'My mum's funeral costs were extortionate'

- Published

Phyllis Harvey died nearly two years ago at the age of 88

A church treasurer said she was shocked by the extortionate cost of her mother's funeral - and immediately saved hundreds of pounds by searching for a better price.

Chris Harvey said she was quoted more than £4,000, even though family members could walk to the church.

The £2bn funeral services sector now faces a major investigation.

The Competition and Markets Authority (CMA) said it had "serious concerns" about above-inflation price rises.

'An extraordinary amount'

Mrs Harvey said her mother, Phyllis Harvey, died nearly two years ago. She told the hospice where her mother died that she was likely to use the same local funeral director that she had used when her father died years earlier.

Only later did she discover the business had become part of the Dignity chain. She was unhappy that they appeared to be initially unaware of where her mother's body was being held.

She was also shocked by the cost, when she eventually found out how much it would be, describing it as extortionate.

"We could just walk to the church, so it was an extraordinary amount of money," Mrs Harvey said.

As a church treasurer herself, she knew that relatively little of that money went to the church. She looked on her phone for a better price with another funeral director and said she saved £1,400 and received "a better service". The family donated those savings to the hospice where Phyllis had been looked after before her death.

Mrs Harvey said she was pleased with the CMA investigation: "They should be more transparent about prices. People do not want to talk about it, but it is important."

How much does a funeral cost?

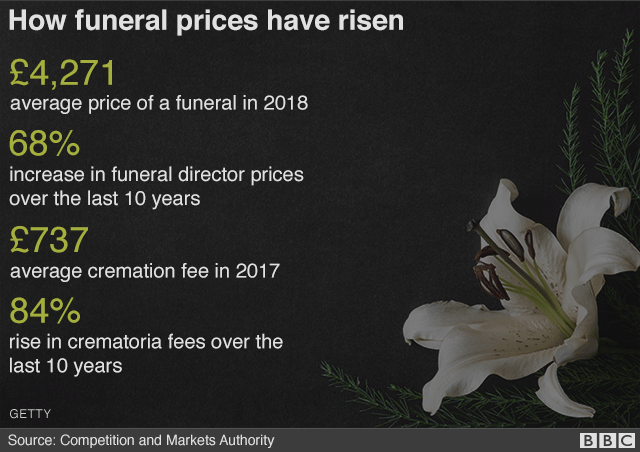

The CMA found that people typically spent between £3,000 and £5,000 organising a funeral, with the average price of the core elements now standing at £4,271.

The average cremation fee was £737 last year, with the fees having risen by 84% in the past 10 years.

The CMA report found:

The cost of essential elements have risen by more than two-thirds in a decade

That is three times the rate of the rise of prices in general, as measured by inflation

Those on the lowest incomes could face funeral costs that amount to nearly 40% of their annual outgoings

That is more than the amount spent on food, clothing and energy combined in a year

The regulator said that these price rises did not appear to be justified by the equivalent rise in providers' own costs or matched by improvements in the quality of service.

It has spent six months studying the sector. In Scotland, the national funeral inspector is set to report to the Scottish Parliament on the standard of funeral directors.

Are there ways to keep costs down?

People arranging a funeral could save more than £1,000 by shopping around for a funeral, the CMA said.

However, the regulator pointed out that grieving families would be distressed and not in a position to do so. Most prices were not available or clear online, it added.

"People mourning the loss of a loved one are extremely vulnerable and at risk of being exploited," said Andrea Coscelli, chief executive of the CMA.

"We need to make sure that they are protected at such an emotional time, and we're very concerned about the substantial increases in funeral prices over the past decade."

One comparison site - Beyond - said that the UK's funeral sector had been "allowed to become like the Wild West". "It is still true that very few people - only 4% - actually [shop around], often because of a very British taboo around death and being seen to 'shop around' for funeral prices," said co-founder Ian Strang.

The CMA also said that smaller funeral directors had tried to keep the costs low, but larger chains had consistently increased prices.

Following the CMA announcement, the share price of Dignity - one of the largest providers - fell by nearly 16%.

"We're fully committed to ensuring vulnerable consumers are protected. In January this year we started materially reducing our prices," said Mike McCollum, chief executive of Dignity. "We've already started publishing our prices online and will make further improvements before the end of March 2019."

The Co-op, another large provider, said it had reduced prices on its "affordable funerals" and introduced simpler options in the past three years.

There is a state safety net, the Funeral Expenses Payment, external, available to people on certain benefits, but critics say it still leaves a shortfall that has to be picked up by families.

The report was "clearly a wake-up call" for the profession, said Terry Tennens, chief executive of the National Society of Allied and Independent Funeral Directors.

It has urged members to put prices on their websites. "The public would benefit from more information about how to arrange a funeral, covering quality and costs," he said.

What about funerals when you pay in advance?

A separate inquiry by the Treasury into the pre-paid funeral sector is continuing.

Many of these plans do not cover costs such as embalming, limousines, a funeral service, a wake, burial plots or memorial stones. In some cases, families are left having to find an extra £2,000, even though they expect such items to be included.

The government is considering a move that would mean tougher regulation of pre-paid funerals.

Funeral costs broken down

Were you to buy the parts of a funeral separately, rather than as a plan, these would be the typical costs - although they can vary significantly in different parts of the UK:

Moving deceased to Chapel of Rest £99; hearse and chauffeur £315; coffin £275 to £1,500 or more; minister or officiant fee £148; funeral director's professional fees £1,000 to £1,500

Cremation costs: Cremation fee £660; cremation urn £200; ash plot £450; doctor's fees (not payable in Scotland) £164

Burial costs: Interment fee (grave-digging and backfilling for a single depth grave) £150 to £1,734; burial plot cost £280 to £5,000 or more; stone memorial £800 to £1,200 or more

Optional costs: Embalming £136 to £165; limousine and chauffeur £305; flowers £151; order of service sheets £72; church service £98 to £149; catering £397

Source: Fairer Finance

- Published19 October 2018

- Published1 June 2018

- Published15 November 2018