Wages rises accelerate to fastest pace since 2008

- Published

- comments

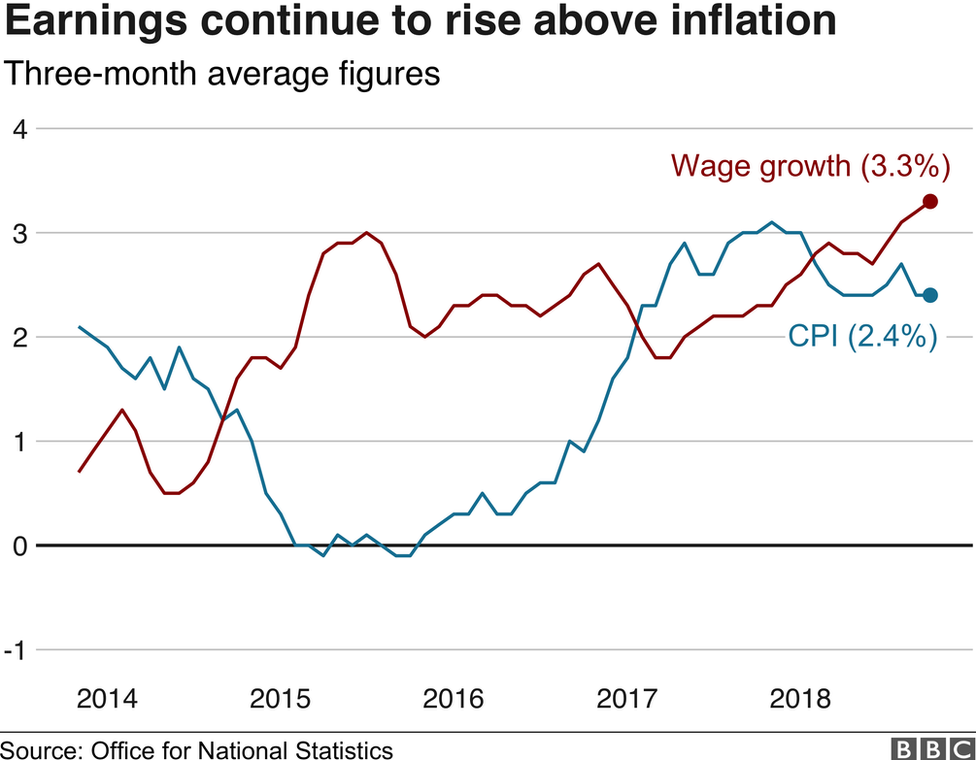

Wages are continuing to rise at their highest level for nearly a decade, the latest official Office for National Statistics figures show., external

Compared with a year earlier, wages excluding bonuses, were up by 3.3% for the three months to October, the biggest rise since November 2008.

Average weekly wages are £495 - the highest since 2011, when adjusted for inflation.

