Top London home prices 'falling fastest' amid UK slowdown

- Published

- comments

Detached homes in London fell in value by more than £50,000 in a year, according to official figures, driving the slowdown in UK house price growth.

Typically, this type of property cost £903,088 in May last year, but fell by 6.1% to £847,998 by this May, Land Registry figures show.

The prices of other property types in the capital also fell, but by less.

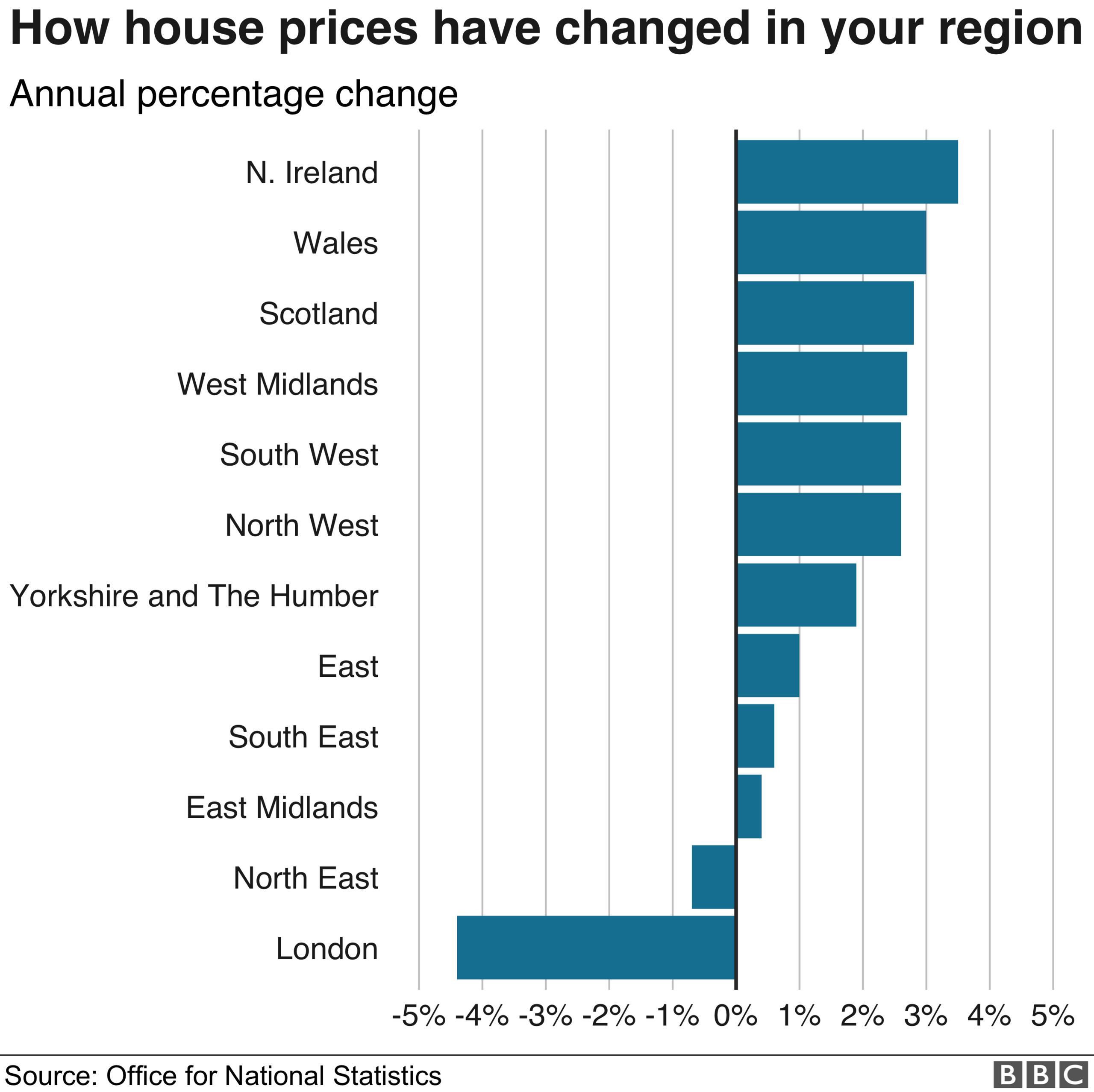

Annual property price rises overall in the UK slowed to 1.2% in May, from 1.5% the previous month.

The fact they are still rising at all is thanks to price increases in homes outside London.

The London housing market has been affected by factors ranging from stamp duty and other tax changes to sentiment among buyers and sellers owing to Brexit.

