Inflation falls to lowest level in nearly two years

- Published

- comments

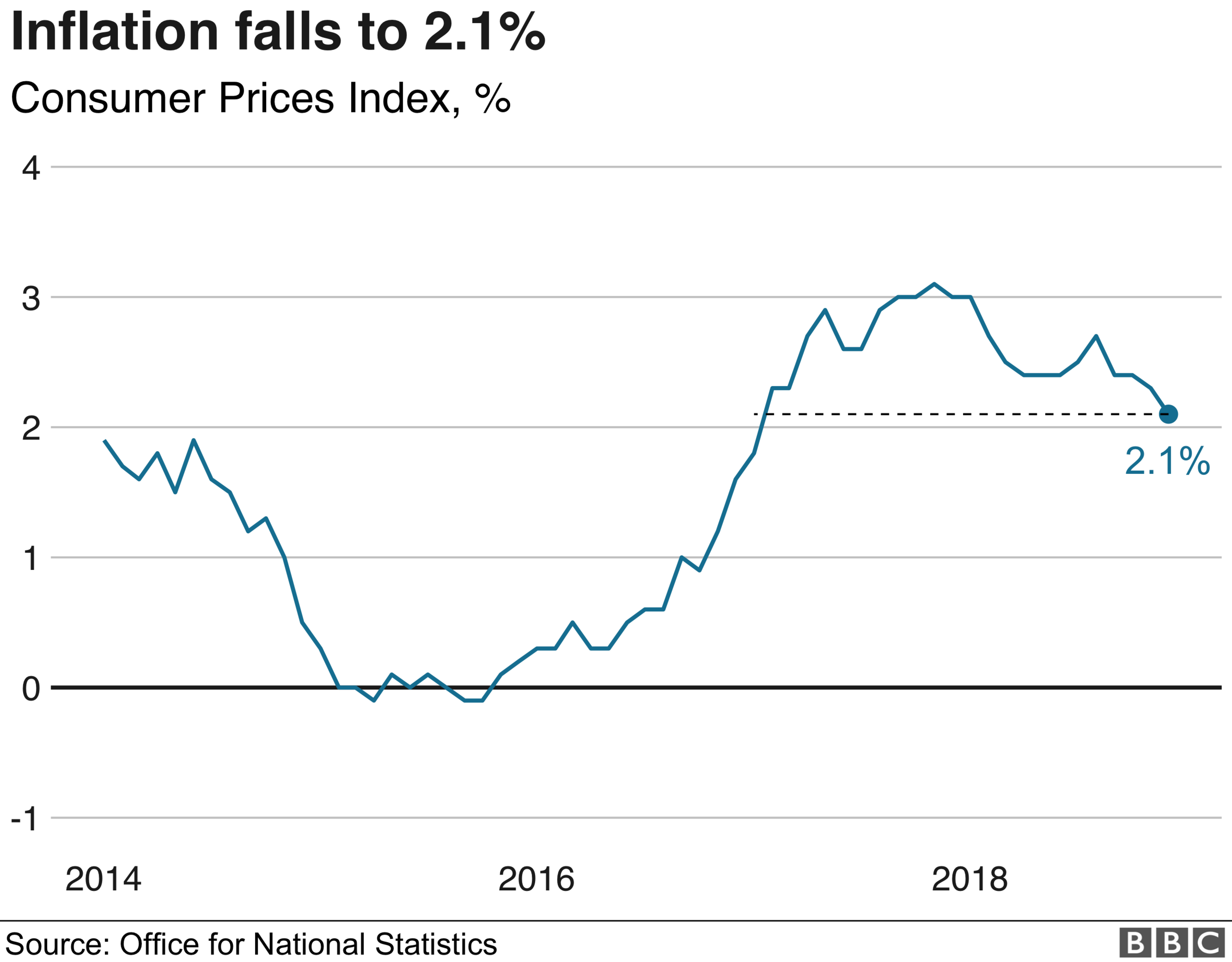

The UK inflation rate fell to 2.1% in December, from 2.3% the previous month, according to the Office for National Statistics (ONS).

