Commuters and students 'short-changed by the government'

- Published

- comments

Commuters and students are being short-changed by the government, the Lords Economics Affairs Committee has said.

The Retail Prices Index (RPI) inflation measure, used to calculate rises in student loan repayments and some train fares, is flawed, it said.

Moreover, the government is using different inflation measures to maximise funds coming in, which "simply is not fair", the committee added.

The UK Statistics Authority agreed RPI "has significant shortcomings."

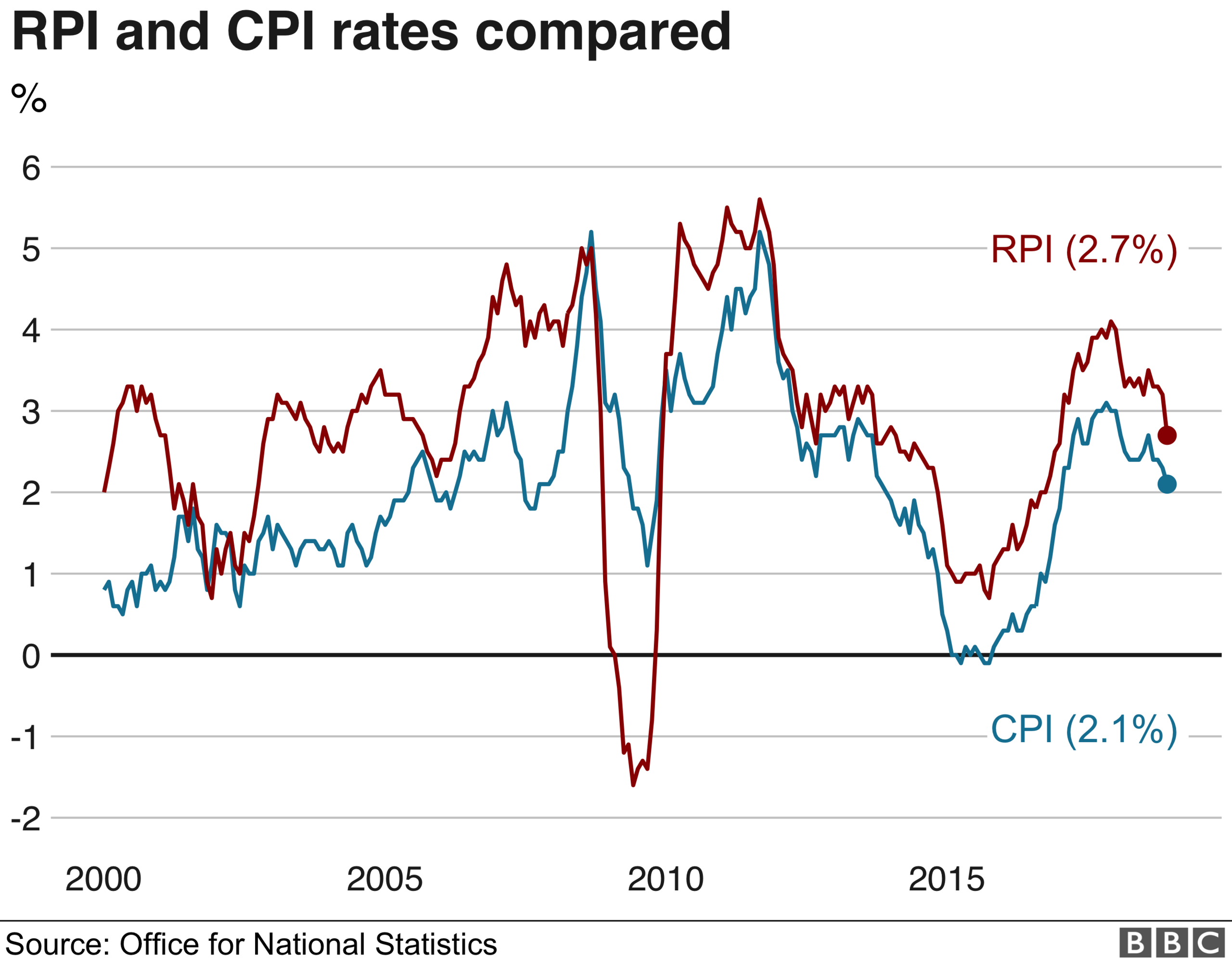

Committee chair Lord Forsyth said: "When the government gives money to people it is generally opting to adjust payments for inflation using the Consumer Prices Index.

"But when it takes money from people, it is generally opting to use the Retail Prices Index, which has been around one per cent higher than CPI in recent years. This simply is not fair."

The government uses RPI, to calculate increases in some of the funds it collects, including rises in about 40% of rail fares, plus duties on alcohol and tobacco and for adjusting student loan repayments for inflation.

However, it uses another measure, the Consumer Prices Index (CPI), to work out increases in monies it pays out or allows people to keep, including benefits, state pensions and tax thresholds.

The Lords Economics Affairs Committee accused the government of "index shopping" and using the higher rate of inflation to increase monies it has coming in compared with what it is paying out.

It also said the UK Statistics Authority (UKSA) was failing in its legal duty to safeguard statistics.

A spokesperson said the UKSA would "continue to work closely with our counterparts in government and at the Bank of England and respond to the committee".

The committee published its report, "Measuring Inflation" after a request from Bank of England Governor Mark Carney, who said RPI "has no merit".

Problems with RPI

The RPI inflation measure was dropped as a national statistic in 2013, but it was decided at the time to not resolve the problems with the way it was worked out as that could affect bonds and some pension schemes.

The index was used to introduce a 3.1% increase in some rail fares at the start of the year, after commuters around the country had suffered widespread disruption and delays.

Research from the House of Commons library last year estimated that the use of RPI added up to £16,000 to the cost of a student loan.

However, ditching RPI would need the consent of the Chancellor Phillip Hammond, as it would affect the returns earned by some holders of government bonds.

A Treasury spokesperson said: "We recognise the flaws in the way RPI is measured and have made progress in moving away from using it.

"However, given the extensive use of RPI across the public and private sectors, further moves away from the measure are complex and potentially costly."