The Land Registry data shows that prices fell by 4.4% in the year to May - the biggest drop since a 7% decrease was recorded during the financial crisis in August 2009. This is made up of the 6.1% fall for detached homes, as well as drops of 5% for flats and maisonettes, 4% for semi-detached houses, and 2.9% for terraced homes.

"The scale of London's fall is also a reminder of the definitive shift in the dynamic in the capital," said Jonathan Hopper, managing director of Garrington Property Finders.

"Buyers are now setting the tempo, dictating terms in price negotiations and frequently able to secure additional discounts on properties that are already reduced."

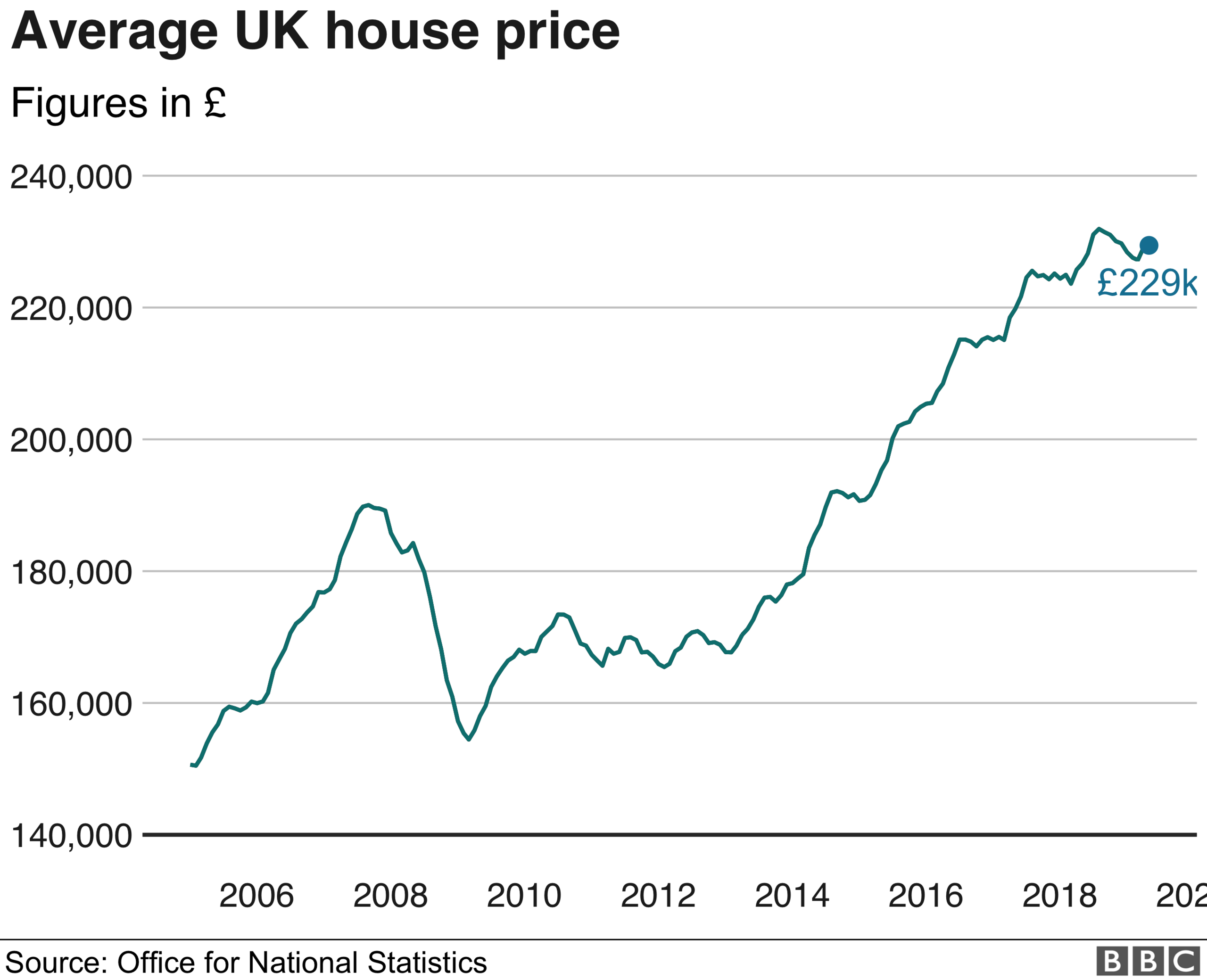

However, the average London home is still valued at £457,471, the Land Registry data shows, which is much greater than the UK average of £229,000.

The average price of homes in the UK is also still rising - up by 1.2% in the year to May, according to the Office for National Statistics. However, this was a slowdown from annual growth of 1.5% in April.

- Published9 July 2020

- Published12 July 2019

- Published19 June 2019

- Published7 July 2019