M&S and Ocado to start home delivery service next year

- Published

- comments

Marks & Spencer and Ocado have confirmed a deal which will give the High Street retailer a home delivery service for the first time.

M&S will buy a 50% share of Ocado's retail business for £750m.

The joint venture will be called Ocado and will deliver M&S grocery products from September 2020 at the latest, when Ocado's deal with Waitrose expires.

Under the deal Ocado will also continue to supply its own-label products and big name branded goods.

What does the deal mean for shoppers?

Ocado's deal to deliver about 4,500 Waitrose goods is due to end in September 2020.

Shoppers will then be able to order more than 4,500 M&S products alongside Ocado own-label goods and big name branded items.

Existing Waitrose customers - who have products delivered by Ocado - will have two choices:

They could choose to stay with Ocado and switch to buying M&S goods

They could switch to Waitrose.com which operates its own online delivery service

Waitrose managing director Rob Collins said the supermarket chain had strengthened its own online business "significantly" and that it planned to double its sales within five years.

M&S chief executive Steve Rowe claimed that current Ocado customers would benefit from the deal as Marks and Spencer products were on average cheaper than comparable Waitrose products.

The deal could also see some of Ocado's own brand products being stocked in M&S stores.

Ocado also has a deal to supply Morrisons with the technology to run its online business. This arrangement is separate and will not be affected by the new tie-up. Visitors to the Ocado site will still not be able to order Morrisons.

How is M&S going to pay for the deal?

M&S is to buy a 50% share of Ocado's retail business for £750m.

The retailer will fund the deal by selling £600m of shares and by cutting its dividend payout to shareholders by 40%.

"We think we've paid a fair price," said Steve Rowe, M&S chief executive.

"It's the only way we could have gone online within an immediately scalable, profitable and sustainable business," he said.

