Topshop tycoon Sir Philip Green to close 23 stores

- Published

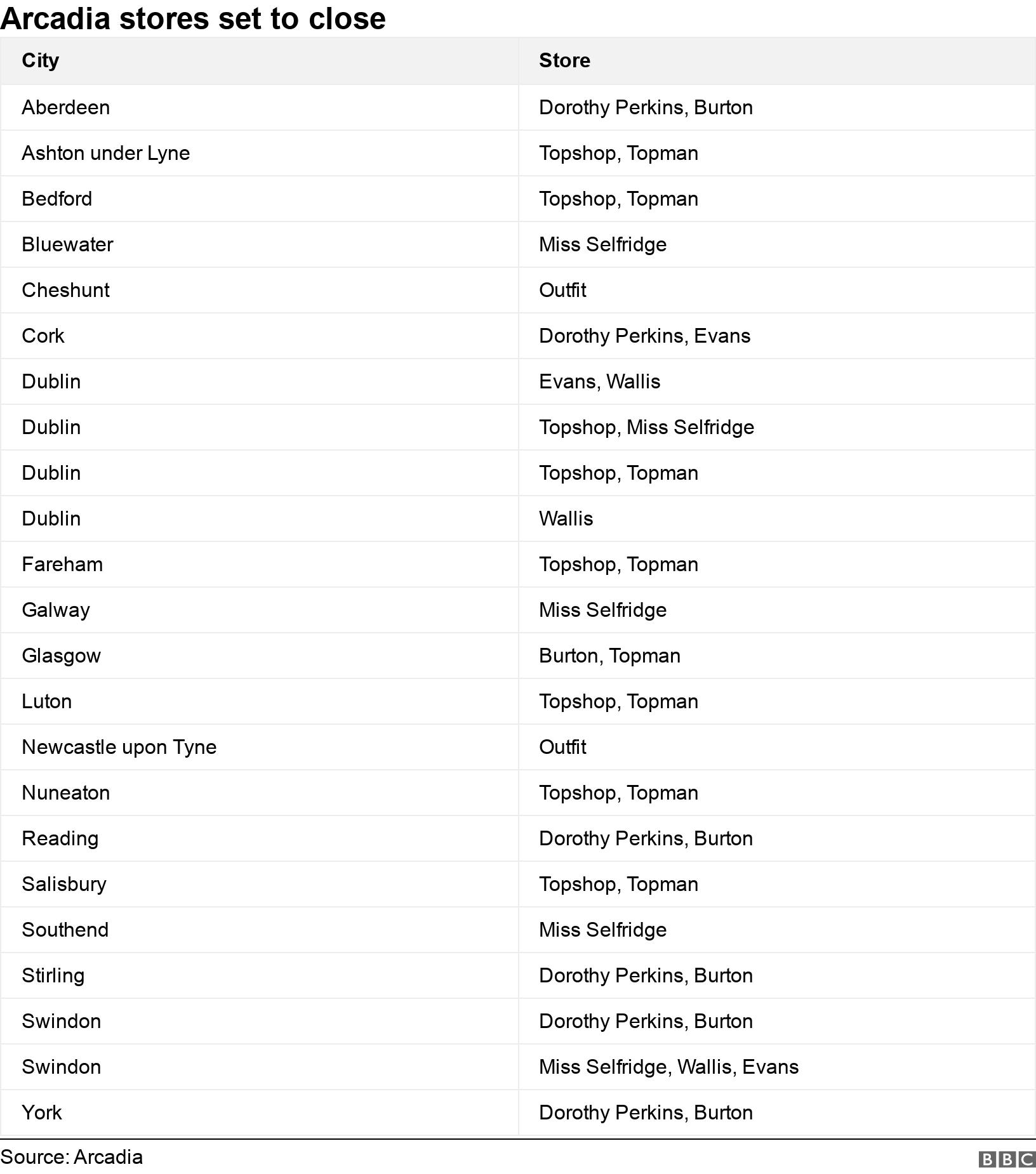

Topshop tycoon Sir Philip Green plans to close 23 stores, putting 520 jobs under threat, as part of a rescue plan.