The Consumer Prices Index (CPI) figure was the lowest in nearly two years, pushed down by petrol price falls.

The inflation reading was in line with analysts' expectations.

The figure is close to the Bank of England's target of 2% and may mean the Bank is less likely now to consider any rate rises in the near future.

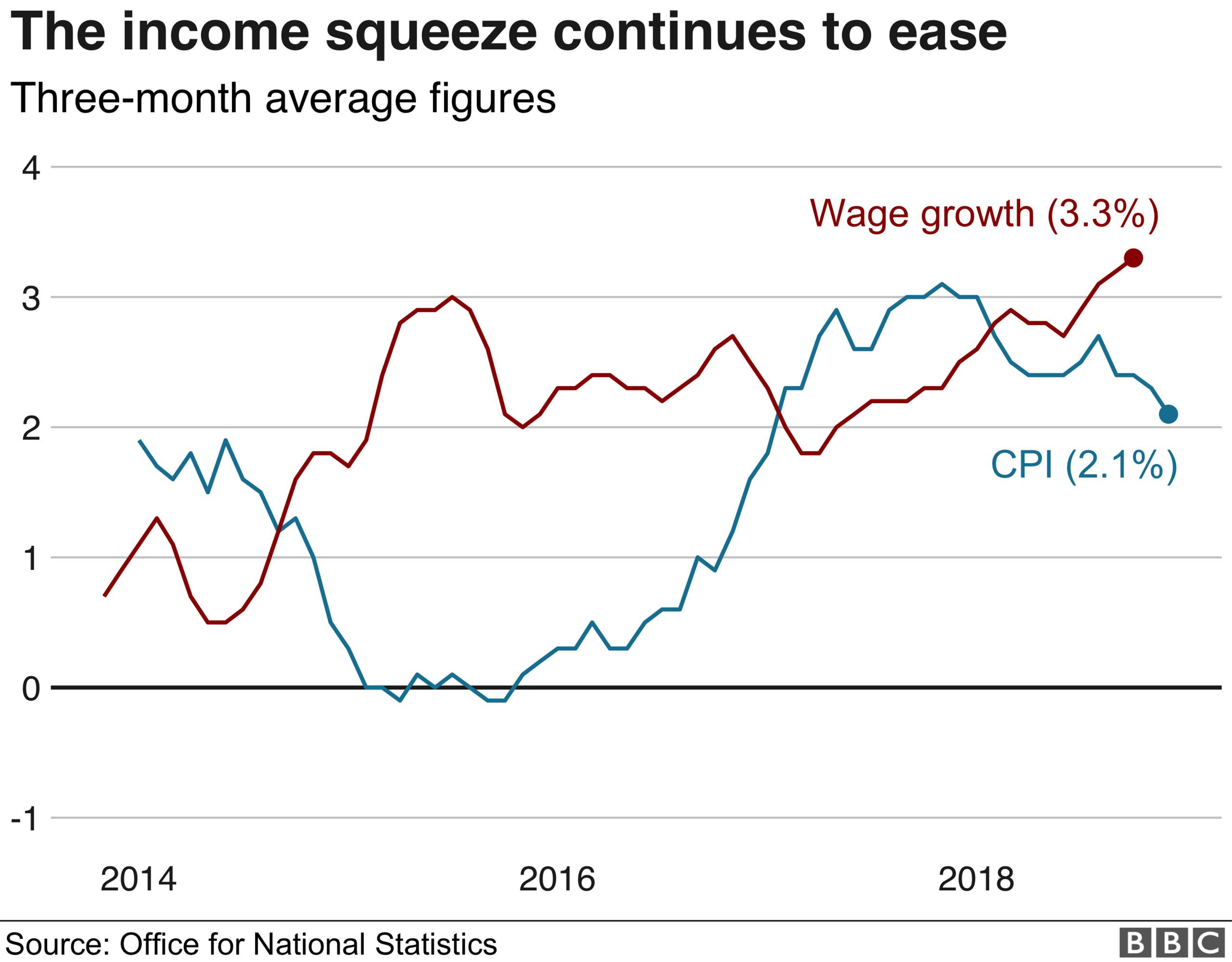

Inflation is being outstripped by average UK pay growth, with the most recent available figures showing that wages excluding bonuses were up by 3.3% for the three months to October 2018.

