How Japan's trade row with South Korea could hit tech supplies

- Published

A trade spat between Japan and South Korea threatens to spill beyond their borders, posing potential risks to consumer electronics supplies around the world.

The row stems from export restrictions Tokyo imposed on certain industrial materials that Seoul needs to make semiconductors and display screens.

Japan has also warned tougher trade curbs could be on the way.

The moves have drawn anger from South Korea, and earlier this month President Moon Jae-in described the situation as an "unprecedented emergency" for his country's economy.

On Tuesday, officials from Seoul will bring the dispute to a meeting of the World Trade Organisation (WTO) General Council.

They hope to convince the international community that Japan has violated global trading rules, and the measures should be rescinded.

The simmering dispute is seen as the latest example of countries using trade as a weapon in diplomatic battles.

"There's blame to be had on both sides," says Robert Dujarric, director of the Institute of Contemporary Asian Studies at Temple University Japan.

"The issue goes back 50 years, this is not something that has just landed today."

How did we get here?

The two countries share a complicated history that includes Japanese colonial rule of Korea from 1910 until the defeat of Japan in 1945.

Last year, South Korean court rulings ordering Japanese firms pay compensation to Koreans over forced wartime labour inflamed long-running tensions.

The decisions drew condemnation from Japan, which argues the dispute was settled in 1965 when diplomatic ties were normalised between the neighbouring countries.

Mitsubishi Heavy, one of the firms involved, has reportedly refused to comply with the court order, while two other companies have had their assets seized in South Korea.

Family members of South Korean victims of forced wartime labour at a rally urging compensation issues be resolved

In July, Tokyo imposed export controls targeting South Korea's key electronics sector, external. Japan says the measures are designed to clean up export control procedures.

But many are sceptical about that justification.

"I don't think there's anyone that believes that the Japanese decision on exports is not related to the desire to 'punish' or 'pressure' South Korea to deal with the court rulings," says Temple University's Mr Dujarric.

What are the export controls?

The export curbs apply to three high-tech materials: fluorinated polyimide, photoresists and hydrogen fluoride.

Japan is the dominant producer of those materials which are vital to make memory chips and display screens.

These are key industries for South Korea.

The country's tech giants Samsung Electronics and SK Hynix exported around 60% of global memory components last year, according to IHS Markit.

A spokesperson for Samsung said the company was "assessing the current situation" and "reviewing a number of measures to minimise impact on our production". SK Hynix declined to comment.

The restrictions don't block the sale of the materials, but require Japanese exporters to acquire licences to sell the products to South Korea, potentially causing delays and choking supplies.

Tokyo may go further by removing Seoul from its so-called "white list" of trusted trading partners.

Striking South Korea from the list would dramatically expand the products that face export restrictions. Japan's decision on the white list is expected by next month.

How has South Korea reacted?

The dispute has sparked strong reactions in South Korea, prompting boycotts of Japanese goods from beer to clothes and travel.

This sign in a grocery shop in Seoul says "This store does not sell Japanese products!"

South Korea plans to take the dispute to the WTO and has argued that other countries could be caught in the crossfire.

"There are major concerns that such a move would have a grave impact on not only the economies in both countries, but the global supply chain," Lee Ho-hyeon, a director at South Korea's trade ministry said last week.

What does the row mean for electronics supplies?

Many analysts have joined South Korea in raising the alarm over the risk the trade spat presents to the global technology supplies.

"The ripple effects on the regional electronics supply chains cannot be underestimated," says DBS economist Ma Tieying.

She says supply disruptions could hit Apple, Huawei and Sony among others in the production of smartphones, computers and televisions.

Global Trade

South Korea is currently the world's second largest producer of semiconductors, according to DBS, while Samsung and LG Electronics hold more than 90% of the global organic light-emitting diode (OLED) screen market.

The longer the dispute drags on, the deeper the potential impact.

Rajiv Biswas, Asia-Pacific chief economist at IHS Markit, says if Japan's export controls remain in place for a prolonged period it "could disrupt the global electronics supply chain" given South Korea's dominance in the memory chip market.

He says the price of memory components "could significantly increase due to the inability of the other memory suppliers to meet global demand".

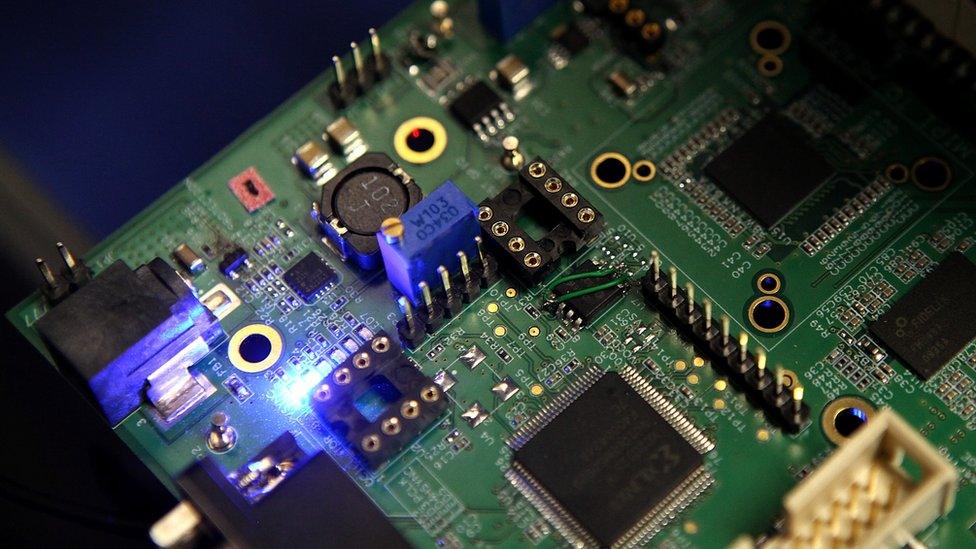

Memory chips are used in smartphones and other devices

Still, electronics manufacturing industry group Semi says it's too early to gauge the impact on global supplies.

"We're still waiting to see. Japan has said this is not punitive. [It said] this is not going to negatively impact trade," Mike Russo, vice president of global industry advocacy at Semi says.

Mr Russo expects South Korea will be removed from the white list, which could create supply delays, but notes that Japan says "that will not happen".

"Our major members in Japan have said to us they are comfortable with the assurances they have received so far from the [Japanese] government and while they are hopeful, it is too early to tell if there will be a negative impact."

- Published29 November 2018

- Published18 July 2019

- Published10 June 2019