Streaming wars: Can Disney topple Netflix?

- Published

Disney, owner of the Avengers and Star Wars franchises, will test its brand appeal with the start of its own streaming services

Last year Disney put Netflix on notice, announcing it would launch its own streaming services and end distribution agreements with the online video giant.

The move was yet another warning that the world of streaming television, where Netflix had long been the leading player, was getting increasingly crowded.

The firm's shares slumped immediately after Disney's announcement, before later bouncing back.

So how big a threat is Netflix facing?

Who's the competition?

Almost everybody.

In addition to Disney, there are the tech giants: Google-owner Alphabet is in the game with YouTube, while Amazon's Prime video and live streaming Twitch platform give the e-commerce giant a stake.

Facebook is developing programmes for its "Watch" video feature, and Apple is expected to launch a new streaming services in 2019.

More traditional media companies are players as well.

Dish Network, a US satellite company, owns SlingTV.

AT&T, previously known as a distributor of pay-TV and internet, plans to launch a new streaming service, built around HBO, in 2019, after its more than $80bn purchase of Time Warner earlier this year.

Even retailer Walmart, which has been flirting with online video since 2010, recently announced a new partnership with a movie studio.

How big a deal is Disney?

Elsa, the snow queen from Disney's Frozen

Two things make Disney stand out: decades of material and deep pockets.

The company's children's movies are already considered must-haves in many households around the world.

With its purchase of 21st Century Fox's entertainment business - announced last year and expected to be completed in 2019 - the firm will cement its ownership of beloved franchises, from Star Wars to the Simpsons.

Top grossing Disney movies

1. Star Wars: The Force Awakens (2015) $936.7m 2. Black Panther (2018) $700.1m 3. Avengers: Infinity War (2018) $678.8m 4: Marvel's The Avengers (2012)$623.4m 5. Star Wars: The Last Jedi (2017) $620.2m

Source: Box Office Mojo; figures not adjusted for inflation

Disney is also in a relatively strong financial position to absorb losses as it invests in streaming, thanks to a diverse business that includes theme parks, cruise lines and sizeable traditional television units.

"Netflix is definitely the most one dimensional of all these companies in the sense that they live and die by their subscription revenue," says Paul Verna, principal analyst at eMarketer.

"The other companies - they have very deep pockets and a lot more sources of funding to pull from," Mr Verna says. "In a way that puts Netflix at a disadvantage."

What are the fields of battle?

Netflix, Disney and others are investing in new programmes, such as the Netflix original 'Narcos'

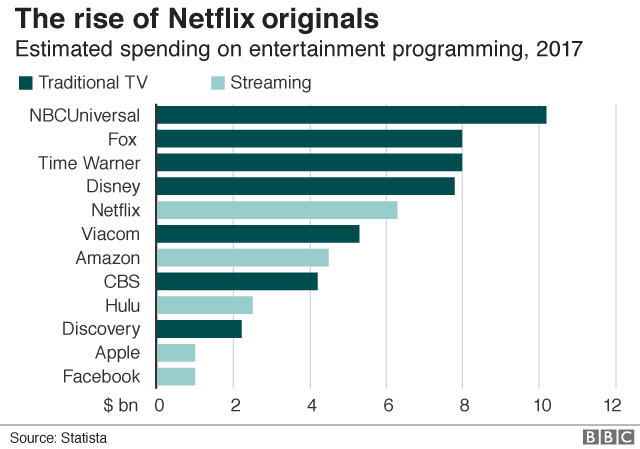

Hollywood has enjoyed a gush of spending as companies battle to woo top writers, directors and actors to their side. Firms are also pursuing mergers, saying size will help them compete.

Disney embodies both trends.

The firm's $71bn takeover of Fox's entertainment business is its biggest purchase yet, following the acquisition of Pixar, Marvel, and Lucasfilm.

And while the deal initially raised fears of cuts at Fox's studios, Mr Iger told financial analysts recently that the firm will increase investment to develop content for its three streaming services: Hulu, known for its general audience TV shows; ESPN+, its new US sports app; and Disney+, a family-focused service set to begin in the US in 2019.

Of course, Netflix isn't sitting still. The firm has its own relationship with Viacom, including a new multi-picture deal with subsidiary Paramount Pictures.

What do the numbers say?

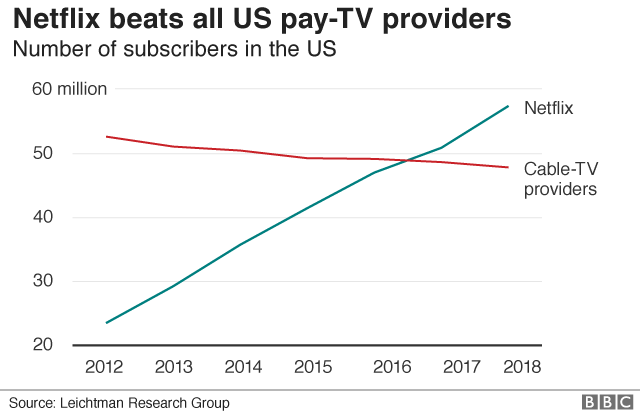

Netflix remains the clear market leader, with more than 137 million global subscribers.

By the end of the year, the firm is expected to have more than 147 million viewers in the US alone, according to eMarketer, which defines viewers more broadly than subscribers to account for practices such as sharing passwords.

The firm places Amazon second with 88.7 million viewers, followed by Hulu with 55 million.

But with many households expected to hold multiple subscriptions and online video watching on the rise, newcomers can still make gains.

Analysts at MoffettNathanson estimate that Disney+ could attract about 2.4 million members in the US by the end of its first year.

What about the rest of the world?

Though its services will launch in the US, Disney plans to eventually expand Disney+ and Hulu internationally, starting in Europe.

And analysts say the firm is in a strong position globally.

That's thanks to its brand recognition and the Fox purchase, which will make it an instant force in key markets, such as India, where Fox's Star India owns the country's leading streaming service.

For now, it's not clear if Disney intends its online video offerings as standalone products pitched at niche groups, such as sports fans and families, or if the firm will aim for a more mass-market audience, says Dan Cryan, executive director media of technology and telecoms at IHS Markit.

Netflix and Amazon are investing in online video in India, where Disney is also set to become a major player

What it decides will determine whether its entry threatens Netflix's lead, he says.

"They've got a really solid position to take it in whatever direction they need to take it to be successful," Mr Cryan says.

"But if it's only aiming for a subset of the market, it's not really playing the same game."

- Published22 July 2018

- Published9 August 2017