Former Barclays traders jailed over Euribor rate-rigging

- Published

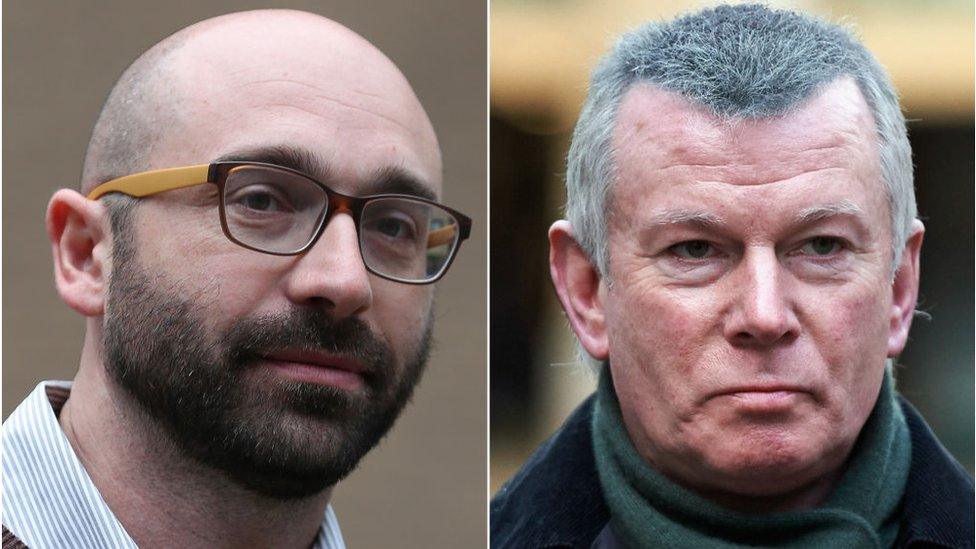

Former Barclays traders Carlo Palombo and Colin Bermingham have been convicted of Euribor rate-rigging

Two traders have been jailed after being convicted of conspiring to rig the Euribor global interest rate.

Colin Bermingham, 62, and Carlo Palombo, 40, both former Barclays traders, were convicted of conspiracy to defraud.

Mr Bermingham received a five year jail term, while Mr Palombo was jailed for four years.

Another trader, Sisse Bohart, has been acquitted.

The sentences bring to an end the biggest trial so far for rigging interest rates - in this case the Euribor benchmark used to fix the interest rates of millions of euro-denominated loans.

Lisa Osofsky, director of the Serious Fraud Office, said: "These men deliberately undermined the integrity of the financial system to line their pockets and advance the interests of their employers.

"We are committed to tracking down and bringing to justice those who defraud others and abuse the system."

Euribor is a key euro benchmark borrowing rate, underpinning about $180tn of financial products, and the accuracy of the rate is important to maintaining trust in the financial system.

Every day, one trader at each bank would estimate the interest rate he or she thought the bank would have to pay to borrow cash from other banks, based on the rates banks were paying that morning.

The estimates would be submitted to the European Banking Federation (EBF), based on current market transactions. Those submissions would then be averaged and a rate would be published.

In the 1990s and 2000s, traders routinely requested that the submissions be tweaked up or down by tiny amounts to suit their banks' commercial interests. Banks typically had trading positions or investments that would benefit from higher or lower submissions.

The traders' defence has been that this was normal commercial practice. The Serious Fraud Office (SFO) says it is corrupt.

During the sentencing hearing, Judge Michael Gledhill echoed controversial remarks by Mr Justice Cooke, who presided over the first interest rate rigging trial in 2015 of former UBS trader Tom Hayes, saying he wanted "a message sent out to the world of banking".

"Those convicted of manipulating interest rates will face substantial custodial sentences," he said.

Mr Hayes was sentenced to 14 years in prison, which was reduced on appeal to 11 and a half years.

Judge Gledhill said it was difficult to understand why Mr Bermingham had become involved in conspiracy, because there was no personal gain to him from accepting requests from traders to put in higher or lower submissions.

But, he added: "Part of the answer lies in a desire to help Barclays prosper, and perhaps it is something to do with the desire to be respected by others. Whatever the reasons, you have been convicted of being knowingly and dishonestly involved in this conspiracy."

A second trial

Mr Bermingham, Mr Palombo and Ms Bohart were tried a second time by the SFO, after a jury failed to reach a majority verdict in an earlier trial in 2017.

Ahead of that trial, Christian Bittar, a former Deutsche Bank trader, pleaded guilty to conspiracy to defraud.

Another former Barclays trader, Philippe Moryoussef, attended earlier hearings but decided not to attend the trial, with his lawyer saying he could not be confident of a fair trial.

Former Barclays trader Philippe Moryoussef, centre, was sentenced to eight years in jail in absentia

He was convicted in his absence and is now a fugitive from British justice.

Both Mr Palombo and Mr Bermingham were convicted by majority verdicts, with two jurors against a guilty verdict in both cases.

Carlo Palombo's lawyer John Hartley said Mr Palombo and his family were devastated by the outcome.

"Mr Palombo started at Barclays as a junior trader and was taught by his management from an early stage about making requests of the submission desk," said Mr Hartley in a statement.

"He gave evidence during the trial that this was an ordinary course of business at the bank and there was never an issue of any of his actions being dishonest at that time and that he had received no training on Euribor submissions. No senior members of management were on trial."

In a BBC Panorama programme "The Big Bank Fix" in 2017, the BBC revealed a secret recording which implicated the Bank of England in a practice called "lowballing".

Lowballing occurred during the 2008 financial crisis, when banks artificially lowered their estimates for Libor (the London Interbank Offered Rate) - the dollar and sterling equivalent of Euribor.

In a statement to the BBC, the Bank of England said Libor was unregulated at the time.

At the 2016 trials, the SFO said it was investigating lowballing. However, after years of investigation, no prosecution has been mounted.

Libor submissions defence

Mr Hayes's case is now with the Criminal Cases Review Commission (CCRC) amid growing doubts about the safety of his conviction. The evidence against him also consisted of "trader requests" to put in higher or lower libor submissions.

Former UBS trader Tom Hayes was jailed in 2015 for allegely rigging Libor

His defence in 2015 was that there were a range of potential submissions, based on the slightly differing interest rates banks were paying to borrow money on any given morning.

Requests to raise or lower it within that range were legitimate, his lawyers argued. Prosecutors dismissed the notion of a range.

However, in 2017, at the trial of Barclays traders for rigging rates, John Ewan, the former Libor manager at the British Bankers Association, agreed requests for higher or lower submissions within a range could be acceptable. The two defendants in that trial, Ryan Reich and Stelios Contogoulas, were acquitted.

The trial of Palombo and Bermingham heard similar evidence from Helmut Konrad, a retired banker who helped set up Euribor in 1999, who told the court in 2018 it was "okay" for banks to submit a rate from a number of options that were equally good, even if one rate would be more profitable for the bank.

At this year's trial, he told the court "as long as we're talking about the range of permissible rates, it's fine".

Mr Hartley said Mr Palombo was considering an appeal.

- Published26 March 2019

- Published19 July 2018