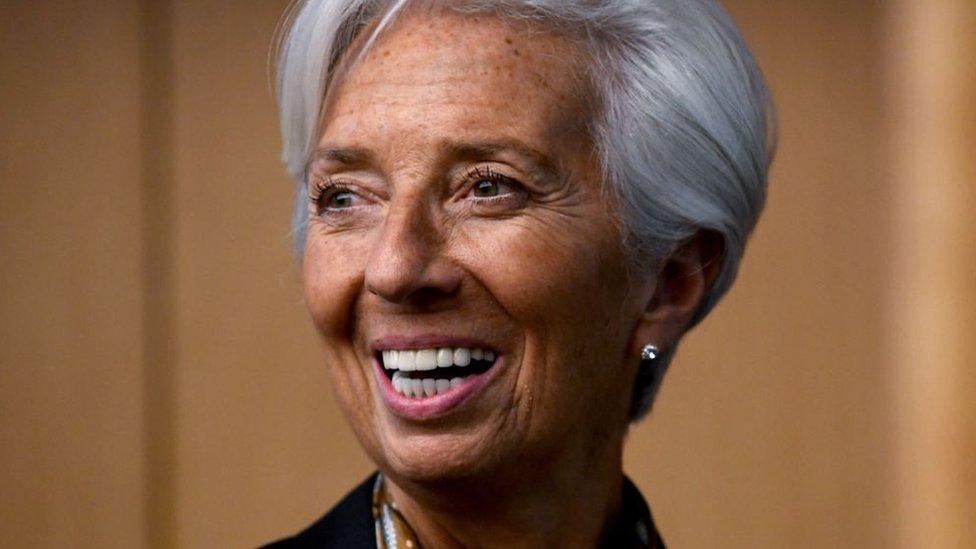

Christine Lagarde: The 'rock star' of finance

- Published

Christine Lagarde is known as the "rock star" of international finance

"No, no, no no, no no," was what Christine Lagarde was reported to have said when asked last year if she was interested in running the European Central Bank (ECB).

Yet just a few months later, she has been nominated as the institution's new president.

Ms Lagarde - known as the "rock star" of international finance - said the new role was "an honour".

Poised, chic and known for her straight talking, she has become one of Europe's most influential ambassadors in the world of international finance.

Until this weekend, the main contenders for the ECB job were male central bankers.

But assuming the nomination is approved she will become the central bank's first ever female leader, responsible for the euro and the monetary policy of the eurozone.

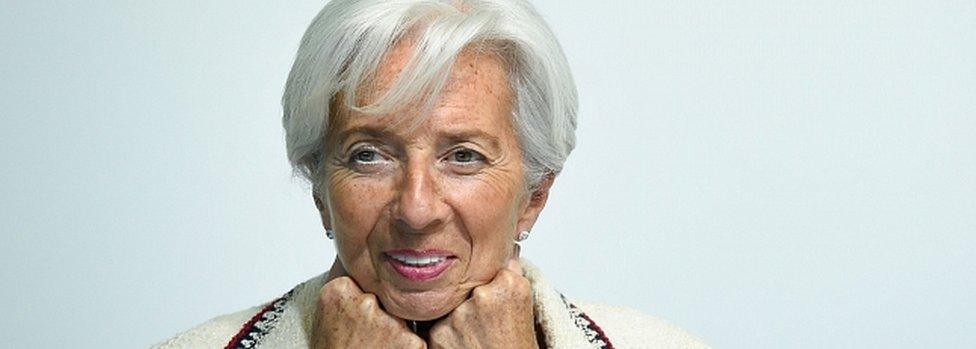

Ms Lagarde is legendary for her stamina

"First ever female" is a tag that has followed Ms Lagarde throughout her career.

The former lawyer was the first woman to chair global law firm Baker McKenzie, the first woman to serve as a finance minister from any Group of Seven nation and then the first to lead the International Monetary Fund (IMF).

Unsurprisingly she has long championed promoting women into powerful positions, saying it's the key to improving the world economy.

"As I have said many times, if it had been Lehman Sisters rather than Lehman Brothers, the world might well look a lot different today," she said earlier this year.

The silver-haired 63-year-old is legendary for her stamina. A former synchronised swimmer for the French national team, she is reported to exercise daily, even during meetings if necessary.

In her current role, she has been praised for steering the Washington-based IMF through the aftermath of the financial crisis.

'She will face challenges'

Analysis by By Andrew Walker, BBC World Service economics correspondent

Christine Lagarde's status as rock star of international finance is beyond doubt.

She has a high profile as managing director of the International Monetary Fund, building on her experience as a cabinet minister in France.

What she doesn't have is the technical expertise as a central banker. The previous presidents of the ECB did.

All three had been governors of their own national central banks. Mario Draghi in particular presided over the bank at a time when it faced the eurozone financial crisis and a weak economic recovery. The response was both innovative and technical.

Christine Lagarde would not be the first ever central banker to be in that position. But there could well be challenges.

The eurozone is struggling with inflation that is persistently below its target. Getting it back up might require more innovation. Ms Lagarde would need to draw on the expertise of the ECB's technocrats.

Her career has however had one significant negative, when she was investigated for abuse of authority during her time as French finance minister in 2007.

In 2016, she was convicted in a French court for failing to challenge a €404m award to flamboyant French businessman Bernard Tapie in 2008 over the sale of sportswear brand Adidas. She did not serve a sentence.

Bernard Tapie was ordered to pay back the €404m with interest

Ms Lagarde has always defended her decision, saying it was "the best solution at the time".

Her drive means Ms Lagarde's career has continued unaffected.

It's a determination that she learnt at a young age after her father's death when she was 17. Her mother, widowed at just 38, bought Ms Lagarde and her three younger brothers up alone.

"My mother was a very strong character. I learnt a lot from her," she told the Financial Times in an interview., external

Ms Lagarde knew how to "impose calm" a former colleague says

Consistently ranked among the top 10 most powerful women globally, Ms Lagarde has helped to rebuild the IMF's credibility following Greece's 2010 bailout, which bent the fund's rules.

She also presided over the IMF's biggest bailout, a $57bn deal for Argentina last year that many credited with arresting emerging market turbulence.

Ms Lagarde has admitted before that she lacks economic experience, telling the Guardian in 2012: "I've studied a bit of economics, but I'm not a super-duper economist."

Many don't believe this will hold her back.

One former IMF official said her leadership of the fund meant she was "exceptionally qualified" to run the ECB.

"She knew how to impose calm without posing as morally superior," instead displaying "a touch of humanity," said a former colleague.

Mark Sobel, a former US Treasury official and chairman of the Official Monetary and Financial Institutions Forum, said Ms Lagarde has experience in monetary policy even though she is not an economist.

"She's been involved in all the monetary debate and it's not like they don't discuss monetary policy at the fund," he said.

Christine Lagarde's career

1956: Born in Paris

1973: Wins scholarship to exclusive US school for a year, where she perfects her English

1981: After law school in Paris, joins international law firm Baker & McKenzie as an associate, becoming chair 18 years later

2005: Becomes France's trade minister in 2005

2007: Becomes France's finance minister, the first woman to hold this post not just in France but in any of the G8 major industrial countries

2011: Becomes head of the IMF

2019: Nominated to become president of the European Central Bank

- Published2 July 2019