Boohoo remains in fashion as sales surge

- Published

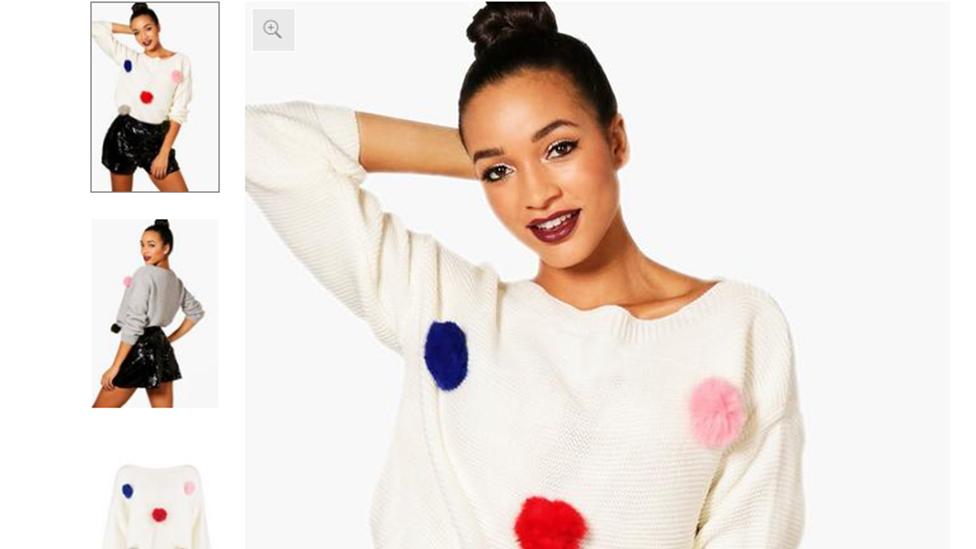

Sales at Boohoo grew strongly in the last four months of 2018, in another sign that people are choosing online shopping over the High Street.

The online fashion retailer, which also owns the PrettyLittleThing and Nastygal fashion labels, saw revenues in the four-month period jump 44% to £328.2m.

It revised its revenue growth forecast for the financial year to 43%-45%, up from a previous estimate of 38%-43%

Boohoo sells clothes, accessories and shoes for the 16 to 30-year-old market.

The company, which was founded in 2006, distributes its stock from a huge warehouse in Burnley, and it claims to have more than five million customers., external

Boohoo called the figures, external "another great set of results". Revenue from PrettyLittleThing nearly doubled, rising by 95% to £144.2m, while there was 74% growth in NastyGal's revenue to £20.6m.

Julie Palmer, partner at business consultancy Begbies Traynor, said Boohoo's results would "go some way to restoring calm" after the surprise pre-Christmas profit warning from rival online fashion retailer Asos.

She said: "Customers are basing their decisions on price, and Boohoo is very competitively placed to capitalise on this.

"Tie in the fact that overall footfall is down on the High Street and online sales continue to grow, Boohoo is entering 2019 in a very strong position."

However, she warned: "According to our latest Red Flag Alert, the number of online retailers in financial distress increased to 8,500 in 2018. Being cut from a similar cloth to Asos, Boohoo must remain innovative and resilient if it is to stay in fashion."

Emily Salter, retail analyst at data and analytics company GlobalData, said: "The Boohoo group appears to have been immune to the tough retail conditions faced by UK retailers over the past few months."

She added that 2019 should be another successful year, but warned UK growth could slow because of "the relative maturity of the brands".

"The group therefore needs to invest in the proposition, operations and infrastructure in key global markets to allow for further growth, especially the USA, where the group experienced a 77.7% increase in revenue during the period."

Sophie Lund-Yates, equity analyst at Hargreaves Lansdown, agreed that the company's investment in the US was important, but warned: "An American adventure isn't coming cheap."

She added: "Looking further ahead, it's important Stateside spending is kept firmly under control if investors are to believe the group hasn't bitten off more than it can chew."

Analysis: By Simon Browning, business reporter

It might come as a surprise to many, but lots of the UK's big fast fashion retailers are making dresses, tops, jumpers and skirts in the UK again - and it's paying dividends for their financial results.

After years of outsourcing to factories in Asia, making clothes here means fast fashion can be reactive and responsive - servicing the huge demand of the Instagram generation which wants what it sees online immediately.

By manufacturing here, distribution and shipping times are hugely reduced meaning products hit online portals when they're at peak demand, meaning the retailer can charge a higher price to cover the higher cost of UK manufacture.

It can often mean the profit margin is slightly tighter, but with higher demand it means more sales and ultimately less waste and discounting.

Manufacturing here also means retailers like Boohoo can quickly replenish stock if a product is a hit with fast access to market.

Now other big UK retailers are recognising the effectiveness of this model, but they face a challenge in making the switch.

Lots of the factories in cities like Leicester are at full capacity, and after decades of manufacturing moving offshore, many of the others have closed down and workers' skills have been lost.

- Published11 January 2019

- Published9 January 2019

- Published17 December 2018

- Published26 September 2018

- Published26 September 2018