Bank overdraft fees targeted in major shake-up

- Published

Bank overdraft fees are to undergo a major shake-up, which the UK financial regulator is calling the biggest overhaul for a generation.

Banks and building societies will no longer be allowed to charge fixed daily or monthly fees for overdrafts.

In addition, there will no longer be higher fees for unplanned overdrafts than for arranged ones.

The Financial Conduct Authority (FCA) said the new rules would start by April 2020.

Under the new measures, which were first proposed in December, banks will also be required to charge a simple annual interest rate on all overdrafts, and overdraft advertisements will need to come with that rate clearly displayed, to help consumers compare various products.

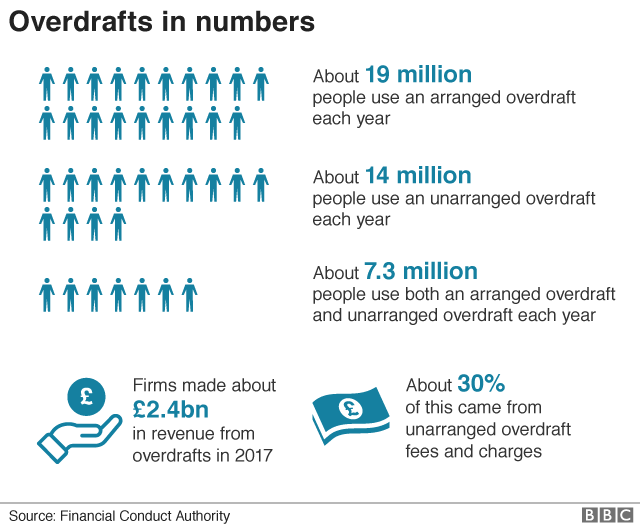

In 2017, banks made more than £2.4bn from overdrafts - with 30% alone coming from unarranged overdrafts.

Previous research showed those aged between 35 and 44 were most likely to have some form of overdraft, and about 10% of all 18 to 24-year-olds had exceeded their overdraft limit in the previous 12 months.

'I keep getting charged'

Megzer Dorj says that he paid about £900 in overdraft fees last year.

"I'm not able to get a planned overdraft limit," the 32-year-old chef says.

"When I go into it, they charge me on a monthly basis. In the last year, 2018, I paid £900. That is just the charge, nothing else."

He says he kept getting charged after going into an unarranged overdraft for day-to-day living costs. He's delighted that the FCA has taken action.

The regulator said the changes would make overdrafts "simpler, fairer, and easier to manage".

It will mean:

No difference between arranged and unarranged overdraft prices - but no cap on the cost either

An end to monthly or daily fees

A requirement for banks to advertise their overdraft rate as a single annual interest rate, or APR

Banks will still be able to refuse to make a payment if a customer does not have the funds to cover it, but any resulting fee for the customer must reflect the cost to the bank

Banks must do more to identify and help customers who are showing signs of financial strain or are in financial difficulty

When the new rules come into force, the typical cost of borrowing £100 through an unarranged overdraft would drop from £5 a day, to less than 20p, the regulator said. However, some fear that the costs to those who previously used arranged overdraft charges might rise, or charges for accounts may rise.

Banks and building societies will be required to charge a simple annual interest rate on all overdrafts, and overdraft advertisements will need to come with that rate clearly displayed, to help consumers to compare various products.

The FCA's chief executive, Andrew Bailey, said the overdraft market was currently "dysfunctional" and "causing significant consumer harm" because vulnerable customers are often hit by excessive charges for unarranged overdrafts, which can be 10 times as high as fees for payday loans.

"Consumers cannot meaningfully compare or work out the cost of borrowing as a result of complex and opaque charges, that are both a result of and driver of poor competition," said Mr Bailey.

"The decisive action we are taking today will give greater protections to millions of people who use an overdraft, particularly the most vulnerable."

Eric Leenders, from bank trade body UK Finance, said: "Overdrafts can provide a convenient way for customers to smooth their short-term cash-flow, and there is a highly competitive market in the UK. The banking industry is committed to helping customers manage their money and we will be working closely with the FCA to implement these rules."

Charity reaction

Gillian Guy, chief executive of Citizens Advice, said overdrafts were one of the most common areas of concern when worried consumers contacted the charity.

"Overdraft charges can have serious knock-on effects for people's debt and mental health. These new rules should help thousands of people from getting trapped in a debt spiral," she said.

"If, after these measures are introduced, people still pay over the odds, the FCA should review the need for an interest rate cap to ensure no one is paying back more than twice what they borrowed."

Peter Tutton, of debt charity StepChange, said: "We would like the regulator to be more pro-active and fleet of foot in identifying and refining the specific, practical steps banks should be taking to help customers escape the overdraft trap more quickly, and to break the cycle of repeat use of overdrafts."

- Published18 December 2018

- Published14 January 2019