Pound and UK shares hit by Brexit turmoil

- Published

- comments

The pound and shares in housebuilders and banks have fallen sharply after cabinet ministers Dominic Raab and Esther McVey quit over Prime Minister Theresa May's draft Brexit deal.

Royal Bank of Scotland sank 9%, with 7% falls for Persimmon, Taylor Wimpey and Barratt Developments.

Sterling fell 1.7% against the dollar and 1.9% against the euro.

The FTSE 100 index closed little moved, but the FTSE 250, which mainly comprises UK-focused firms, fell 1.6%.

Capita topped the fallers in the FTSE 250, plunging 14%, with Countryside Properties down 9%.

Why have shares tumbled?

Shares in companies that do most or all of their business in the UK reflected the continued political uncertainty, as members of the Conservative Party and opposition politicians voiced their scepticism over the draft deal.

"The market has taken a big red pen to stocks which are heavily exposed to the UK economy like the banks, retailers and housebuilders," said Laith Khalaf at Hargreaves Lansdown.

"These sectors were already under pressure, but the potential for an orderly Brexit to unravel in the next few days is causing further distress to be manifested in share prices."

BBC business editor Simon Jack said: "The odds of a general election have just gone up and that means the possibility of a Corbyn government must have increased as well.

"Markets don't like the prospect of that because of Labour's intention to raise taxes on companies and nationalise large sections of the economy."

The higher chances of an election was one of the reasons behind RBS' steep fall, as the Labour Party has said it would nationalise the lender. However, shares in other banks also fell, as investors considered the threat to the economy and therefore to banks' balance sheets if the UK were to leave the EU without a deal.

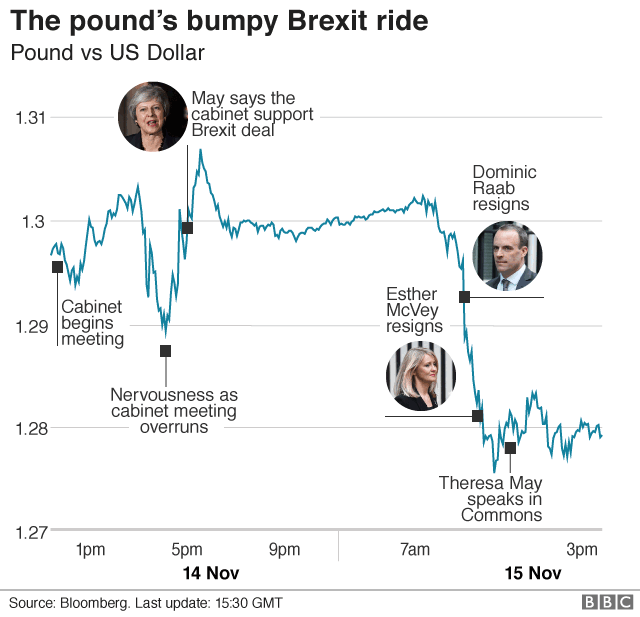

What's happened to the pound?

Sterling ended the day in London at under $1.28 against the dollar after a turbulent day's trading.

Initially on Wednesday, when Theresa May announced she had secured cabinet backing for the draft Brexit agreement with Brussels, the pound recovered earlier lost ground. But by Thursday morning it was already wavering.

A string of ministerial resignations led by Brexit Secretary Dominic Raab and Work and Pensions Secretary Esther McVey, undermined confidence in the pound further as market observers deemed the chances of a disorderly Brexit had risen.

Pound vs US dollar

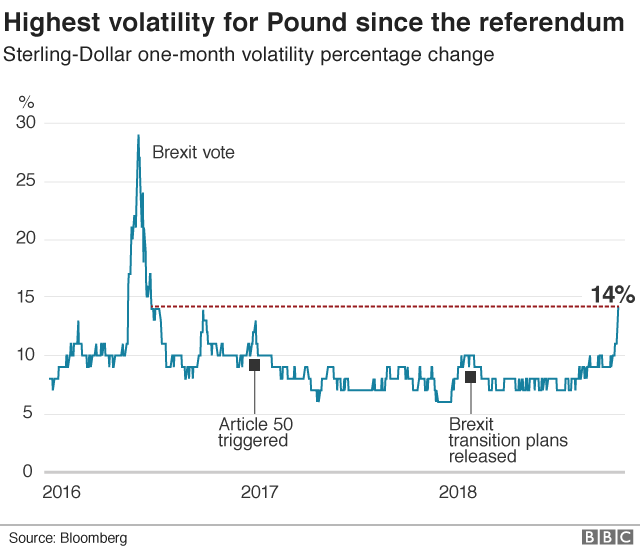

How has Brexit affected the pound's volatility?

The Brexit process has been punctuated by big movements in the pound's relationship with the dollar, something which can lead to big gains or losses for investors.

In the run-up to, and immediate aftermath of the Brexit referendum on 23 June 2016, for example, the pound hit a peak of volatility against the dollar.

And as the graphic below shows, the events surrounding Wednesday's draft agreement has triggered the greatest volatility for sterling since the referendum.

What do the currency strategists say?

Jane Foley at Rabobank said the pound's plunge was "firmly tied" to the perception that Mrs May will have difficulty in pushing the Brexit plan through Parliament.

She said the resignations had increased speculation that the prime minister would face a no-confidence vote, something that would weigh heavily on the pound: "Any turn of events that could raise the risk of a general election would also punish the pound, given the risk of a market-unfriendly far-left government."

Chris Turner at ING said Mr Raab's resignation had increased the chances of a leadership challenge and a no-deal Brexit.

He said the pound "could fall another 3-4% unless the threat of a leadership election is quashed or there are clearer signs that the withdrawal agreement can garner more support in parliament".

What does business think of the agreement?

Organisations that speak on behalf of business like the Confederation of British Industry welcomed the draft deal, because it offered the prospect of a smooth path towards Brexit.

The CBI described the agreement as a "compromise, including for business" but was happy that it represented a "step back from the cliff-edge".

The agreement includes a 21-month transition period, during which time the UK will negotiate new trade terms with the EU. The UK would have a unilateral right to extend that transition period, which was described as "very positive for business" by James Stewart, head of Brexit at KPMG.

Northern Ireland also has the guarantee of a "friction-free" customs border with the Republic of Ireland.

CBI Director-general Carolyn Fairbairn told the BBC: "There is a possible path to frictionless trade now in terms of negotiating the final deal. I don't think anyone thinks the transition or the backstop is the answer, so this has to be used as a route to a final deal with frictionless trade and access for services."

So is everyone happy?

Of course not.

Pro-Brexit economist Gerard Lyons, chief economic strategist at Netwealth Investment and former chief economic adviser to Boris Johnson while he was Mayor of London, says the draft withdrawal deal is not something to cheer about.

"Whilst it has avoided the cliff edge, I think it's important we don't bury our heads in the sands here and view this as a 'good' deal - this is still disappointing," he said.

Those who had hoped the draft deal would supply some reassurance will also be disappointed as Theresa May wrestles with critics and struggles to unite enough MPs behind her plan.

- Published6 November 2018

- Published31 October 2018

- Published11 December 2018

- Published15 November 2018