'I paid £2,000 for a £450 TV' says rent-to-own victim

- Published

Scott Clayton was working part-time when he became a customer of one of the UK's rent-to own firms.

Having entered into an agreement he ended up paying four times the value for a TV.

But experiences such as his should come to an end next month after plans to cap rent-to-own shops have been confirmed by the City watchdog.

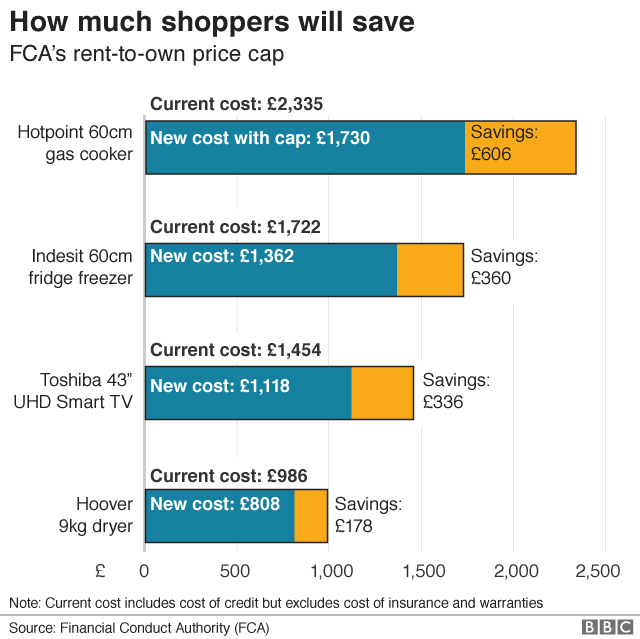

The Financial Conduct Authority (FCA) will limit the interest that customers pay to no more than the product's cost.

The rules - which will apply to new goods from 1 April - will mean if a cooker costs £300, borrowers will pay no more than £600 in total, including the cost of credit.

The move will save some of the UK's most vulnerable consumers millions of pounds from April, the FCA said.

They come too late to Scott who rues the day he encountered rent-to-own.

"I wish there was a cap back then. I would have been a lot better off now," he said.

He went to rival chain Perfect Home after his TV broke.

"The ticket price was £450 for a 42 inch TV, but by the end I paid about £2,000."

Under the new rules, external the interest charged will only be as much as the cost of the product, but the price of the goods themselves will also be limited.

Shops will be able to charge no more than the median - the middle price - of three mainstream retailers, including delivery and installation charges.

Rent-to-own stores offer people the chance to buy items they need for their home - such as TVs or washing machines - through smaller, regular payments, instead of paying for the goods in one go.

But once interest charges have been added, some rent-to-own consumers have ended up paying more than four times the retail price they would have paid in normal shops.

Rent-to-own shops will still be able to charge for insurance and warranties on top of that, but the FCA said it would stop firms from increasing their prices for insurance premiums, extended warranties, or arrears charges, to recoup lost revenue from the price cap.

"The measures come into force from 1 April and we will be keeping a close watch on firms' compliance," said Mr Woolard.

"We will review the impact of the price cap in 2020 and if further work is needed to protect these customers we are prepared to intervene again."

The main companies offering rent-to-own goods are Brighthouse and PerfectHome.

A BrightHouse spokesperson said: "We remain committed to offering our customers, who are excluded from mainstream credit, great service and the best prices possible for the products they require.

"Over the coming months we will fully implement the changes that have been confirmed today."

A spokesperson at PerfectHome said: "Our customers will start seeing changes to our agreement terms for new products in the coming weeks, in readiness for the start date set by the FCA, 1 April 2019.

"The changes will apply to new agreements only; customers with existing agreements will not be affected."

Michele Jacques found rent-to-own meant paying over the odds for her cooker

MoneySavingExpert founder Martin Lewis welcomed the confirmation.

"The rent-to-own sector is perhaps the most visceral example of the poverty premium in the UK," he said.

"The fact that the most vulnerable with the least, pay four times as much for their electrical and white goods as everyone else is simply unjust, and it's rightfully about time that the FCA cracks down on it."

Andrew Hagger, finance analyst from Moneycomms, also welcomed the news.

He said: "It's good to see the regulator stepping in to protect some of the most financially vulnerable in our society.

"These people have been taken advantage of for far too long, mainly because the retailers know such customers often have nowhere else to turn.

"The credit cap of 100% is a welcome move and it's pleasing that the FCA won't let these retailers recoup their money via the back door by increasing the cost of add on insurances," he added.

- Published22 November 2018

- Published31 May 2018