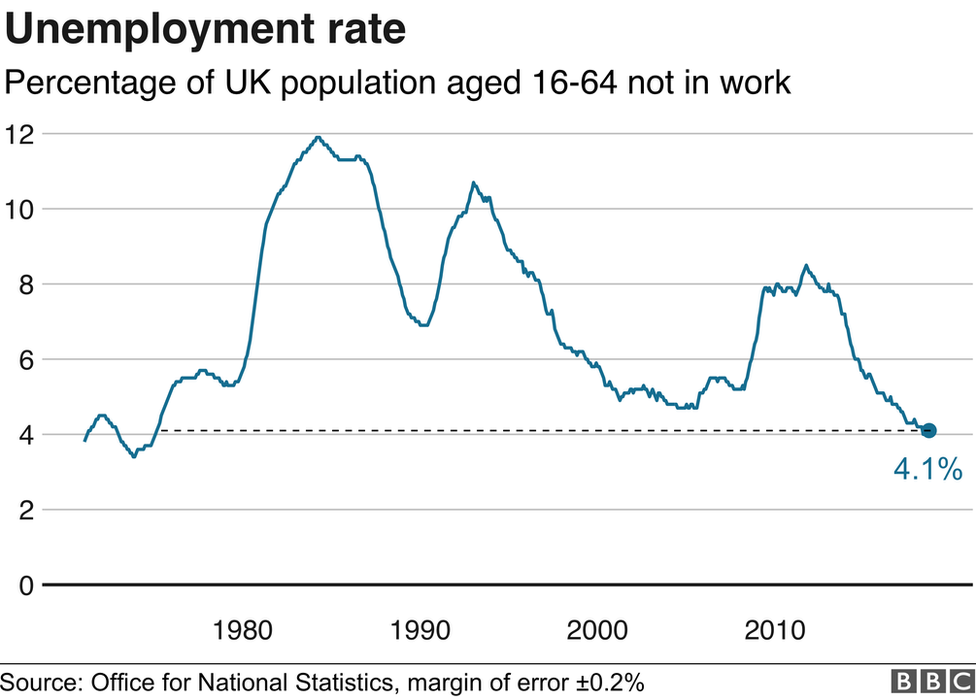

The number of people in work rose by 79,000 to 32.48 million, a record high.

That is the highest figure since records began in 1971.

Unemployment increased by 20,000 to 1.38 million, although the margin of error is 70,000 and the total is still lower than a year ago.

The number of unemployed men increased by 27,000, while the number of unemployed women fell by 8,000.

The reason both employment and unemployment have increased is a result of the UK's rising population and more people joining the labour force, such as students and older people.

Job vacancies were up by 10,000 on the quarter to a record high of 848,000.

More than half, 195,000, of the 329,000 jobs created in the year to October went to people who are no longer economically inactive, who are the main reason for the expansion in the workforce

There are fewer students, people who are not working because of caring responsibilities, long-term sick and retired people in the 16 to 64 age group than a year ago.

"Real earnings are now growing faster than at any time since around the end of 2016," said the ONS senior statistician Matt Hughes.

Employment Minister Alok Sharma said: "Today's statistics show the enduring strength of our jobs market, with wages outpacing inflation for the ninth month in a row and employment at a record high."

Shadow work and pensions secretary Margaret Greenwood said: "The reality behind these figures is that the number of people in work in poverty is rising faster than employment. Real wages are still lower than they were 10 years ago."

Fears that the labour market is tightening were expressed by the CBI's Matthew Percival and Suren Thiru, of the British Chambers of Commerce,

Mr Percival said this was shown by "a record employment rate and a rising number of jobs that can't be filled".

He added: "While pay growth is improving at its fastest and most sustained rate in a decade, this is still slower than the UK has achieved in the past."

Mr Thiru blamed "the second successive rise in unemployment, coupled with a decline in the number of people who are not seeking work" for the labour market's contraction.

"Businesses report that the political and economic turbulence, together with significant difficulties finding the right staff, are diminishing recruitment intentions, which is likely to increasingly weigh on the UK labour market over the near term," he added.

TUC general secretary Frances O'Grady said: "The rise in pay growth is little consolation for workers in the middle of the longest pay squeeze in 200 years, with real wages expected only to get back to pre-crisis level in 2024. We need a plan that supports jobs and wages."

Howard Archer, chief economic adviser to the EY Item Club, said: "Current decent employment may be influenced by companies being keen to employ while they can, given the increased concern in some sectors over a lack of suitably skilled candidates.

"In some cases this has been significantly influenced by fewer workers coming from the EU," he said.

In a note, analysts Capital Economics said: "The latest labour market figures suggest that a recovery in real pay growth is taking root. This supports our view that GDP growth will rebound next year if a 'no-deal' Brexit is avoided.

"Admittedly, there have been false dawns in the past few years. But we think that the recent recovery in real earnings growth will probably be sustained."

Stephen Clarke, of the Resolution Foundation think tank, said: "While Brexit uncertainty and political paralysis are having a cooling effect on the wider economy, the labour market is proving more resilient."

He added that pay should improve in 2019, but warned: "After a pretty appalling decade, Britain remains some way off a return to the levels of real pay we enjoyed before the crash."

- Published27 November 2018

- Published27 November 2018