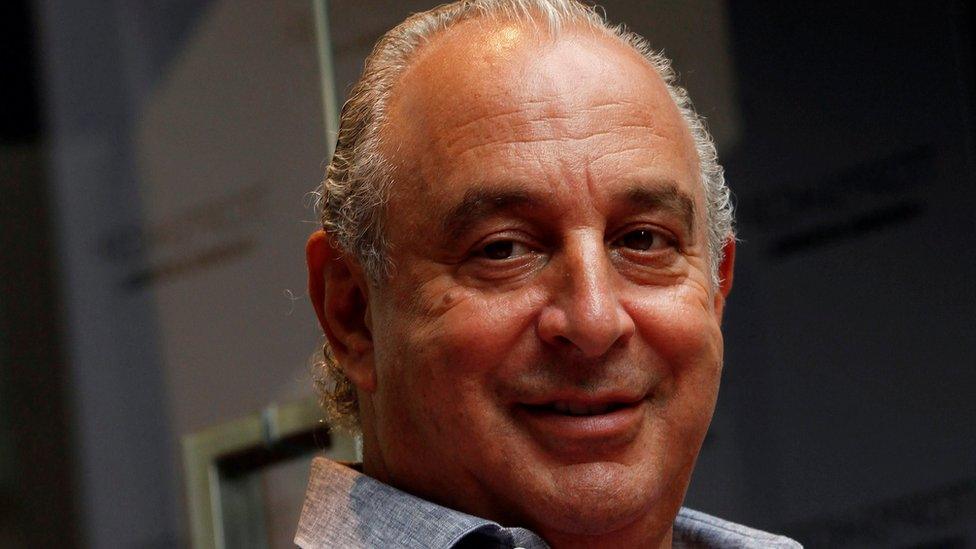

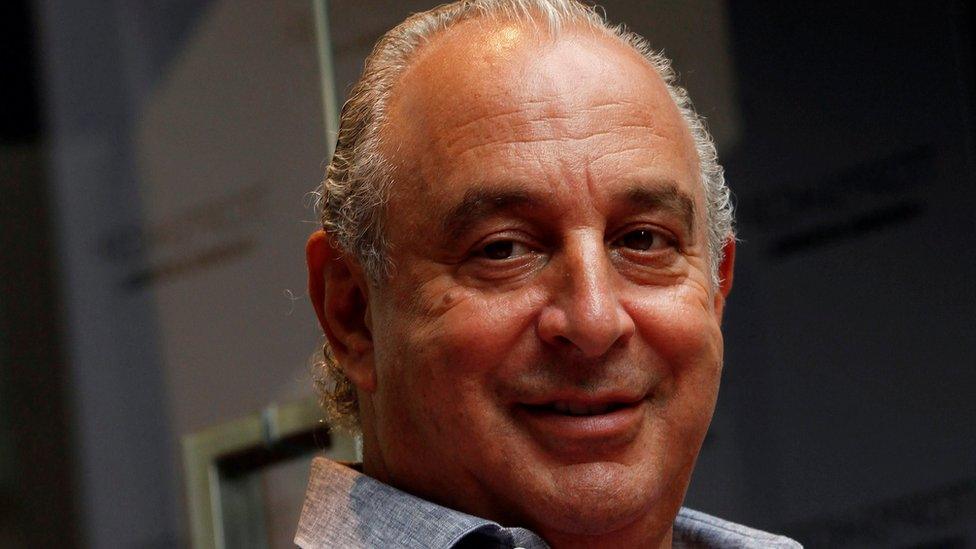

Sir Philip Green: Will landlords fight his rescue deal?

- Published

Is this the moment the landlords fight back?

This afternoon, the landlords to Arcadia - Sir Philip Green's retail empire - will be asked to vote on whether they will accept swingeing cuts to the rent they charge to well-known retailing brands like TopShop and Dorothy Perkins.

This form of insolvency - called a Company Voluntary Arrangement - has been used to keep other struggling retailers (Debenhams, House of Fraser) alive. Up to now, landlords have largely been forced to accept that in the current retail climate, having a tenant paying anything at all is better than having the building stand empty.

But some industry insiders say that many landlords have been looking for a moment to hold the line and there's a chance this could be it.

Even when the landlords vote against a CVA, they are often outvoted by the other creditors - particularly if one of those creditors is a pension scheme many million pounds in deficit.

However, in the case of Arcadia, the landlords have more power thanks to its complex structure. The pension scheme is only a creditor to one of seven interconnected companies. That means its massive voting power does not blow the creditors to the other six companies out of the water.

Even so - the landlords will know that if they vote against today's restructuring, the company could very well collapse - leaving them without a tenant, right?

Well maybe not. If you are landlord to some of the better brands - like TopShop - in some of the better retail locations, you might think it is pretty likely that someone will want to buy it out of administration - so why take a massive hit on your income to prop up a company that has been performing poorly.

That is one of the fundamental objections to the concept of a CVA. Not only are the landlords bearing the brunt of a company's poor performance, but they are in effect making life worse for successful retailers which are well run.

No wonder the boss of fashion chain Next says he wants a CVA clause in all his new rental agreements. Why should I have to compete with a retailer next door to me, who has the same square footage and the same landlord but is paying half the rent I am?

Those comments from Lord Wolfson sent shivers down many a landlord's spine and made a lot think they would need to show some backbone at some point.

The truth is that companies that really need or want to cut their cost base are not going to be able to do it by cutting rents on rubbish units in rubbish locations. They are not paying much rent for those locations. What they need to do is cut the expensive rents in the premium locations - and a CVA allows the company to do that.

It is hard to muster much sympathy for landlords who grew fat off the retail land by charging eye-watering, ever rising rents during the good times. But some argue that rewarding unsuccessful businesses can't be good for competition or the wider economy.

Almost all of the recent CVAs have been passed despite the gritted teeth of landlords. If this does turn out to be the moment they fight back in sufficient numbers, Sir Philip Green will know his high street luck has really run out.

- Published5 June 2019

- Published3 June 2019

- Published1 May 2019