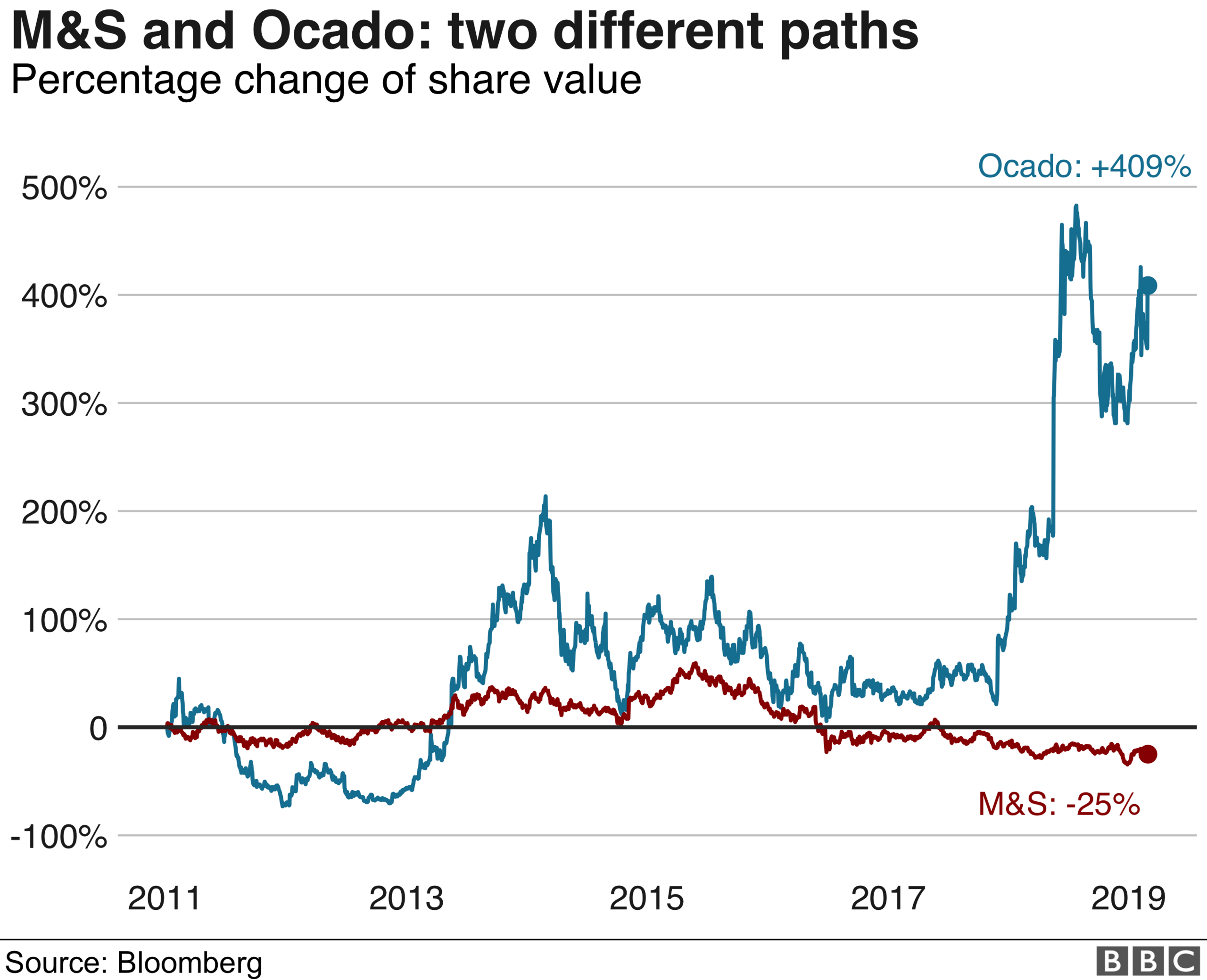

M&S shareholders were sceptical, its shares fell 10% following the announcement, while Ocado's shares rose by almost 4%.

Why is M&S doing the deal?

M&S has struggled in recent times.

Clothing, home and food sales have all fallen, amid "challenging" trading conditions on the High Street.

