Apple iPhone sales fears rock Wall Street

- Published

Apple chief executive Tim Cook presenting the firm's newest line of products last month

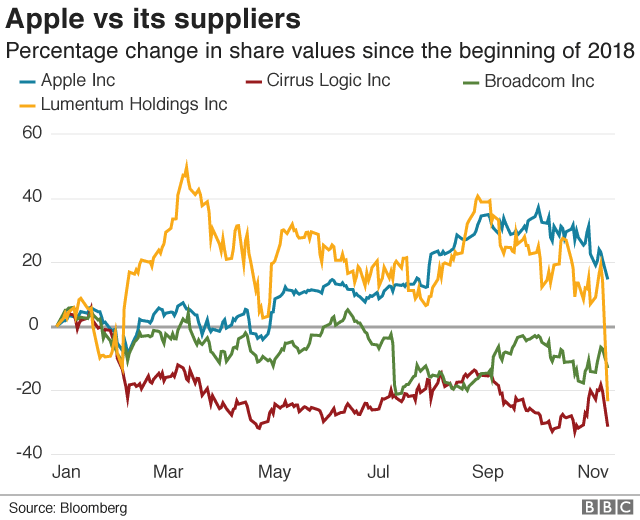

Apple shares sank by 5% on Monday, dragging down US markets and wiping more than $40bn (£31bn; €35bn) off the tech giant's market value.

The fall followed a profit warning from some of the firm's suppliers, which exacerbated concerns that demand for iPhones is slowing.

The declines made the company one of the biggest losers on the Dow, which closed down 2.3%.

The wider S&P 500 ended about 2% lower, while the Nasdaq fell more than 2.75%.

Technology stocks led the Wall Street sell-off which saw shares in most sectors tumble.

Tech firms helped drive many of the stock market gains earlier in the year but now face rising calls for regulatory and tax changes that could hurt their growth.

Amazon shares lost more than 4%, Alphabet dropped over 2.5% while Facebook fell 2.3%.

Apple's share price fall came after Lumentum, a US manufacturer of facial recognition technology and Apple supplier, said one of its major customers had reduced its shipments.

As a result, Lumentum downgraded its sales and profit outlook, sending its shares down over 30%.

Lumentum's warning came shortly after another Apple supplier, Japan Display, also cut its full-year guidance blaming "volatile customer demand".

The warnings from Apple suppliers extended a slide in Apple shares that started earlier this month after the firm's sales forecast disappointed investors.

The shares closed at about $194, down 5% for the day and more than 15% below their peak in October.

Apple has said it will no longer report individual sales of iPhones, iPads and Macs

Apple has insisted that it is optimistic about its Christmas season outlook, attributing the weaker than expected forecast to one-off changes, such as the timing of the release of new phones, and temporary supply chain issues.

It continues to make record profits, thanks to higher prices and growing income from its services business, which includes services such as the App Store, Apple Pay, Apple Music.

But analysts have remained sceptical, especially after the firm said it would stop sharing the number of iPhones, iPads and Macs it sells with investors.

They have warned that Apple's reliance on higher prices could also make it especially vulnerable if there is a broader pullback in consumer spending.

Goldman hit

Meanwhile, Goldman Sachs, which has been embroiled in a corruption scandal at Malaysia's state-backed development fund, also dragged Wall Street indexes lower.

Shares in the investment bank ended down about 7.5%, after a Malaysian official said the country wanted a refund of the fees Goldman earned for work on bond sales for the 1MDB fund.

A former Goldman executive this month pleaded guilty to US charges that he had participated in a scheme to use some of the money raised in those offerings for bribes.

The US market declines come amid an extended period of volatility on Wall Street, with investors wary due to warnings of a slowdown in global growth, trade tensions, falling oil prices and rising interest rates.

US companies are also facing a rising dollar, which hurts sales overseas.

The combination of factors has helped fuel speculation that corporate profits may be at their peak, especially after several companies, including Apple and Amazon, issued weaker than expected sales forecasts for the months ahead.

- Published1 November 2018

- Published3 August 2018