Reality Check: Has it been the worst November for retailers?

- Published

Mike Ashley, founder and chief executive of Sports Direct, has said that November was the worst month for retailers "in living memory".

His comments came in a letter to the boss of Debenhams, of which Sports Direct is a big shareholder, which was revealed by the Telegraph.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Do the statistics back up his claim? It was made before the official figures were released but his company also owns House of Fraser, Evans Cycles and more than a quarter of French Connection, so he should have a good idea of what is happening on the High Street.

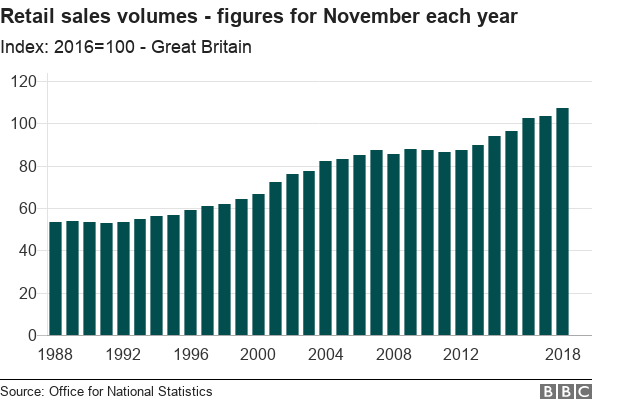

It's hard to know which measure to go for but the sales volume measure is probably a good place to start.

This is a measure of how much was bought in the month, adjusted to exclude the effect of changing prices, which means that inflation should not affect it.

It is also seasonally adjusted, which is important because the retailers who respond to the survey are not actually asked about calendar months. The research covers a four-week period, then another four-week period and then a five-week period.

The responses are then adjusted to reflect calendar months, which means that important days for shopping such as bank holidays or, in the case of November, the period around Black Friday, would sometimes end up in the wrong month without seasonal adjustment.

On this measure, this November was better than last November and indeed all other Novembers since records began.

The latest figures from the ONS, external also estimate that the actual amount spent at retailers in November was up 5% on November last year, which is well above the 2.3% inflation rate announced on Wednesday, external.

So the official figures certainly don't back up Mike Ashley's claim. But is that a fair reflection of what has been going on on the High Street?

What else has been going on?

Shops on the High Street have been feeling the competition from online retailers, which have been taking more and more of the retail spend for the past decade.

Last month, for the first time, online sales accounted for more than 20% of total retail spend for the first time.

In its weekly sales update on 27 November, John Lewis & Partners said that sales over the week of Black Friday had been the "biggest in its history" - although big volumes were partly driven by price-matching activity, which reduces profits for the store.

But some researchers said that increasing online activity had hit other High Street chains harder.

The headline official figures also do not reflect the costs faced by retailers. So, for example, in order to achieve these sales, a retailer may have had to double its staff, cut prices and open loads of extra stores.

Richard Lim, chief executive of Retail Economics, told BBC News: "It's important to remember a lot of the sales seen in November were heavily discounted, to the detriment of retailers.

"Pair that with rising operating costs due to increasing business rates and labour costs with the increase of the National Living Wage and the minimum wage, and you often see sales growth being outstripped by operating costs."

Smaller shops

The official figures also suggested that it had been a better month for smaller retailers than the big chains that Mr Ashley operates.

"ONS figures suggest that while large retailers (both online and offline) had a dismal November, Christmas apparently came early for small businesses," said Rachel Lund, from the British Retail Consortium.

She pointed to figures suggesting that sales among small retailers had been up more than 13% compared with the previous November, while sales for large businesses had risen less than 2%.

How busy was the High Street?

Another indication of how difficult things have been on the High Street comes from the retail analysts Springboard, external, who said the number of people out shopping in the UK in November had dropped to its lowest level since the 2008 recession.

Footfall fell by 3.2% in November, which was a steep decrease in comparison with growth of 0.2% seen last November.

The group tracks the number of shoppers visiting UK High Streets, shopping centres and retail parks.

Diane Wehrle, Springboard's marketing and insights director, said: "These figures are the worst footfall figures that Springboard has recorded since the recession - and we're not actually in recession.

"It's clear that something significant is happening out there in consumer demand. It has really railed back this year."

The company warned that more High Street chains could collapse in January, as shoppers who would previously have gone into a shop make their purchases online instead.

How many shops have closed?

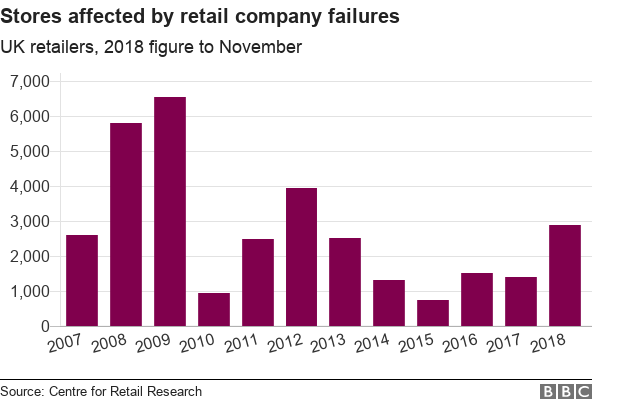

It has certainly been a bad year for many retailers, with the collapse of High Street chains such as Maplin, Mothercare having to restructure and close many of its stores and a series of profits warnings.

With figures up to the end of November, it has so far been the worst year for store closures since 2012.

In addition to High Street names such as Poundworld and House of Fraser (which was bought out by Sports Direct), there have also been signs of challenges for online retailers.

The online fashion retailer Asos has warned of weak profits this financial year, after "unprecedented" discounting hit its trading in November.

So while November's retail sales figures were better than expected, behind the figures there are signs of considerable challenges for High Street shops.

- Published16 December 2018

- Published14 December 2018

- Published20 September 2022