Uber shares drop further as markets slide

- Published

Uber's share price has fallen another 11% amid wider stock market turmoil, as the trade war between the US and China escalates.

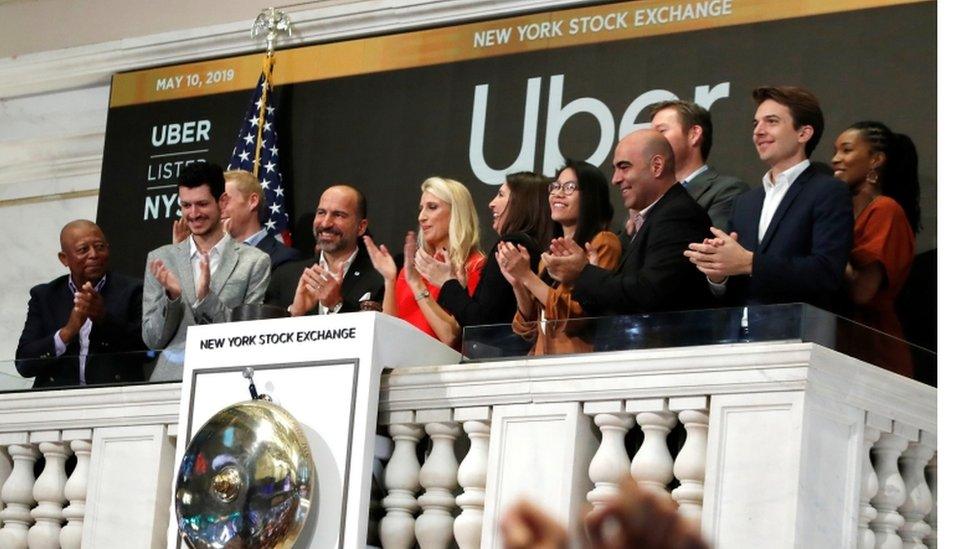

Shares in the ride-sharing app dropped further below the $45 price they began trading at on Friday when the company made its stock market debut.

Uber has begun trading as a public company just as the US and China have stepped up the level of trade tariffs.

The Dow Jones Industrial Average fell more than 2% on Monday.

Since floating on Friday, Uber has seen $20.2bn wiped off its market valuation to $62.2bn as its share price dropped to $37.10.

Analysts at Wedbush Securities said that Uber had clearly not had a "storybook start" as "investors continue to grapple with the valuation of the tech transportation stalwart especially in the backdrop of a risk-off vibe on the heels of heightened US-China trade tensions and market choppiness".

On the wider market, US markets were hit by news that China plans to impose tariffs on $60bn (£46bn) of US goods from 1 June.

The move comes in retaliation to the decision by President Donald Trump last week to more than double levies on $200bn worth of Chinese imports to 25%.

Comment: Michelle Fleury, New York business correspondent

After China hit back by raising tariffs on US goods, traders at the New York Stock Exchange were left scratching their heads.

One put into words what many investors were feeling this morning as the trade war between the world's two largest economies escalated another notch: "What happens after that? I have no clue."

And it's this uncertainty that has roiled US markets.

Most here believed some sort of trade deal was in the offing, hence the knee jerk reaction now that its being called into question.

Sam Stovall, chief investment strategist at CFRA Research, summed up the mood on Wall Street this Monday: "It seems this tit for tat, this political gamesmanship could get out of hand and I think as a result investors are worrying that it could have negative implications for the global economy."

Of course if a deal does come to pass, he believes the market losses would be recovered.

But with the Trump administration preparing tariffs on a further $325bn worth of Chinese goods, investors are buckling up for a bumpy ride ahead.

Mr Trump has also ordered the US trade department "to begin the process of raising tariffs on essentially all remaining imports from China", estimated to be valued at around $325bn.

The S&P 500 share index was also down 2.4%, while the Nasdaq fell 3.4%.

- Published14 May 2019

- Published10 May 2019