Lloyds' overdraft fees unacceptable, says MP

- Published

Lloyds Banking Group has been criticised for introducing new overdraft charges on Monday ahead of a proposed crackdown later this year.

An MP described the fees - which will equate to an annual interest charge of up to 61% - as "unacceptable".

The Financial Conduct Authority wants to scrap overdraft fees and replace them with a single interest rate.

Lloyds Banking Group said: "The changes were announced prior to the FCA's latest recommendations."

MP Rachel Reeves, who chairs the Business, Energy and Industrial Strategy select committee, said: "While these fees might be legal, they are not within the spirit of the FCA's recommendations."

She said: "It is unacceptable for financial institutions to try to game the system at the expense of customers, particularly those struggling with their finances."

Ms Reeves added that the new fees would "increase the charges for the vast majority of customers".

What are the new fees?

A quarter of current account holders will be hit by the new charges, which come into effect on 14 January for Bank of Scotland, 28 January for Lloyds Bank and 4 February for Halifax customers.

Rather than paying 1p every day for every £7 of overdraft used, the cost for the first £1,250 borrowed will increase to 1p a day per £6.

That works out at an annual interest charge of 61%, much higher than widely-criticised guarantor loans or expensive credit cards aimed at people with poor credit records.

The cost for borrowing between £1,250 and £2,500 remains at 1p a day per £7, while borrowing more than that will be charged at 1p a day per £8.

The new tariff means anyone borrowing less than £4,100 on their overdraft will pay more.

What is the watchdog proposing?

The Financial Conduct Authority , externalwants banks to charge a single interest rate for all types of overdraft.

Under its proposals, banks would set a single rate for going into the red and customers would be able to compare banks for the best deal.

The City watchdog has also proposed a ban on any fixed fees linked to an overdraft.

"The FCA isn't tinkering around the edges, it wants to radically change the UK overdraft market to make it simpler, fairer and easier for consumers to manage and compare," said analyst Andrew Hagger of Moneycomms.

What does Lloyds say about its charges?

The bank maintains that there is nothing wrong with its new fees.

It said they were in the spirit of the FCA's views "in terms of removing costs for unplanned and complexity of charging".

Andrew Hagger disagreed. He said: "I'm surprised that the increase is going ahead, as it doesn't fit in any way shape or form with what the regulator wants to see for personal overdrafts."

Ms Reeves said: "We need an end to the excessive fees that continue to harm borrowers, particularly those with persistent money problems."

She added: "Lloyds should rethink these fees as a matter of urgency."

How do overdrafts work?

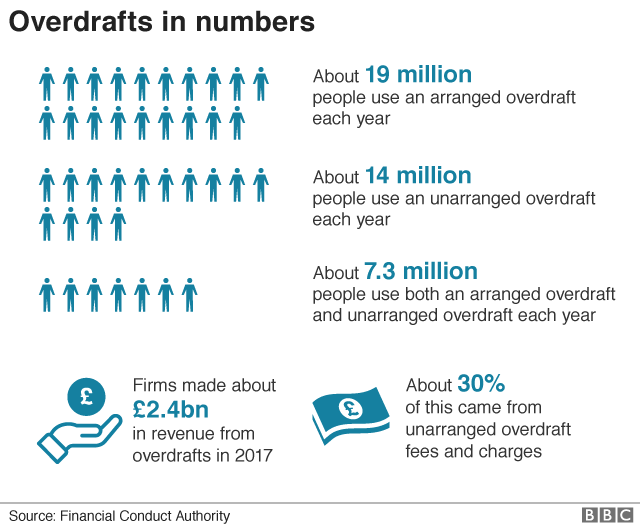

There are arranged overdrafts, when current account holders borrow up to a limit agreed with, or offered by, the bank. About 19 million people use one each year.

Some banks also have unarranged overdrafts, with extra or higher charges for going beyond this limit or going into the red without permission, used by 14 million people a year.

Those aged 35 to 44 are most likely to have some form of overdraft, while about 10% of all 18 to 24-year-olds have exceeded their overdraft limit in the past 12 months.

For customers, the charges and fees are difficult to compare - with a mix of interest rates, daily fees or monthly fees among banks.

Those costs could be high even with a small debt. For example, someone could be charged £5 a day for borrowing £100 on overdraft.

The majority of unarranged overdraft charges are paid by only 1.5% of customers. They pay about £450 a year in fees and charges, according to the FCA.

On average, consumers in more deprived areas paid twice as much in charges for unarranged overdrafts as did consumers living in less deprived areas, the FCA found, external.

- Published18 December 2018

- Published13 November 2018

- Published6 September 2018