World economy facing delicate moment, IMF says

- Published

- comments

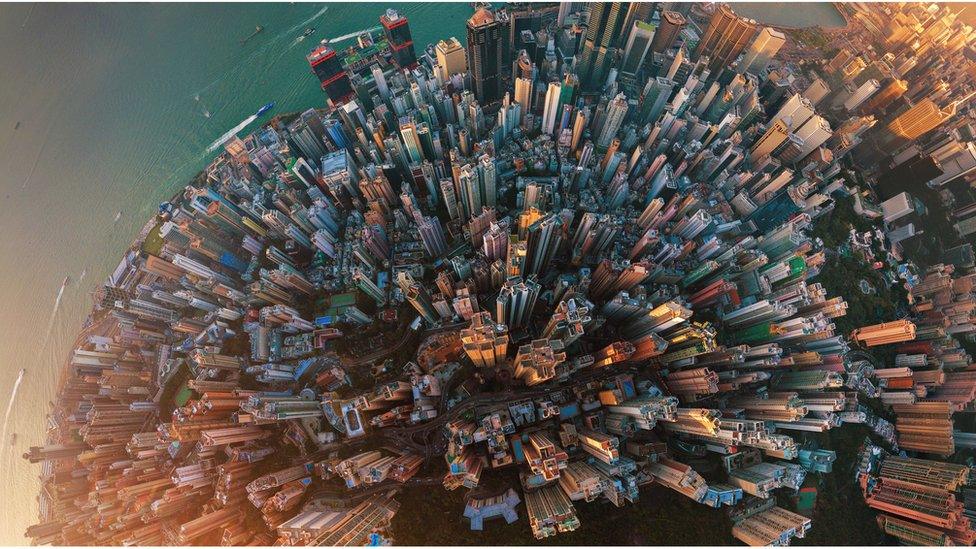

The global economy is at what the International Monetary Fund's chief economist calls a "delicate moment".

Gita Gopinath says that while she does not predict a global recession, "there are are many downside risks".

The IMF has released its regular assessment of the World Economic Outlook, which forecasts global growth of 3.3% this year and 3.6% in 2020.

That would be slower growth than last year - and for 2019, a downgrade compared with the previous forecast.

The downward revision of 0.2 percentage points for global growth is spread widely.

Developed economies affected include the US, the UK and the eurozone.

The UK economy is predicted to grow by 1.2% in 2019, down 0.3% from the IMF forecast in January. Growth in 2020 has also been revised down.

The revisions are especially marked for Germany and Italy, which is already in recession.

The IMF expects weaker performance in Latin America, as well as in the Middle East and North Africa.

For China, there are small revisions, upward for this year and downward for next. The slowdown there, which began at the start of the decade, is expected to continue.

'Precarious' recovery

The weakness in the forecast reflects a slowdown in the latter part of 2018, which the IMF expects to continue in the first half of this year.

After that, growth should pick up more pace, with the additional momentum continuing into next year.

But Ms Gopinath describes that recovery as "precarious".

She says it depends on a recovery in a number of developing economies that are stressed, notably Turkey and Argentina.

Ms Gopinath also expects a partial recovery in the eurozone.

The US, however, is likely to slow further, growing by slightly less than 2% next year as the impact of President Donald Trump's tax cuts fades.

There is no sign in her blog, or in the IMF's report, of any sympathy for President Trump's view that the main thing holding back the US economy is the Federal Reserve's increases in interest rates over the last two years.

Flare of disruption?

The risks that Ms Gopinath warns about include some familiar ones.

The first she mentions is the possibility that global trade tensions could flare up again and spread into new areas.

She refers to cars in particular, an area where President Trump is considering new tariffs on imported goods.

That, she suggests, could lead to "large disruptions to global supply chains". She says the escalation of US-China trade tensions contributed to last year's slowdown.

She also mentions risks associated with Brexit. The forecasts for the UK are based on the expectation of an orderly departure - with a deal - from the EU later this year. A no-deal Brexit would be more costly.

Other risks include the possibility of a deterioration in financial markets, leading to higher borrowing costs, including for governments. That raises the possibility of what she calls sovereign/bank doom loops.

That was a particular problem in the euro-area financial crisis, when financial problems for governments and banks reinforced one another.

- Published8 April 2019

- Published9 April 2019

- Published21 January 2019