rivals, according to industry figures. It's got a lot of plates to keep spinning now retailers are into the most important trading period of the year.

'Canny move'

Julie Palmer, partner at Begbies Traynor, said: "The purchase of Argos has been a well-crafted tactical decision to draw greater footfall into its stores and reduce cost savings measures, with 90 Argos units expected to be opened in stores this financial year.

"However, there is still uncertainty around its merger with Asda, with the regulators yet to give the thumbs-up to the deal."

Laith Khalaf, senior analyst at Hargreaves Lansdown, said: "Argos is proving to be an ace up the sleeve for Sainsbury's in a tough retail environment.

"The World Cup and barbecue weather over the summer provided a welcome shot in the arm for the supermarket, though without this seasonal stimulus, sales growth from existing outlets wouldn't look great."

He praised Sainsbury's decision to fill excess supermarket space with Argos outlets, calling it "a pretty canny move when you consider that many consumers will like the idea of combining their Christmas grocery shop with picking up some gifts from Argos at the same time".

- Published25 October 2018

- Published1 October 2018

- Published19 September 2018

- Published30 April 2018