Toys and hobbies

The head of inflation at the ONS, Mike Hardie, said: "Inflation eased mainly due to a big fall in petrol, with oil prices tumbling in recent months.

"Air fares also helped push down the rate, with seasonal prices rising less than they did last year. These were partially offset by small rises in hotel prices and mobile phone charges.

"House price growth was little changed in the year to November, with buoyant growth across much of the UK held back by London and the South East."

Analysis: Andy Verity, BBC economics correspondent

What's striking about the inflation figures isn't so much what they tell you about the cost of living. It's what they suggest about interest rates. In October, traders in the City were betting the Bank of England would seek to head off inflationary pressure and take some heat out of the economy by raising interest rates again by May.

Pay rises had started to improve significantly, fuelling fears employers would have to start boosting prices to pay those higher labour costs and keep up their profits. In order to head off inflation and keep it close to the 2% target over the next two years, so the logic went, interest rates would have to rise sooner rather than later.

But now the betting is a rate rise won't happen before November. And part of the reason may be Brexit-related uncertainty. In other words (so the theory goes) Brexit-related uncertainty is causing consumers to pull their horns in and businesses to hold back on new investment.

Therefore there's less demand for the goods or services they wish to buy, and therefore less upwards pressure on prices. Therefore, in turn, there's less need for an early rise in interest rates.

This might be some comfort if you're stuck with a huge mortgage, concerned about exactly when the next quarter-point rise in interest rates will come. Think of it as a modest silver lining to the gathering clouds of Brexit-related uncertainty.

The price of petrol fell by 6.4p per litre on the month to 121.7p, which was the lowest price since April 2018. Diesel fell by 4.6p to 131.9p per litre, the weakest since July 2018.

These downward effects were offset by upward contributions from a variety of categories, including accommodation services and, to a lesser extent, mobile phone charges, games, toys, hobbies and food.

Raw materials

Inflation peaked at a five-year high of 3.1% in November 2017, but is now at its lowest since January of that year.

The ONS said consumer prices over the fourth quarter as a whole were 2.27% higher than a year previously, a smaller rise than the 2.47% forecast by the Bank of England in November.

The inflation figures also pointed to less short-term pressure in the pipeline for consumer prices, the ONS added.

For manufacturers, the cost of raw materials - many imported - was 3.7% up on December 2017, down steeply from annual inflation of 5.3% in November and marking the weakest increase since June 2016.

'On track'

Examining the possibility of interest rate rises, Ruth Gregory, senior UK economist at Capital Economics, said: "With inflation within a whisker of its 2% target, the [Bank of England's Monetary Policy Committee] will probably feel comfortable in waiting until Brexit uncertainty is resolved before moving again.

The fall in CPI inflation from 2.3% in November to 2.1% in December was bang in line with the consensus forecasts. Note that the MPC predicted in December that CPI inflation would fall to 1.75% by January. So the committee's forecasts are on track."

She said that Ofgem's energy price cap on utility prices should subtract 0.2 percentage points from CPI inflation in January and, looking ahead further in the year, that inflation should remain below the Bank's 2% target for much of the year.

Stephen Clarke, senior economics analyst at the Resolution Foundation, said the easing of inflation provides a "welcome relief to households amid wider economic uncertainty".

He added: "Assuming very damaging Brexit outcomes are avoided, a tight labour market continuing to put upward pressure on pay should mean 2019 is set to be a better - if not great - year for wages."

- Published11 January 2019

- Published11 December 2018