First-time buyer numbers rise: 'I was saving for a lifetime'

- Published

Joe Brewer and Stacy in their new home

Joe Brewer, from Dartford in Kent, moved into his two-bedroom terrace with girlfriend Stacy a month ago.

"It's a big relief getting in there. It really took a long time but it has paid off. It seemed I was saving for a lifetime!" says the 27-year-old.

He is among increasing numbers of 25 to 34-year-olds for whom home ownership has become a reality.

For the first time in 30 years, home ownership among this group has risen, says the Resolution Foundation.

But the new research by the think tank, which focuses on people on lower incomes, warns that first-time buyers face still face acutely high barriers to entry.

The Foundation says that easier credit conditions and a slowdown in house price growth in recent years have improved the situation for young first-time buyers.

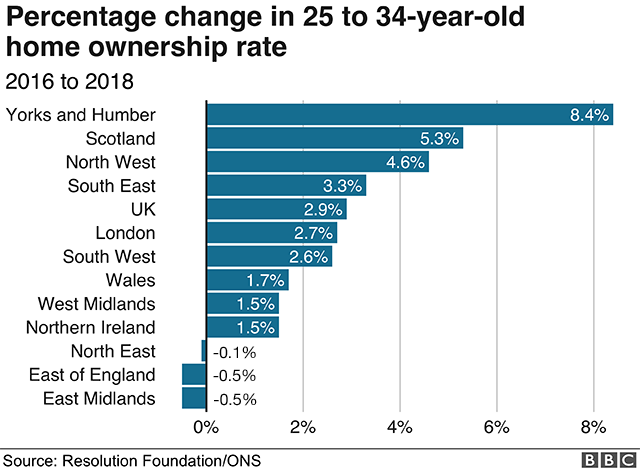

As a result, home ownership rates among 25 to 34-year-olds have risen by 3% since they hit 25% in 2016.

But it says home ownership among this age group is half that of the 1980s, when half of this age group owned their own home.

Sharing rents

The Foundation says that despite this recent uptick, renting will continue to be the norm for the majority of young people, particularly in the UK's major cities.

That means the share of young families in the private rental sector increased from just 9% in the late 1980s to 34% now.

Among this group, even those with children are increasingly sharing a roof, with 12% of all young families now sharing with others, up from 3% in the late 1980s.

In Bristol and Brighton, one in three young private renters is now living in shared accommodation.

The Foundation says a better deal for renters is needed, as the high financial barriers to owning remain.

It calls for the government to help young tenants by making indeterminate tenancies the sole form of private rental contract and limiting rent rises.

Daniel Tomlinson, Research and Policy Analyst at the Resolution Foundation, said: "Home ownership politicians should act to increase the number of homes available to buy, use the tax system to favour first-time buyers over second-home owners, and ensure that the private rental sector is fit for purpose - providing the security that many young families need."

- Published11 December 2018

- Published9 July 2020

- Published8 October 2018

- Published17 April 2018