Under the proposal, Burton, Dorothy Perkins and Topshop stores will close and rents will be cut at another 194 stores at the Arcadia group.

However, the pensions regulator has doubts that the deal will "adequately protect" the pensions of employees.

The regulator's support is crucial in order for a Company Voluntary Arrangement (CVA) to be approved.

CVAs are a type of insolvency for troubled businesses that allows rents to be cut. There are seven in total and all must be approved by creditors.

The proposal states that Arcadia Group is prepared to put an additional £100m into the scheme over a number of years to bridge a shortfall in pension contributions, but the regulator does not think the plans are sufficient.

Ian Grabiner, chief executive of Arcadia Group, called the steps "tough but necessary" to mend the business.

The company also plans to shut all its 11 Topshop and Topman stores in the US.

The closures would add to the 200 UK stores shut over the past three years as it struggles with a challenging market.

They are seen as a final effort by a company to stave off administration or breakup.

Many retail experts believe Topshop, Sir Philip's prize asset, has fallen out of favour with today's young consumers, who are favouring online retailers such as Asos and Pretty Little Thing.

It is another blow to the tycoon, who this month lost his Sunday Times Rich List billionaire status.

In return for the rent cuts, Sir Philip's wife, Lady Tina Green, who is the main shareholder of Arcadia, will invest £50m in the company.

Landlords, thought to number in the hundreds, and other creditors will have to agree to the proposal, which will be put to them on 5 June.

The deal will see them owning 20% of the firm, while they will also be able to claim against a £40m "compromised creditor" fund.

It has not been made clear just how steep a rent reduction they are being asked to provide.

