Bank customers hit by dozens of IT shutdowns

- Published

Customers suffered dozens of digital banking shutdowns last year, according to new figures that reveal the scale of banks' IT problems for the first time.

UK banks have begun publishing the number of operational and security incidents that have occurred, under a voluntary scheme overseen by the financial regulator.

The data reveals major banks typically suffer well over one outage a month.

Barclays reported the most problems, but said many were minor incidents.

Banks were told by the regulator, the Financial Conduct Authority (FCA), to show evidence of the quality of the service they were providing. The aim was to make it easier for customers to compare what banks were offering and to switch accounts.

As a result, banks now publish details, external on their websites showing the time it takes to open an account and to replace a lost or stolen card if you bank with them. The figures suggest that typically overdrafts can be provided very quickly, often on the same day, whereas lost or stolen cards take more than five days on average to replace.

Other details include how and when customers can make payments, cancel cheques, and whether 24-hour help is available.

Shutdown data

This month, for the first time, the data also shows the frequency of IT-related shutdowns. Prior to this there had been little evidence available about the number of times bank services have been unavailable owing to security or operational incidents.

The figures cover the nine months to the end of last year, and analysis by the BBC reveals that most major High Street banks suffered more than ten shutdowns between April and December.

Barclays had the highest number of incidents with 41 over the nine months.

A spokesman for the bank said: "We take IT resilience extremely seriously and we welcome transparency for our customers which is why we report every incident to the regulator, even minor glitches that have minimal impact on customers."

He added that the bank's service was designed to allow customers to use other channels, such as branches and telephone banking when problems occurred. Moreover, the bank had its own status page, external to keep customers informed of which services were working and which were not, he said.

Lloyds Bank suffered the second highest number of outages with 37 recorded instances, and other brands in the Lloyds Banking Group jointly had 31.

Recently customers expressed their frustration with one Lloyds brand, MBNA, after IT updates made it difficult for customers to pay off their credit cards.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

The scale of the problem is significant, according to financial analyst Andrew Hagger, of Moneycomms.

"There will be occasions when there are minor glitches," he said. "But there comes a time when [the banks] have got to overhaul these systems. When banks are pushing us towards online and mobile banking, some savings from branch closures and profits should be apportioned to getting systems up to speed."

A spokeswoman for UK Finance, which represents the banks, said that providers worked "around the clock" to minimise disruption and get services working again when incidents occurred.

"Operational resilience is crucial in a modern financial system and is a key priority for the industry," said.

UK Finance said its members invested billions of pounds in ensuring IT and human systems were "robust and secure".

Nicky Morgan. who chairs the Treasury Committee, which has an ongoing inquiry into IT failures in the financial sector, said: "IT failures at banks are a regular occurrence. We all think 'please don't let it be mine', but these failures now seem to have an air of inevitability.

"These figures are concerning, especially considering that the availability of these online services is vital as more and more customers are ushered online."

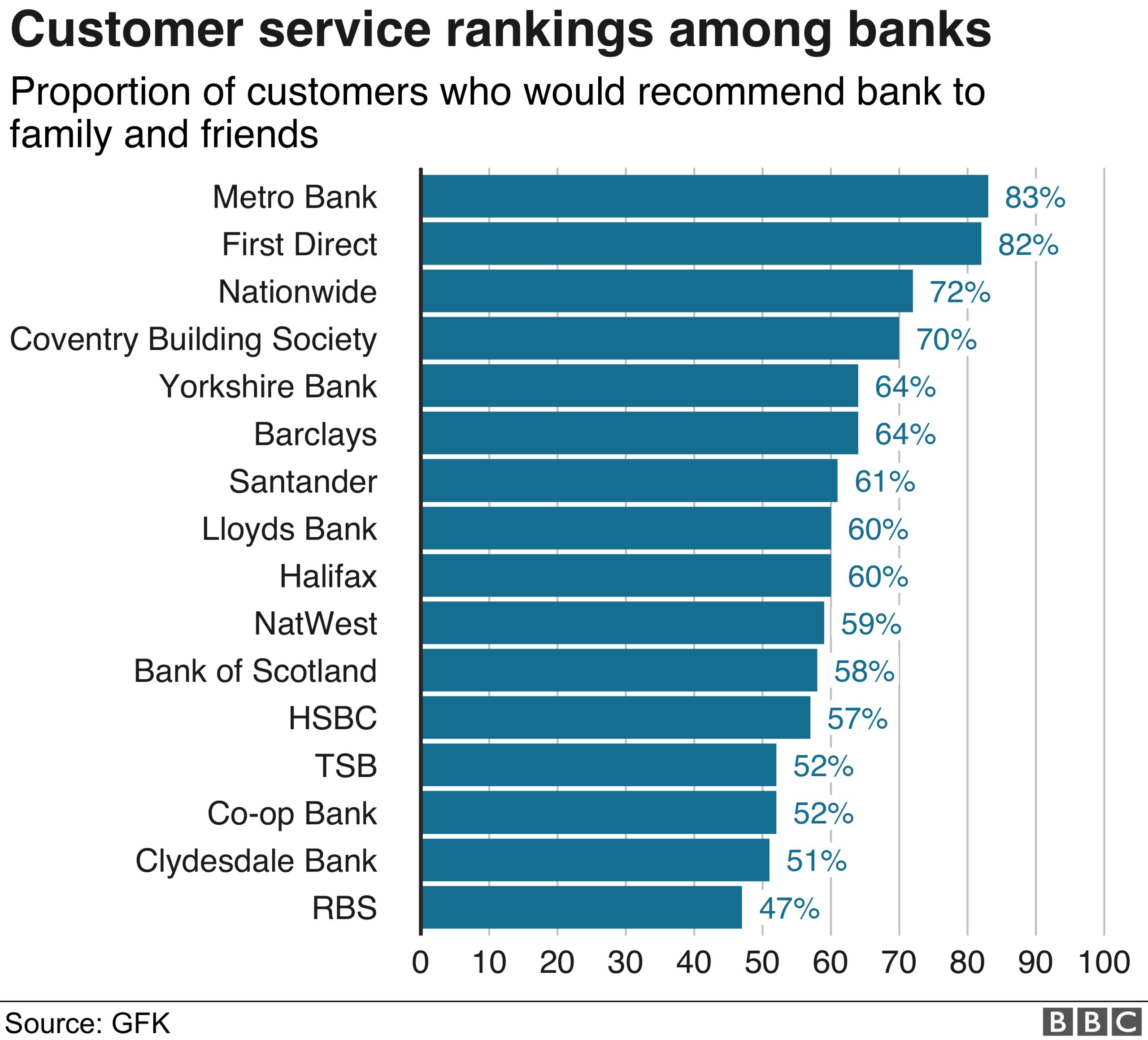

The number of shutdowns does not necessarily translate to poor customer satisfaction. Barclays, despite recording the highest number of incidents, was ranked second in official rankings, external for mobile and online banking, and joint fifth for overall satisfaction in a survey of 16,000 banking customers.

- Published15 February 2019

- Published18 June 2018

- Published27 June 2018