House prices 'subdued' amid Brexit impasse

- Published

- comments

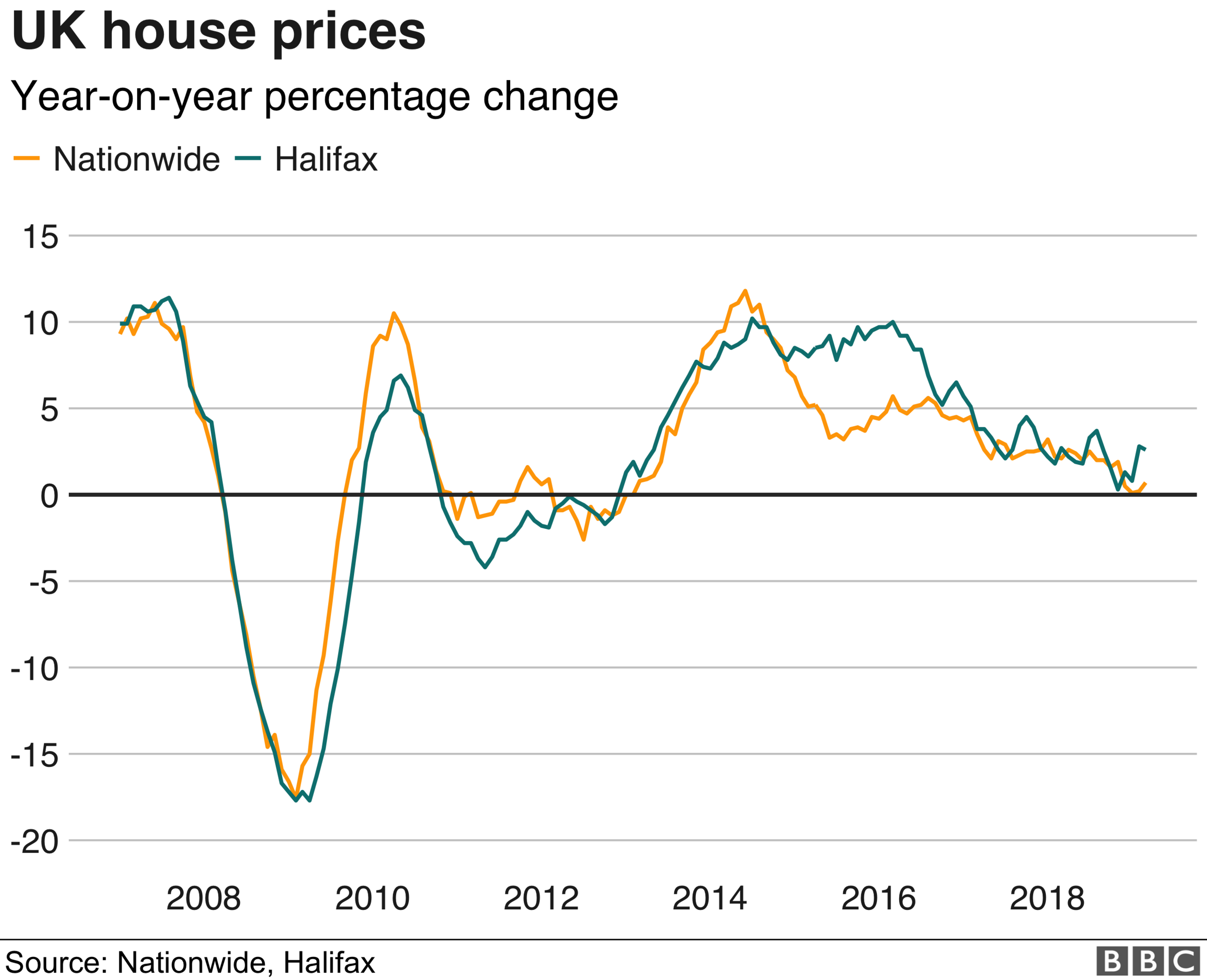

UK house price growth will continue to be "subdued" during Brexit uncertainty - particularly in London, according to the Halifax.

The UK's biggest mortgage lender said that property prices had fallen by 1.6% in March compared with the previous month.

However, prices were 2.6% higher in the first three months of the year compared with the same period in 2018.

It said the price of the average home was £233,181.

A lack of activity from both buyers and sellers meant that prices were unlikely to fall sharply, the Halifax said. However, this meant it was still difficult for many potential first-time buyers to raise a deposit.

"These conflicting challenges, when combined with the ongoing uncertainty around Brexit, have had an impact across the country but most notably in London, meaning that we continue to expect subdued price growth for the time being," said Russell Galley, managing director of the Halifax.

Tomer Aboody, director of property lender MT Finance, said: "For the past couple of years March was flagged up as the date when we would get Brexit [but] people have been too busy watching the political shenanigans on television to go out and view houses.

"The Brexit saga is such a debacle and until it gets sorted, one way or another, few people are going to do anything."

A week ago, rival lender the Nationwide said that UK house price in March were up 0.7% compared with the same month a year earlier, although property values in England had fallen over the same period.

Where can you afford to live? Try our housing calculator to see where you could rent or buy

This interactive content requires an internet connection and a modern browser.

- Published9 July 2020

- Published29 March 2019

- Published3 October 2018