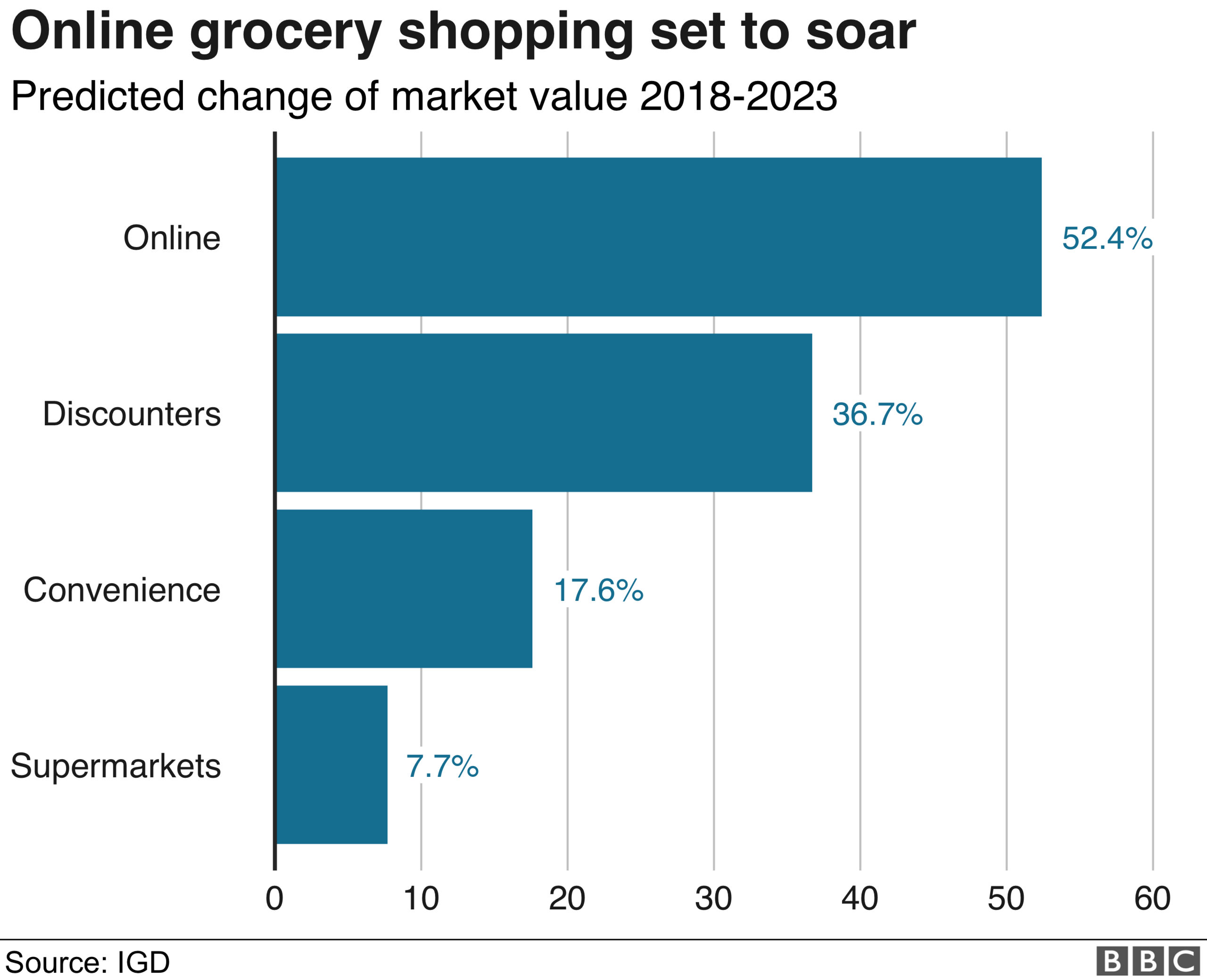

It has been hampered by not having an online delivery service.

However, Mr Rowe said in the future one third of M&S business would be online.

The deal was the "only way we could have gone online within an immediately scalable, profitable and sustainable business", he said.

But Neil Wilson, chief markets analyst at Markets.com, questioned whether the value of a shop with M&S was big enough for online shopping.

"Basket sizes at M&S are extremely small relative to other larger supermarkets and significantly below the current Ocado minimum for delivery.

At the moment M&S shoppers spend an average of £13 on each shop, while Ocado averages just over £100 per shop.

M&S said that part of the reason it has such a relatively low average spend was that customers could not access a wider range of products.

The company said the Ocado deal would offer their customers the ability to do a full shop online.

What does the deal mean for Ocado?

The company will split into two parts.

The new joint venture will be called Ocado.com and will deliver M&S, Ocado and big name branded products. It will have access to M&S's database of 12 million food shoppers.

Its Ocado Solutions division will continue to develop new robotic warehouse technology and supply companies like US retail giant Kroger and France's Groupe Casino, helped by the injection of money it gets from the new deal.

However, according to Market.com's Mr Wilson, there is a risk that shoppers will defect to Waitrose when the current arrangement with Ocado comes to an end.

"I would also query whether M&S can retain the current Ocado customer base who are used to getting Waitrose products. There is a high risk of customer leakage as consumers rotate to Waitrose's in-house delivery service," he said.

However, Ocado founder and chief executive Tim Steiner brushed off that suggestion.

"Our customers have told us that they are looking forward to getting their M&S Percy Pig sweets", he said.

The ending of the deal with Waitrose means that Ocado will no longer have to pay sourcing fees to Waitrose, which came to more than £15m in 2018.

Who benefits most from the deal?

Analysis: By Dominic O'Connell, Today business presenter

The two companies' share price reactions give a succinct verdict. M&S was down nearly 8% in early trading; Ocado up 4%. Retail experts - and professional investors - think there is a lot more in this for Ocado than for M&S.

The latter is paying £750m for a half share in a division of Ocado that last year made just over £80m of trading profit. Shareholders will have to find £600m of the purchase price from their own pockets, and - possibly worse news for the many investors who have bought M&S shares for the income they provide - stomach a hefty cut to the dividend.

The high price explains some of investor misgivings, but there are bigger questions about the fit between the two.

M&S is a (relatively) upmarket convenience store, where the average basket price is just £13. Ocado, thanks to its tie-up with Waitrose and its wide-range of own-label products, is a full-service grocery store where most customers are doing their weekly shop, not topping up.

Will M&S be able to push enough of its products through Ocado to justify the price, and how will Ocado customers react when its relationship with Waitrose comes to an end next year?

Archie Norman, M&S's wily chairman and chief strategist, might judge these criticisms short-sighted, and typical of the City's lack of long-term vision.

Having lagged behind on online shopping for years, M&S has been catapulted into the front ranks at a stroke.

The cost of the deal, Norman might argue, should be judged against the cost of the alternatives, and the cost of doing nothing.

- Published26 February 2019

- Published5 February 2019

- Published10 January 2019

- Published19 May 2018