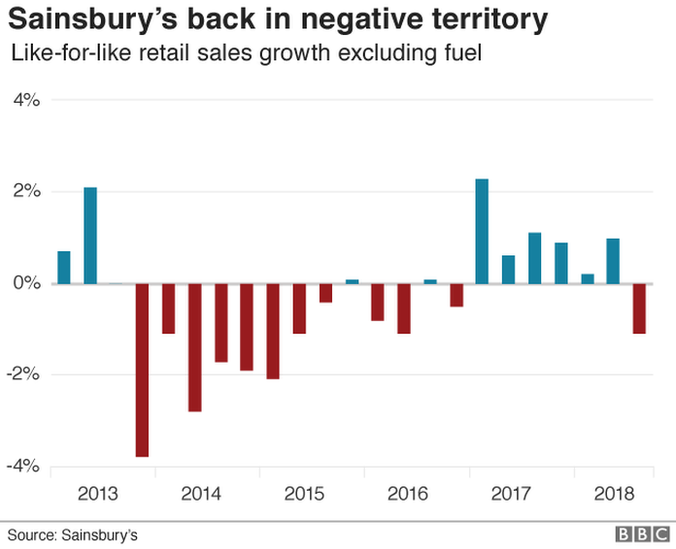

Sainsbury's sees retail sales fall 1.1% over Christmas

- Published

Sainsbury's has seen sales fall over Christmas after non-food trading was hit by consumer caution.

Like-for-like retail sales, which exclude sales from new stores, fell by 1.1% across the Christmas period.

General merchandise sales, including at Sainsbury's-owned Argos, fell by 2.3% and overall clothing sales by 0.2%.

Chief executive Mike Coupe said: "Retail markets are highly competitive and very promotional and the consumer outlook continues to be uncertain."

'Tough market'

He added: "General merchandise sales grew strongly over the key Christmas weeks and outperformed the market over the quarter.

"Sales declined in the quarter due to cautious customer spending and our decision to reduce promotional activity across Black Friday. Clothing performed well, with strong full-price sales growth in a tough market."

Shoppers in Nottingham reveal whether they spent more or less this Christmas

He said shoppers also cut back on their spending on food over Christmas, with slower sales growth for the premium Taste the Difference range.

However, the supermarket giant said in the 15 weeks to 9 January, grocery sales grew by 0.4%, with groceries online and in convenience stores up by 6% and 3%.

Sainsbury's shares were ahead by 2.18% in midday trading in London.

Analysis by Today business presenter Dominic O'Connell

Pundits had expected Sainsbury's to have the weakest Christmas numbers of the big four grocery chains.

They were right - but for the wrong reasons. Sainsbury's core grocery business did quite well given the fierce competition from the mainstream rivals Tesco, Morrisons and Asda, and the extra squeeze from the German-owned discounters Aldi and Lidl.

The weakness came in so-called general merchandise, which includes Argos, which Sainsbury's bought two years ago.

The problem, Sainsbury's said, was not Christmas trading, but Black Friday.

It chose not to follow rivals' fierce discounting and sales suffered accordingly.

While this explanation is undoubtedly correct, it will not impress investors, who will point out that Argos was meant to provide diversification away from the super-competitive grocery market, and that complaining about discounting on Black Friday is like complaining about cold weather in January.

All this week's trading updates show only sales. We will not know the real winners - which retailers turned those sales into profits - until later in the year, in Sainsbury's case in the full-year results in May.

'Mixed bag'

The third-quarter retail sales figure was worse than analysts had expected, having predicted a 0.2% decline.

Retail analyst Teresa Wickham told BBC Radio 4's Today programme: "It is a mixed bag. Christmas has clearly been difficult for them."

She said Sainsbury's had had to make difficult decisions about how far it should go down the promotional route in order to compete with Aldi and Lidl.

But she added that the UK's second-largest grocery chain had a "very valuable property in Argos", despite the fall in merchandise sales.

And Richard Lim, chief executive at Retail Economics said: "These results aren't disastrous but demonstrate the significant challenges faced by the big grocers."

Sainsbury's plans to merge with rival Asda, with a verdict on the plan due from the Competition and Markets Authority (CMA) in February.

Sainsbury's customers cut back on their food spending during the festive period

Mr Coupe denied that the emphasis on the merger meant Sainsbury's management had lost direction. He said there were about 20 people dealing with the merger, but more than 100,000 members of staff focused on Sainsbury's customers.

He said the firm continued to have constructive talks with the CMA and was confident a merger would "bring lower prices for consumers".

'Hugely disruptive'

Meanwhile, Sainsbury's, like other UK supermarkets, is preparing for the possibility that the UK will leave the EU without a deal.

Mr Coupe said a no-deal Brexit would be very challenging for retailers, given that UK retailers bring in more than 30% of their volumes from continental Europe.

"There is only so much contingency planning you can do," he said. "We have 20 distribution centres and each one can hold about a week's worth of food. But it is not as if there are another 20 distribution centres out there."

How have other retailers fared over Christmas?

Baker Greggs has seen annual sales to January rise by 7.2%, driven by growth in new categories such as vegan-friendly foods. Like-for-like sales at company-managed shops were up 2.9% across the year, and in the Christmas fourth quarter by 5.2%.

Fashion retailer Ted Baker reported higher sales in the holiday period. In the five weeks to 5 January, they were up 12.2%. Online sales jumped 18.7% to make up more than a quarter of retail sales.

Majestic Wine has said the Christmas trading period was more challenging than expected, but total sales were 6.3% higher in the 10 weeks to 31 December, accelerating from the 3.2% growth rate seen at the same time last year.

Mr Coupe said a lot of the stock that the firm brought in from mainland Europe was fresh fruit and vegetables, which could only be held for short periods of times and not be stockpiled.

"It would be hugely disruptive if there was a no-deal Brexit, and we would have to manage that on a day-to-day, week-to-week basis," he added.

"We don't have the capacity to manage more than one week's worth of stock."

- Published12 December 2018

- Published8 November 2018

- Published25 October 2018

- Published19 September 2018