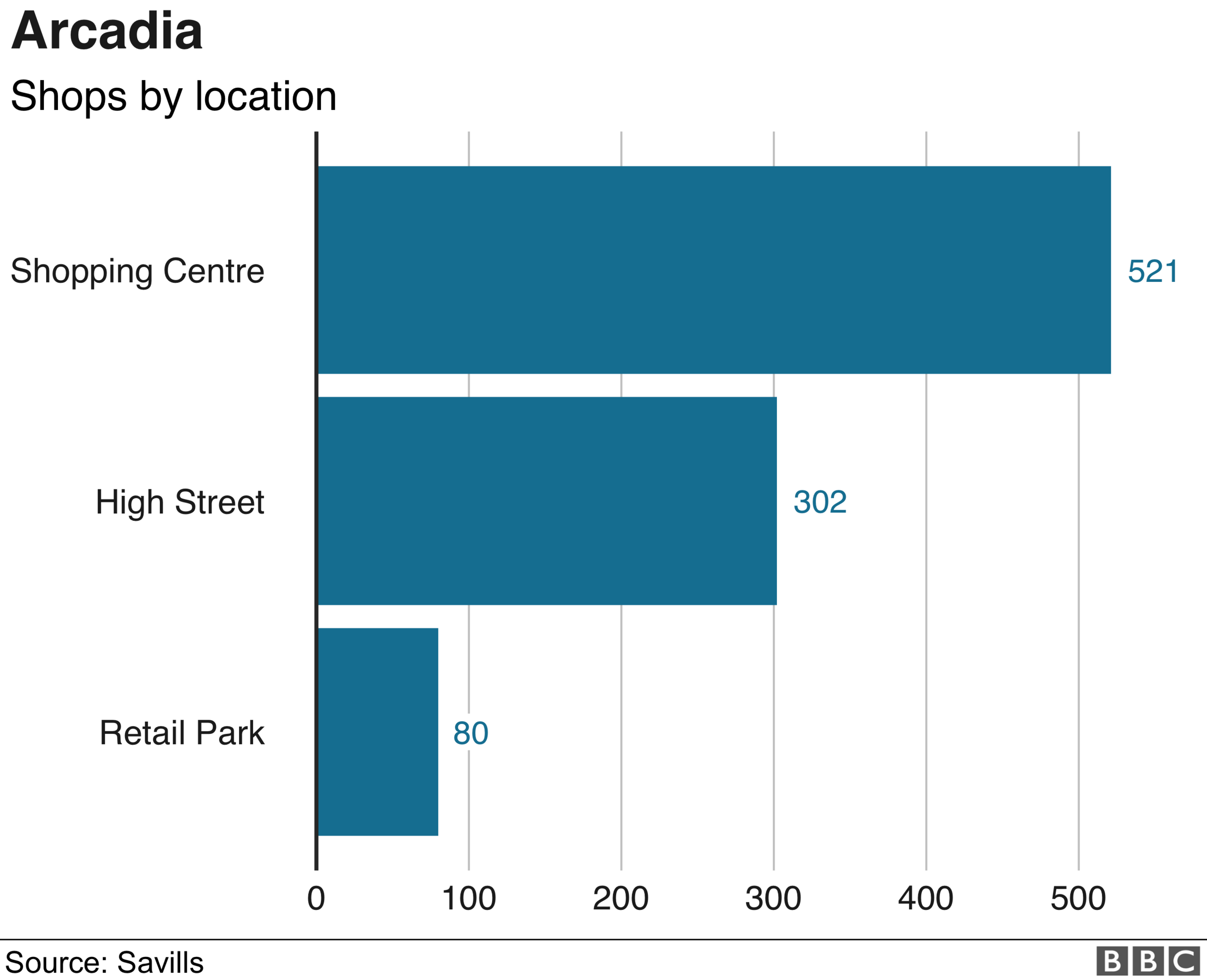

Sir Philip's Arcadia group has 1,170 shops in 36 countries, although the majority are concessions or franchises.

It has 566 locations in the UK and Ireland, employing 18,000 people.

The plan must also be approved by the company's pension trustees, who are also being offered a new deal.

The company has been topping up the two largest Arcadia pension schemes by £50m a year.

This will be cut to £25m, but Lady Tina will make up the shortfall for three years and add another payment of £25m.

Sir Philip's US stores were opened with great fanfare

Tough times for the former 'King of the High Street'

Sir Philip Green's brands used to dominate the High Street. He was the king of retail, making a fortune in the process.

He famously took out a £1.2bn dividend from Arcadia back in 2005, the largest corporate payout in UK history.

But this once powerful retail empire is now in serious trouble. Dorothy Perkins, Burtons and Miss Selfridge fell out of fashion a long time ago.

Topshop has long been the jewel in the Arcadia crown but it too is struggling. It's no longer the go-to place for young fashion-seekers.

Behind the scenes, his brands have suffered from years of underinvestment. But, like other traditional retailers, Arcadia is also been hit by rising costs like business rates and wages as well as our changing shopping habits.

Sales are on the slide. This restructuring deal, which must be approved by landlords and the Pension Protection Fund, is a pivotal moment for Sir Philip and his business.

If he doesn't succeed, administration looms. His aim is to put the group on a more sustainable footing so a turnaround plan can be put in place.

But launching a CVA, even though they're in fashion, is a dramatic fall from grace for a businessman whose glory days seem long gone.

Last year, landlords called for a government review as more struggling retailers asked for rent reductions.

The British Property Federation (BPF) said too many companies were abusing CVAs and using them to dodge rent.

The BPF said that it would be for individual property owners to decide on how they would vote on Arcadia's plan.

New Look, Carpetright, House of Fraser and Mothercare are among retailers that used the process to shore up their finances.

Last year, Sir Philip was embroiled in claims, which he strongly denied, of bullying and inappropriate behaviour.

He was also criticised over the demise of department store chain BHS, which, after he sold it for just £1, collapsed a year later.

It emerged in January that the business had hired advisers at Deloitte to explore a restructuring, prompted by a decline in sales and profits.

- Published1 May 2019

- Published27 November 2020

- Published15 March 2019

- Published7 June 2018