Tourists facing travel money 'shock' this summer

- Published

- comments

Tourists could face a "shock" this summer when they travel abroad according to foreign currency experts.

Those that buy euros at the airport can expect to receive around 98 euro cents for their pound. Better rates can be found by buying in advance, with the Post Office offering €1.0819.

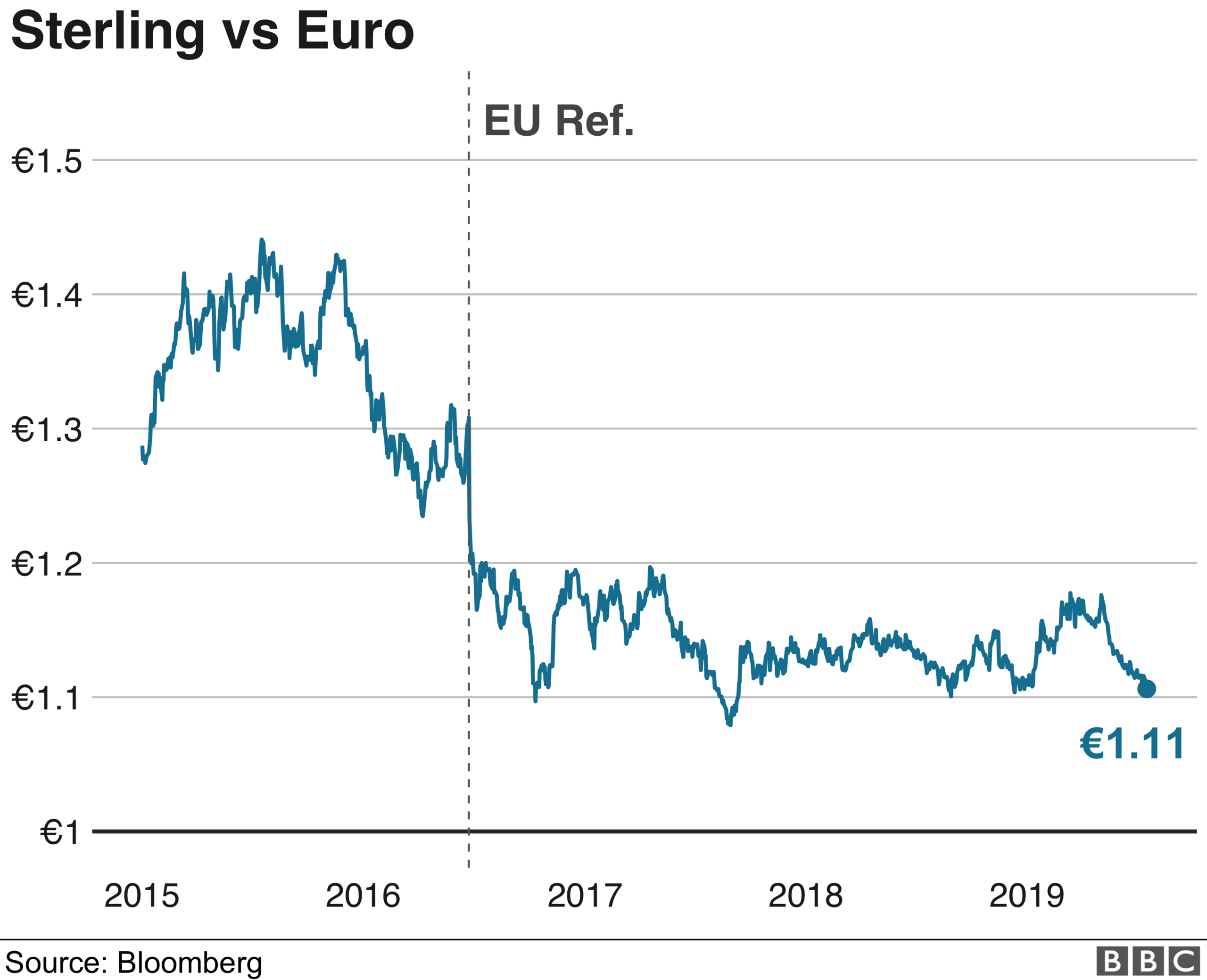

But that's still a long way from the summer of 2015, when tourists were getting at least €1.32 for their pound.

The big fall came in 2016 after the UK voted to leave the European Union.

Tourist rates are based on trading levels on the international currency markets.

On those markets the pound earlier hit $1.2382, the lowest level against the dollar in 27 months.

That fall was attributed to rising fears that the UK will leave the European Union without a withdrawal agreement.

The pound also fell against the euro, hitting €1.1062, its lowest level for the year.

"It will be a big shock for tourists to Europe if they are expecting to get good value this year," said James Hickman, the chief commercial officer of travel money firm FairFX.

He does not expect any recovery in the pound until the Brexit situation is resolved.

"All pointers are that we're in for a rocky road," he says.

"If people are waiting to buy at a better rate I don't think that's going to happen."

If there is a no-deal Brexit then he thinks the pound could go lower. He points out that some in the financial markets think it could hit parity against the dollar, meaning tourists would receive just $1 for each pound they exchange.

At the moment the tourist rate for the pound against the dollar is $1.2127. That's down 5% on this time last year, according to the Post Office.

Getting the best from your travel money

Analysis by Kevin Peachey, BBC personal finance reporter

Millions of us would have spent many hours hunched over a computer trying to find the perfect accommodation and flights for a summer getaway,

Currency experts say holidaymakers should put the same amount of effort into organising holiday money, external.

That certainly means never waiting until you reach the airport to exchange money, as bureaux in the airport complex usually have the worst rates.

Timing can be tricky - it is difficult to predict how the value of the pound will move, so one common suggestion is to change half of your holiday money weeks in advance of departure, and the rest just before, to hedge your bets.

Ordering currency online in advance and then collecting the cash in person can also secure a better rate.

Cash exchange is not the only option. Carrying a wad of notes can be dangerous and not always covered by travel insurance. The market for specialist pre-loaded currency cards is growing, and banks are competing on the rates and deals for overseas use that they offer to current account holders. So doing your homework on charges and shopping around is advisable.

In general, using your regular debit card can be expensive, owing to the extra charges, and remember to let your bank know if you are going away to avoid being locked out by anti-fraud processes.

If you do use a card on your holiday, shops, restaurants and cash machines will usually ask if you want to pay in pounds rather than the local currency. Always choose the latter. Tourists can lose up to 10% by paying in sterling rather than the domestic currency.

However, if you haven't already booked your trip, then there are destinations where your pound will go further.

The Post Office says it has seen a surge in sales of Turkish lira, which has been hit by political turmoil.

Compared to last summer, the pound is up around 14% against the lira. Iceland is also better value than last year, the pound is up 12% against the Icelandic krona.

The pound is also a little higher against the South African rand.

The weak pound can also be more than compensated for by falls in local prices, the Post Office says.

It tracks the prices of a range of items in European family destinations, including meals and drinks.

It found that prices had fallen in half of the 15 locations, including the Algarve in Portugal.

"Picking a destination where prices on the ground are low can outweigh the impact of a weak exchange rate, but a destination where prices and cheap and sterling is strong is the best bet," said Nick Boden, head of Post Office Travel Money.